Aug 17: In-play "unstoppable", says Sportradar

Sportradar Q2, GAN analyst reaction, Flutter analyst reaction +More

Good afternoon. On today’s agenda:

Sportradar CEO says US profitability ahead of schedule.

Entain hit with record fine by UK regulators over AML and social responsibility failures.

Analysts are split about the prospects for a “disappointing” GAN.

Sportradar Q2

Revenue rose 23% to €177.2m but adj. EBITDA decreased 13% to €27.6m.

US revenue up 66% to €29.1m while US EBITDA losses hit €5.5m.

RoW betting revenues up 21% to €95.5m; RoW AV up 9% to €39.7m.

Forecast revenue upgraded to between €695m-715m from €665m-€700m.

On the money: In the US, CEO Carsten Koerl said Sportradar was now likely to hit profitability ahead of the previously forecasted date of 2025. He pointed to the progression on adj. EBITDA margins from minus 34% in Q321 to minus 19% in Q2 as proof of the operating leverage now being achieved in the US.

Part of the story in the US is the gradual rise of in-play betting. Pointing to the trend elsewhere in the world, Koerl said the move towards in-play was unstoppable.

“Undoubtedly, once it starts you can’t reverse it,” he added.

Rights inflation: the cost of rights rose 28% over the quarter to €48.7m due to new deals with the NHL, UEFA and the ATP. Departing CFO Alex Gersh said that sports rights profitability increases as the company accelerates sales while Koerl said Sportradar has “excellent visibility” over the next three years

Carsten Koerl: “We fully expect sports rights expenses to increase but revenue will grow faster.”

War torn: Management noted that previous worries about the impact on revenues from the Russian-Ukrainian conflict were mitigated by growth elsewhere.

**Sponsor’s message** Venture capital firm Yolo Investments manages €550m in capital across 80 of the most exciting companies in fintech, gaming & blockchain. Their Gaming Fund, regulated by Guernsey Financial Services Commission, a dedicated 29-company, €183m AUM portfolio has invested in fast-growth assets including Dabble, Kalamba, SimWin & ThriveFantasy.

Yolo Investments has just opened its fund to new investors as it looks to scale new cutting-edge concepts, including its exclusive high-roller land and live casino brand, Bombay Club, global banking network & OTC desk Aims Group (aimsgroup.io).

Get in touch with your pitch or disruptive products to plug into our investment network!

Entain’s record fine

The UK Gambling Commission has slapped Entain with a record £17m fine for social responsibility and AML failures in its online and land-based businesses.

Charge sheet: Social responsibility failures included being slow or not interacting at all with certain customers to minimize their risk of gambling harm.

With regard to anti-money laundering, the Commission found that Entain failed to conduct an adequate risk assessment of their online business.

Unacceptable: UKGC CEO Andrew Rhodes said the failures “were completely unacceptable”, adding that the loss of a license was a “very real possibility”.

Second time round: Entain’s latest fine is the second time it has failed to apply the CSR and AML standards expected by the UK regulator.

Legacy issues: In a statement, Entain said it accepted that “certain legacy systems and processes” in the UK business in 2019 and 2020 were “not in line with the evolving regulatory expectations of the Commission”.

No “criminal spend”: Entain added that the Commission’s statement found “no evidence of criminal spend” and had entered into the settlement with the Commission “in order to bring the matter to a close and avoid further costly and protracted legal proceedings”.

Entain’s share price was down just over 3% at pixel time.

GAN analyst reaction

GAN’s below expectations Q2 earnings has analysts split on its prospects.

