Apr 21: Ontario on course for $1.1bn

Ontario app and GGR data, DAZN-Pragmatic sportsbook plans, Rank and Monarch Q1s, EKG app testing.

Good morning. On today’s agenda:

Analysts sift the app and geolocation data in Ontario.

DAZN announces plans to build a sportsbook with Pragmatic Play.

Rank and Monarch Casino & Resorts are on earnings duty

Up with the people, sign up now

Ontario data

Early geolocation data suggests a market run-rate of $1.1bn GGR in 2022.

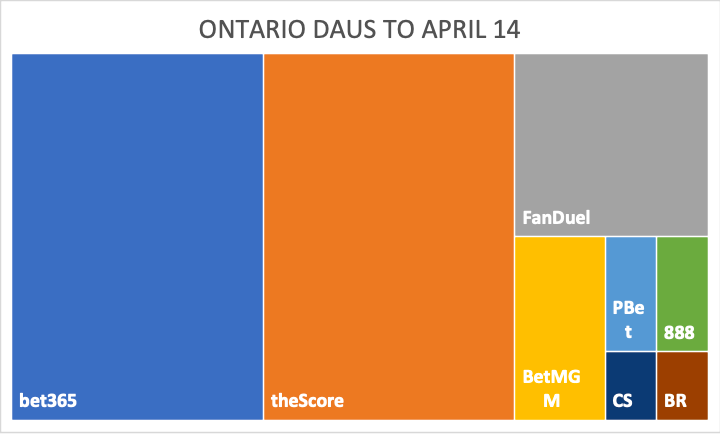

Bet365 and theScore neck-and-neck in app downloads

Market sizing: A report from Morgan Stanley yesterday cited the geolocation data which suggested Ontario GGR for 2022 was tracking at below MS estimates of $1.3bn. Data from GeoComply put Ontario volumes at around a third of New York in the opening weeks.

The analysts add a caveat on the 2022 GGR estimate, cautioning that there have been technical and KYC teething troubles in the first few weeks.

They also note that not all offshore operators have moved onshore and not all big operators have launched (DraftKings remains an absentee).

April is also a seasonally slower month for sports-betting volumes.

New app data: Wells Fargo issued new data from Apptopia which confirmed that as of Apr14, bet365 and theScore led the way with ~78k in DAUs. Next up was Betway at ~43k, then FanDuel with ~30k followed by BetMGM (~14k), PointsBet and 888 (~5k each), then Caesars and BetRivers (~3k each).

Happy with that: Wells Fargo suggested these early results were “encouraging” for Penn National, owner of theScore.

“Its ~78k DAUs are impressive, especially given its two closest competitors had an advantage from their gray market presence.”

But the analysts expect Ontario OSB share to evolve further in the coming weeks.

Wells Fargo: “We note that the three current DAU leaders all had an existing presence in Ontario before April 4th; bet365 and Betway operated in the gray market, and theScore was a leading sports/media app that was awarded a license earlier than many competitors and may be beneting from pre-registration, which began roughly two weeks prior to launch.”

One to watch: Wells Fargo note that FanDuel got off to a similarly slow start in New York before powering into the lead within weeks.

MS addendum: Morgan Stanley also revisited their own app data from earlier in the week (see Tuesday’s email) and after fixing a mapping issue and adding data to April 19, they found that FanDuel was now third on 16% of app downloads vs. 35% for theScore and 27% for bet365.

Morgan Stanley: “Taking first-mover advantage has proven a successful strategy in most US markets so an early lead is a positive read-through for the top 5 operators which account for 92% of April MTD downloads.”

**Sponsor's message: Spotlight Sports Group (owned by Exponent Private Equity) is a leading technology, content and media business specialising in sports betting. Its industry-leading Superfeed is used by the biggest betting brands in the world including bet365, Flutter and Entain. The content engine powers on-site engagement by delivering impartial expert betting insight for 20 sports in 70 languages.

