Mar 25: Weekend Edition #39

Gambling.com Q4, WE+M pod #2, Deutsche Bank on promotional spend (again), sector Watch - streaming, Kero Gaming funding news +More

The turducken is featured in today’s podcast in relation to a comment from an analyst on Playtech’s full-year earnings this week. ‘Full of good things’ was the Playtech link but it strikes us that the three-bird monster is a great analogy for a rollup M&A strategy. The latest example of an M&A turducken came this week from Better Collective with its Canadian Sports Betting deal. There will be more to come. Expect to see today’s picture used more in the months to come.

S’vry gravy. Click below.

Gambling.com Q4

FY group revenue up 51% to $42.3m, North America revenues up 89% to $7.5m. Adj. EBITDA rose 26% to $18.4m.

Group guidance of $71-$76m for 2022, adj. EBITDA $22-$27m.

Loud and clear: As industry talk around marketing spend continues, CEO Charles Gillespie kicked off the analyst call by saying operators will pull back on costly media spend, but not on affiliate marketing.

“Investments in traditional media can be a very large and expensive black box,” Gillespie said.

“When we deliver traffic, every customer interaction can be tracked by the operator. Given such clear attribution, operators have the confidence to invest heavily into the affiliate channel, especially when under pressure to show ROI on marketing spend.”

“That’s just maths” Gillespie was clear affiliates had more room to grow. LTVs for casino players were much higher than OSB customers, but what operators were paying “folks like us is a fraction of that”.

Charles Gillespie: “Essentially the margin between what they’re paying affiliates and the customer lifetime value that they’re acquiring from these NDCs are very significant. It’s not close. It takes months or possibly years to capture that lifetime value, but that’s just maths.”

10,001 things to do: Gillespie said talk of a shift from the predominant CPA to more revenue-share models was not happening, despite industry chatter from both operators and affiliates.

“Rev-share really helps (operators) with financing their growth. But not every affiliate in the States has the licenses to be able to do that and every American operator is absolutely slammed, right? They’ve got a list of 10,000 things they need to do – everybody is always playing catch-up, and stuff at the margins doesn’t get a lot of attention.”

Bigger and better: M&A will continue to be a focus but Gillespie said the group wouldn't be specific on the guidance other than the previous guidance on larger deal being preferable. “We don’t want to get bogged down in the weeds with lots of small deals,” he said, adding that vendor valuation expectations had come down in recent months

Charles Gillespie: “If we’re talking to small-to-medium-size European affiliates, I’m not sure how much they pay attention to the US equity markets, to be honest. But certainly, for the bigger stuff, everybody’s expectations must have come in a bit over the last six months.”

Analyst reaction: Truist Securities noted the company was off to a strong start with a record January. Gambling.com will be “a beneficiary of an impending shift in promotional spend as B2C interactive operators curtail dollars on traditional media channels”. Jefferies said the New York launch was “meaningfully above expectations” and that there were “more than 50 licensees” going live in Ontario in April.

** Sponsor’s message: Venture capital firm Yolo Investments is home to €350m of equity in more than 50 of the most exciting companies across fintech, gaming and blockchain. It continues to build one of gaming’s most dynamic portfolios as it eyes up seed and A-stage opportunities across the sector. Its dedicated 28-company, €135m AUM gaming fund already houses holdings in fast-growing suppliers and operators, including Kalamba Games, SimWin and ThriveFantasy. Yolo Investments is also on the lookout for LPs as it looks to scale new concepts, including its high-roller live casino brand, Bombay Club.

As a proud sponsor of Earnings+More from Wagers.com, Yolo Investments wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat.

Earnings+More - the pod

Edition #2 of the Earnings+more podcast brought to you by Wagers.com is now available via Youtube, Spotify and Apple. This week, Jake and Scott discuss Playtech’s full-year 2021 earnings - possibly its last as a listed entity - as well as the last quarterly earnings call by GAN and recent analyst commentary on OSB and the recent betting-related stocks sell-off.

Deutsche Bank igaming update

Sins of omission: Following up on their note earlier this week looking at promotional spend levels in Pennsylvania, Michigan and Colorado, the team at Deutsche Bank make the point today that a “notable omission” was New Jersey.