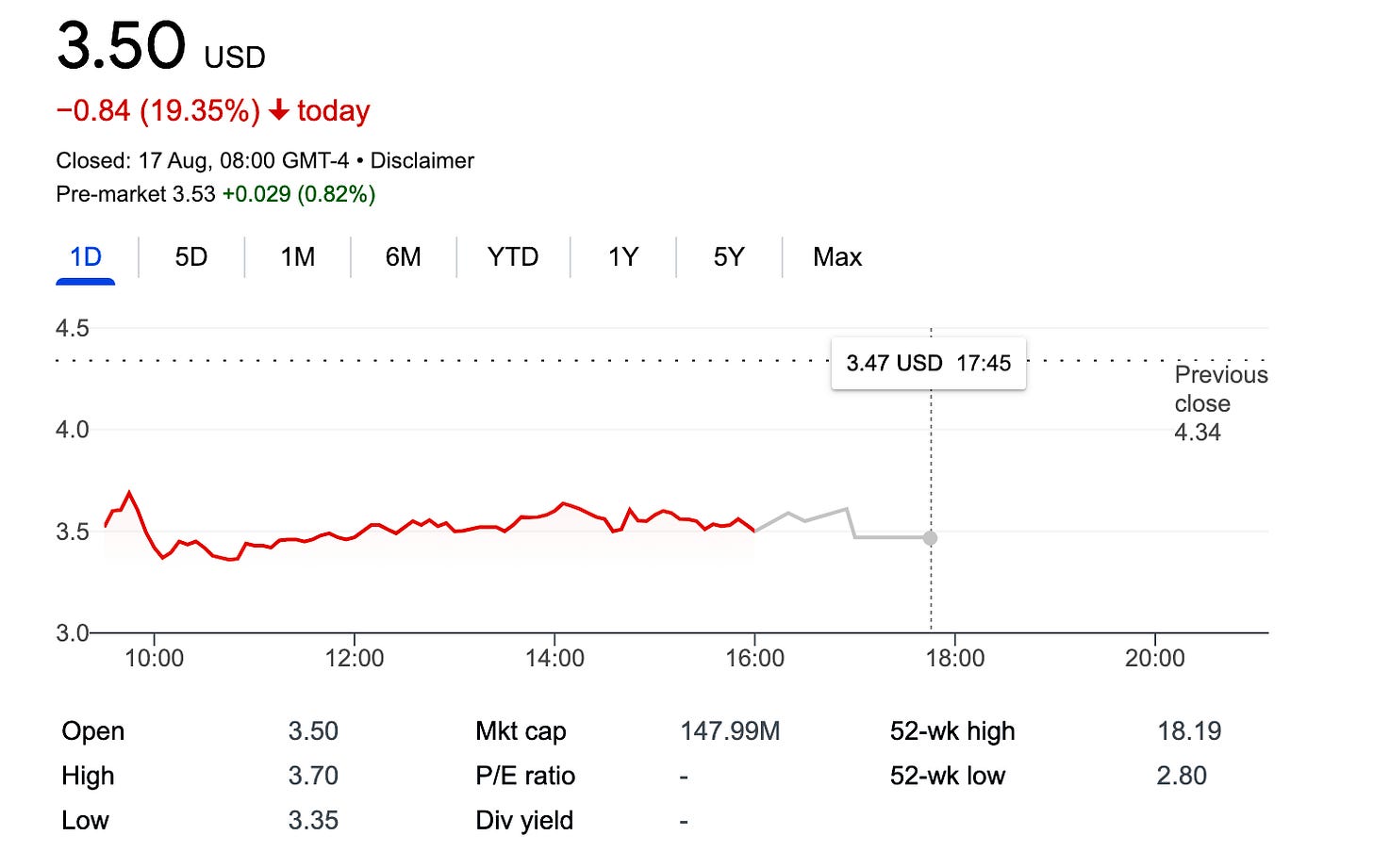

After a bruising day for its shares - down over 19% yesterday - analysts lowered their guidance for the operator/supplier with the team at Macquarie saying the results were “disappointing” and noting that the B2C guidance was now 14% lower than the target set in at the time of the Q1 earnings.

“International revenue pressure has been a relatively common theme in 2Q, but we did not expect the miss and reduction to this degree,” they added.

Poor marksmanship: Macquarie also noted that since IPOing in May20, GAN has missed its targets on revenue four quarters out of 10 and six out of 10 on EBITDA.

Street cred: They added that GAN’s shares will continue to be discounted “until credibility is restored”.

Rock the boat: More positive was the reaction from the team at B Riley who looked ahead to the launch of GAN’s sportsbook B2B product due to be road-tested with Red Rock Resorts in the Nevada locals market late this year.

