Jun8: LeoVegas helping police with enquiries

LeoVegas insider trading probe, Kindred gets Netherlands license, Skywind buys InTouch +More

Good morning. On today’s agenda.

LeoVegas says it is being investigated over suspected insider trading.

Kindred gets green light for Unibet relaunch in the Netherlands.

Skywind expands into UK B2C via InTouch buyout.

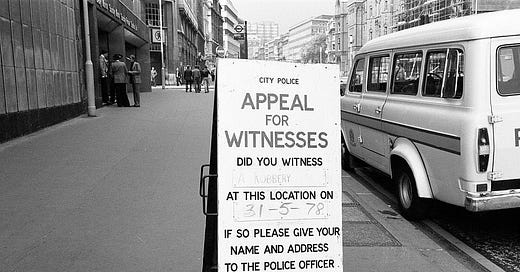

Police and thieves. Click below:

BREAKING NEWS: Kindred has announced it has received a license from the Dutch gambling authority and will relaunch operations in the Netherlands in the coming days. The news comes eight months after the company halted operations when the market regulated in October.

Joy to the world: Anne-Jaap Snijders, chief commercial officer, said Kindred wanted to “convey entertainment” to Dutch society and was “very keen on bringing the joy and excitement of sports to everyone”.

Kindred also announced a capital markets day to be held in London on September 14.

LeoVegas insider trading probe

Caught by the fuzz: LeoVegas said on Tuesday it is the subject of a preliminary investigation by the Swedish Economic Authority a matter of weeks after announcing a plan to be acquired by MGM Resorts International.

LeoVegas statement: “No employee, member in the management team or board member in the Company has been notified about any criminal suspicion.”

No comment: LeoVegas said it has “no further information to provide” and that all further questions should be put to the SEA.

Timeline: On Monday May 2, MGM made its $607m offer for LeoVegas public at a 44% premium to the share price on the previous Friday close of SEK42.32.

The share price rose on Monday May 2 to SEK60.30.

But in the month leading up the MGM news, the LeoVegas share price rose 32% from a low of SEK31.10.

We ain’t sayin’ nothin: A spokesperson for MGM told iGB that the announcement from LeoVegas was “all the info we have at this time”.

** Sponsor’s message: Venture capital firm Yolo Investments is home to €551m of equity in more than 70 of the most exciting companies across fintech, gaming and blockchain. It continues to build one of gaming’s most dynamic portfolios as it eyes up seed and A-stage opportunities across the sector. Its dedicated 29-company, €183m AUM gaming fund already houses holdings in fast-growing suppliers and operators, including Kalamba Games, SimWin and ThriveFantasy. Yolo Investments is also on the lookout for LPs as it looks to scale new concepts, including its high roller live casino brand, Bombay Club.

Skywind buys InTouch

You spin me round: The Teddy Sagi-owned B2B games provider Skywind has expanded its presence into UK-facing B2C operations via the acquisition of the company behind mobile gaming sites mFortune, PocketWin and Dr Spin. The buyout number was not disclosed.

Skywind’s B2B offering includes games and live casino. The company said it had recently created B2C partnerships in Romania and Colombia.

History lessons: InTouch was formed in 2001 as a manufacturer of gaming machines to the UK pub and bookmaking markets. It launched its first online brand, mFortune, in 2007.

Skywind was formed in 2012 and is led by CEO Hilary Stewart-Jones, previously a board member at Playtech and currently a non-executive director at Paysafe. She previously headed up the gaming teams at DLA Piper and Berwin Leighton Paisner.

VICI analyst update

Hole in one: The analysts at Jefferies suggest VICI’s $120m deal for destination golf experience provider Cabot “establishes further opportunities” for VICI to grow beyond gaming.

Crowded house: Jefferies say that with the influx of institutional capital into the gaming space, they had expected VICI to “pursue value-accretive experiential non-gaming assets in a broader context”.

Churchill Downs analyst update

Churchill Downs’ newly-developed $90m Rivers Casino in Des Plaines, Illinois, should “position the property to accommodate peak demand periods and cater to customers that prefer table games and a higher-end, Las Vegas casino experience,” the team at Wells Fargo said.