The sector bellwether state does not provide a breakout of promotional spend as it taxes at GGR level and thus “does not care about the level of promotions being deducted for tax purposes”.

However, promotional spend levels can be deduced from the quarterly reporting each licensee makes to the state.

Do you want to know a secret? The DB team warn that its findings on promotional spend levels in the most mature of US OSB and igaming are “to be frank, somewhat draconian”.

Investor expectations, they note, are tethered to “essentially bogus” handle and GGR metrics. If operators continue to focus on handle and GGR growth “to satiate investor expectations” then the “steady-state” of investor comfort with the sector’s profitability prospects.

The sector has also used handle and GGR metrics to “articulate the size of the industry” and future TAM forecasts with New Jersey “often used as the focus for all future state ramps”.

I don’t care too much for money: Deutsche Bank reach the conclusion that “extrapolating” New Jersey GGR and then “simply extracting what currently amounts to a very large slug of promotions that are producing phantom GGR, with no impact to gross revenues, is an impossible dynamic to achieve”.

Sector watch - streaming

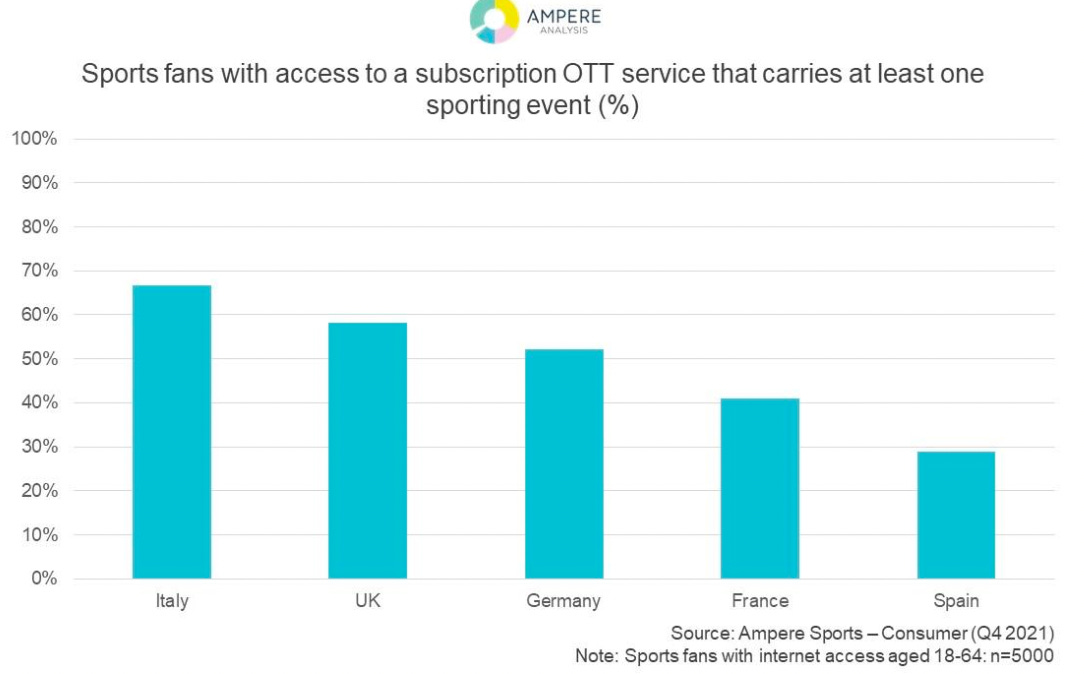

On the rise: A report from Ampere analysis suggested that streaming services will account for a fifth of all sports TV broadcast rights spending this year.

In the big five markets - the UK, Spain, Italy, Germany and France - OTT platforms are predicted to account for 20% of all sports broadcast-rights spend in 2022, up from 12% in 2021.

Room at the top: Ampere notes that Amazon and DAZN have grown their presence in the sports rights market in recent years. They point out that the top-tier domestic leagues in each of the big five will have at least one OTT partner in 2022.

More than half (53%) of spending on Italian sports rights come from streaming providers. This is followed by Germany (32%), Spain (16%), France (14%) and the UK (2%).