They suggest GAN Sports can be a “continuous catalyst” while a California opening with either ballot initiative would open up opportunities from a “fragmented” operating environment.

🤕 GAN’s share price was down 19% yesterday

Flutter analyst reaction

FanDuel’s Q2 profitability was the tide which raised all boats, according to CBRE.

Rocket fuel: Looking at the 12% rally in the Flutter share price on Friday, the team at CBRE have “doubled down” on their outlook and raised their FY23 US revenue forecast by 27% to £3.18bn and EBITDA by 66% to £113m. The analysts cite the 1.5m of customers picked up by FanDuel in H1, a third of which came from pre-2021 states.

Key catalysts include the new NFL start, state launches and the “potentially game-changing” ballot initiatives in California.

Italian job: The team added that Sisal’s EBITDA run rate from H1 is 20% higher that their initial forecast, providing upside to international estimates for next year.

FuboTV investor day

Help needed: Scott Butera, President of Gaming at FuboTV, said the macro environment and difficulty in accessing capital were the reasons for the group deciding to seek a sports-betting partner to develop its proposition.

Burning down the house: The company was “committed” to developing the first watch-and-wager platform, Butera said, but developing and “operating a national sportsbook is capital intensive”.

With investors focused on profitability, Butera said FuboTV “decided to seek a partner to help scale our business to where we want to be”.

Transaction iteration: All wagering transactions are done through its mobile app currently, but CEO David Gandler declined to put a timeline on when there would be a fully-integrated TV-mobile betting product.

Profile match: Butera pointed to the 97% of the group’s subscribers who are also sports fans, “their profiles match closely with those of sports bettors” and Fubo’s ability to target advertising at those potential bettors.

Analysts in brief

Genius Sports: The broader sector narrative about promotional spend decelerating continues, suggest the team at Credit Suisse in response to comments from Genius Sports management yesterday but the upcoming NFL season “will be telling”.

Earnings in brief

Raketech: Revenue was up 28.6% to €11.3m while adj. EBITDA increased 16.6% to €3.9m. Sports revenues of €1.3m were 31% of group revenues vs. 15.2% in Q221. Revenues in July were up 34.4% YoY to €3.9m. The company extended its revolving credit facility of €15m until September 2023.

Playmaker: Pro forma revenue was up 10% to $7.4m while pro forma adj. EBITDA was down 14% to $1.9m. User sessions on Playmaker web properties increased 40% to 674m. The group agreed a $20m convertible loan with Beedie Capital in July Post-Q2 it completed the acquisitions of Juan Football and World Soccer Talk.

Would you like to get your brand seen by more than 2,500 decision-making executives in the iGaming sector? How about positioning your business as a thought-leader in your area of expertise? Well, sponsorship opportunities at iGaming NEXT: Valletta ‘22 are still available. Built on three core pillars of content, networking opportunities and VIP hospitality, iGaming NEXT Valletta is rapidly cementing its reputation as the must-attend business event.

In order to find out more about the available sponsorship opportunities, please contact iGaming NEXT at sales@igamingnext.com.

Datalines

New Jersey: Total GGR in July rose 6.6% YoY to $480.7m, land-based casino GGR was up 8% to $299m, online casino GGR was up 15.2% to $136.7m with Borgata leading market share at 31.4% of GGR, Golden Nugget in second with 25.3% and Resorts third with 22.3%.

Sports-betting GGR was down 18.1% to $45m on handle that was down 8% to $531.9m with hold at 8.5%. Mobile GGR was down 15.5% to $42.8m and retail was down 49.6% to $2.2m.

Newslines

Kinectify, a compliance and AML startup, has secured Seed round investment from OpenBet, Acies Investments, the Eastern Band of Cherokee Indians, Fifth Street Gaming, and Eilers & Krejcik. The amount was not disclosed.

What we’re reading

Making a point: Disney pushes back on activist investor Third Point’s calls for ESPN spin-off, The hedge fund suggested such a move would give ESPN “more flexibility” in areas such as sports-betting.

From Twitch to crypto casinos: How young players’ Twitch viewing is leading them to crypto casinos.

On social

Calendar

Aug 18: Catena Media Q2, Rank H1

Contact us

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com