For more information visit: spotlightsportsgroup.com

DAZN sportsbook

DA’ sportsbook: Sports streaming provider DAZN has announced that it will partner with online gaming tech supplier Pragmatic Play to launch an online sportsbook in Ontario in Q3. Up to now Pragmatic’s focus has been on online slots and live casino supply but the group launched its online sportsbook platform this month.

Pragmatism: The DAZN sports-betting offering will be called DAZN Bet. The announcement follows rumors that DAZN would be developing an OSB offering using source code from Spanish sportsbook specialist Optima (now part of Sportradar).

In its statement, DAZN said: “Pragmatic Group will supply the underlying platform and content and be responsible for the ongoing product development”.

The press release did not provide detail on which tech stack it would be developing the sportsbook solution.

On appointment: The DAZN sports-betting venture has long been trailed and CEO and ex-Entain boss Shay Segev recently recruited former Entain COO Sandeep Tiku as its new CTO. More betting-focused appointments are expected in the coming months.

For the heavily loss-making DAZN it also means a new revenue stream focused on the convergence of sports media, streaming and betting. The new business will be headquartered in Gibraltar.

Backgrounder: In the year to Dec20, DAZN saw losses climb to $1.3bn on revenues that rose to $871.8m. In early February, majority shareholder Access Industries, owned by billionaire investor Len Blavatnik, agreed to a $4.3bn recapitalization of the business that leaves the company debt-free.

Line to take: Now’s not the time to be the Netflix of sport.

John Authers: “The collapse in the share price of the dominant video-streaming group Netflix is now a phenomenon for the ages.”

Tekkorp Capital Australian launch

Southern cross: Matt Davey’s Tekkorp Capital has teamed up with Australian sports-betting pioneer Matthew Tripp and News Corp for an Australian-facing sports-betting venture.

The details: BetMakers Technology will be the exclusive platform and services provider. Robin Chhabra, M&A adviser and seasoned gaming exec, will join the board.

BetMakers said the revenue share deal was for 10 years and would generate potential revenues of A$300m. Matt Davey will be stepping down as a board member at the company but will remain as a major shareholder.

Monarch Q1

Q1 revenues of $108.3m up 44% YoY and Adj. EBITDA hit a record $34M.

FY22 revenue estimates of $469.2m and adj. EBITDA of $153m.

High sailing: Despite Monarch’s Reno resort undergoing renovation the group said the property has still gained share.

The team at Truist said the gains were believed to be more sizable at the newly-expanded Black Hawk venue thanks to increased VIP activity following the removal of table bet limits in May 2021. Monarch management said the property was in its “early innings of growth and is excited for long term prospects”.

Coming up for air: Jefferies said Monarch’s room renovation project at its Atlantis venue in Reno would be completed by the end of Q2 and the Black Hawk was in the early stages of exploiting the Denver feeder market. However Monarch management said there were signs of macro-economic pressures linked to inflation, fuel price rises and labor shortages.

On balance: Macquarie said Monarch had “the best balance sheet in the space at 0.3x leverage” and free cash flow of E$114m by 2023 that could lead to M&A opportunities or a push for more organic growth.

Rank Q3 trading statement

Group revenue rose 221% to £156.4m. Recall, all Rank’s land-based casino and bingo venues were closed throughout Q121.

UK digital down 1% to £40m; international digital down 5% to £5.2m.

Continued uncertainties see EBIT target for 2022 lowered 22% at midpoint to £47m-£55m.

Open all hours: Rank said the best comparable for its casino and bingo businesses in the UK was the company’s financial Q319. Against that, Grosvenor venues revenue of £691.m was down 14% while Mecca Bingo’s £34.1m was down 25%.

“For both our UK venues businesses there was a softness in visits at the end of the quarter consistent with the rise in new COVID-19 cases reported across the UK.”

Ride the pony: Grosvenor’s online casino business grew NGR by 3%, benefiting from the return of omnichannel business. Mecca was down 11%, however, due to issues around the January migration to the RIDE platform.

Out of office: The company said the seasonally slower Q4 has started with lower visitor numbers to its Grosvenor venues. The company is waiting to see how the return of office workers and summer visitors to London develops.