However, by percentage of sports fans with access to OTT services, the UK comes second as all the major broadcast providers (Sky, BT Sport and Eurosport) provide OTT services to their subscribers.

Baller: DAZN is now the third biggest spender on sports TV rights behind Sky and Telefonica and is forecast to spend €2.1bn this year. According to reports in Italy, where it controls the domestic rights to Italian Serie A, it is looking to expand its footprint in the country by acquiring the rights to the Italian basketball league which is currently broadcast by Eurosport.

Startup funding - Kero Gaming

We could be Kero’s: White-label in-gaming sports-betting provider Kero Gaming - previously Rush Sports - has completed its first public funding round raising $1m from investors including Acies Investments, Sharp Alpha Fund, iGaming Ideas and other strategic stakeholders such as Benjie Cherniak of Avenue H Capital and Scott Secord of Cardinal Sports Capital.

Tomash Devenishek, founder and CEO, said the new funding has “drastically accelerated our ability to create transformative turnkey betting products”.

Datalines

New Hampshire Feb22: Sports betting handle was 30% MoM but up 39% YoY to $71m, GGR was down 44.4% to $1.8m and 87.5% down MoM. Online operators recorded $59m of the handle.

Louisiana Feb22: Betting handle came to $211m in the first full month of legalized online sports betting in the state, with $40.5m wagered in the first four days of regulated OSB at the end of January. GGR totaled $16.7m but included $11.7m in promotion-driven GGR, excluding these GGR was $2.7m. Including retail wagers, total handle was $238.4m.

Washington D.C. Feb22: Betting handle rose 25.7% YoY to $19.1m but revenue was down 43% to $740.5K due to punter-friendly results. Caesars’ partial online and retail offering at the Capital One Arena recorded $11.3m in wagers, but just $61K in revenues. DC LOttery’s online sportsbook Gambet DC took $3.9m in handle and $440,5K in GGR. BetMGM took $3.5m in bets and $190K in GGR.

Regulatory roundup

The Missouri House passed the two bills that would enable sports-betting within the state and they now move on to the Senate. The bills incorporate taxes at 8% and are supported by the state’s 13 casinos and professional sports teams. Casinos would have three skins each whole then sports teams would receive one skin each.

In Minnesota, sports-betting legislation progressed through the House Judiciary, Finance and Civil Law Committee.

France’s regulator L'Autorité Nationale des Jeux (ANJ) warned operators that they are not doing enough to “de-intensify” marketing following an annual review of promotional strategies. The ANJ has banned one advert from leading brand Winamax and previously announced rules designed to stop gambling ads trivializing gaming.

Partnerships

PointsBet Canada’s has struck a multi-year partnership deal with the Canadian Football League’s Ottawa Redblacks. The deal includes PointsBet branding throughout the team’s stadium.

Newslines

Crown and out: Crown Resorts has two years to return to suitability at Crown Perth in Western Australia after being found unsuitable to operate the casino by the Western Australian government. The company can still operate, but under the watch of an independent monitor.

Woohoo: The gaming identity verification and fraud prevention provider Mitek has announced the acquisition of customer acquisition specialist HOOYU for £98m. This will allow Mitek to offer document validation, geolocation and identity confidence scores.

Temporary measures: DraftKings has opened a temporary retail sportsbook at Hollywood Casino Baton Rouge in Louisiana. A permanent sportsbook will open next year.

Names on the list: Entain, BetMGM and PointsBet have all secured iGaming operator licenses in Ontario.

NY pays: Paysafe continues to launch with US OSB brands. It has gone live with Resorts WorldBET’s online sports betting platform in New York and will offer its Skrill, Paysafecash and paysafecard deposit and withdrawal methods to Empire State players.

Play facilitator: JP Morgan will be the primary payment facilitator for Play+, which is payment provider Sightline Payments’ prepaid card for online gambling transactions.

What we’re writing

On Wagers.com: Jake Pollard on GAN and market fragmentation and Steve Ruddock on why icasino regulation is such as tortuous process.

On social

Calendar

Mar 29: XL Media

Mar 30: Sportradar Q4

Contact us

Scott Longley scott@clearconcisemedia.com

Jake Pollard jake@openmediaservices.com