The analysts said Churchill Downs has a “solid portfolio of regional gaming/HRM properties”, but also recognized “some investor aversion to companies making a major acquisition (P2E) and commencing a multiyear growth capex cycle.”

However, the group “has a strong balance sheet and capacity for further stock repurchases, and we have confidence in management executing”.

Islands in the stream: The Rivers build is expected to be completed by end of July. The number of slot machines has risen to 1,500 and now includes nearly 100 tables (up from ~75) and more than 20 poker tables and a dedicated poker room, which “should help attract new customers”.

Datalines

Arizona Mar22: Sports betting handle was up 40.5% to $691m, revenue increased 52.3% to $37.2m.

Handle rankings: DraftKings led in handle, recording $230.2m (+74.8% MoM), FanDuel was second with $187.4m (+29%), BetMGM was third with $133.7m (+33.9%), Caesars was fourth with $95.7m (+21.1%). The drop to Barstool Sports in fifth was marked, Penn National’s US betting brand recorded $19.1m in handle in March.

Revenue leaders: FanDuel led the revenue charts despite its lower handle, its GGR was up a whopping 543% MoM to $12.9m, BetMGM was second with $10.3m (+20.6%) and DraftKings third $6.6m in GGR, a drop of 32% on the previous month.

Illinois May22: Gaming revenues were up 8.9% YoY (+4.5% ssb) to $116.6m, Boyd Gaming’s Par-A-Dice resort was down 5.4% to $5.3m, Penn National’s GGR was down 3.9% to $19.2m and Caesars’ GGR was down 0.1% YoY to $29.6m. GGR at Rivers casinos, ~40% of Illinois market share, was up 11.8 YoY to $46.3m.

Maryland May22: Gaming revenue came to $178.7m, a 3.7% rise MoM, total revenue for slots was down 3.3% to $114.2m, table games revenue was up 19% to $64.5m. GGR for the Baltimore-Washington area, including Live!, Horseshoe Baltimore and National Harbor resorts, was up 4.7% to $156.3m.

New Hampshire Apr22: Mobile sports betting GGR was up 25.5% to $2.8m, retail betting GGR was down 43.3% to $584K, for a combine GGR total of $3.4m (+4%). Mobile handle came to $60.4M, retail stakes were $12.7m for a total handle of $73.1m (+56.6%).

Virginia Apr22: Sports betting revenues was 82.4% to $20.7m, handle increased 82.4% to $399.4m.

Ohio May22: Gaming revenue dropped 3.6% to $201.6m. All outlets, bar Hard Rock Cincinnati’s 10.8% growth to $21.8m, were down. Jack Casinos were down 8% to $60m, Penn National Gaming resorts were down 5% to $69.3m.

Portugal Q421: Gaming revenues were up 24.6% YoY and +23.6% QoQ to €141.1m. Online casino revenue was up 53.3% to €75.3m QoQ and OSB revenue was up 2.6% to €65.8m. Online casino stakes were up 17.8% YoY to €2.1bn, online betting handle increased 26.9% to €377.3m. The number of new accounts was down 27.6% to 212.6K. Q4 revenue for the country’s land-based sector increased 61.3% YoY to €58.1m.

Newslines

Routemaster: Accel Entertainment has completed its $164.2m (vs. $140m announced at first) acquisition of Century Gaming. The cash and stock transaction enables Accel to extend its reach into Nevada and Montana and adds more than 8,000 machines in 900+ locations to Accel’s installed base of 13,000+ slot machines.

Opta data providers Stats Perform and Sporting Solutions have launched a Betting Innovation Centre which they say will develop new B2B products that provide a new range of markets and product options.

Rush Street Interactive has launched its BetRivers mobile sportsbook to partner its online casino at Century Casinos’ Mountaineer resort in West Virginia.

Gone crabbin’: Gaming Innovation Group has signed heads of terms with seafood restaurant chain Crab Sports in Maryland. Maryland is expected to go live with regulated sports-betting in Jan23.

Electronic table games provider Interblock has been acquired by private equity house Oaktree Capital.

The British Columbia Lottery's PlayNow igaming site will expand into Saskatchewan, the third Canadian province in which the platform will operate.

On social

Calendar

Jun8-9: WE+M at the Betting on Sports Europe Conference.

Contact us

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com