Cost-of-living crisis: CEO John O’Reilly said Rank “recognize (s) the pressures on UK consumers” but said the company would benefit over the rest of this year from the gradual reduction of pandemic impact and the return of overseas customers.

EKG app analysis

Tied at the top: DraftKings and FanDuel are tied as the top two online sports betting apps in the US, according to the Eilers & Krejcik Q1 app analysis report. EKG said both apps were “effectively indistinguishable from one another in terms of quality”.

However, there were differences between the two, “especially in terms of weaknesses”, EKG said, with DraftKings continuing to struggle in the ‘Core’ category and some “minor UX problems” for FanDuel.

Breaking the deadlock: Meanwhile, PointsBet’s development work is paying off. It is number 3 in the rankings and EKG said the group had succeeded in being a genuine contender in consecutive quarters in what is a “near-complete lock DraftKings and FanDuel have on the top two spots”.

However, the report adds that while the “drop-off to 4th is sizable, in that 4th-6th range apps like BetRivers and BetMGM need only some minor improvements to challenge for podium position”.

Debutants fail: EKG tested eight new apps during Q1, including SI Sportsbook, Fubo, MaximBet, PlayMaverick and DRF and all of them “ranked in - or very near - our lowest tier”, the firm said.

Eilers & Krejcik on new app fails: “Each app tended to struggle with even basic functionality; whether it was a lack of features, poor UX, clunky bet processing, or a generally buggy experience, every one exhibited some or all of those flaws.”

Emperor’s no clothes: Caesars Sportsbook re-launched its app in Q3/Q421. The app runs on a William Hill-NeoGames stack and currently ranks just outside of the EKG top 10.

Eilers & Krejcik on Caesars’ OSB app: “The app (...) incrementally improved this testing cycle, its most glaring weakness continues to be features - namely, a lack thereof.”

Earnings in brief

Holland Casino said 2021 revenue was down 8.7% to €304.2m due to COVID restrictions at its venues. Casinos were closed for 168 days last year and faced restrictions when open. Slot revenue was down 18% to €152.4m and table game revenue fell 25.5% to €94.1m. Online gaming generated €40.4m in revenue.

Questions we are asking

What is happening with DraftKings and Golden Nugget? The pair led the fallers on a generally bad day for the markets yesterday, down 7.8% and 7.5% respectively.

Newslines

Indiana wants me: PlayUp has expanded its market access footprint in Indiana to include igaming, pending regulatory approvals, via its existing sports-betting market-access agreement with Caesars Entertainment. This adds to the existing access arrangements with Caesars in New Jersey, Pennsylvania and Iowa.

And then there were two: The Wakayama Prefecture in Japan has pulled out of the race to host a casino development, according to reports from the Japan Times. It leaves Nagasaki with Casinos Austria and Osaka with MGM Resorts in the bid for casino licenses. The pullout is bad news for Caesars which had plumped for Wakayama alongside partners Clairvest Neem Ventures.

At bat: Maximbet is the first sportsbook to sign up with an active MLB player after it agreed terms with Colorado Rockies outfielder Charlie Blackmon to become a sportsbook brand ambassador.

Speed kills: Sportradar has signed a multi-year integrity services contract to provide bet monitoring and fraud detection to NASCAR.

Pay off: VICI has announced a $5bn debt offering with the majority of the proceeds going towards the MGP acquisition and the paying of MGM Resorts International’s interest in the business.

What we’re saying

Back together: Scott and Jake are reunited on podcast episode #5 which will be sent to subscribers later today. Up for discussion this week, ICE, 888, DAZN +More. It can be viewed on YouTube now if you can’t wait.

What we’re reading

Stupid is as stupid does: America’s problems are more than just a phase.

On social

Ian Wright, Wright, Wright.

Calendar

Apr26: Boyd Gaming Q1

Apr27: Kambi, Churchill Downs Q1

Apr28: Kindred, GLP Q1

Contact us

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com