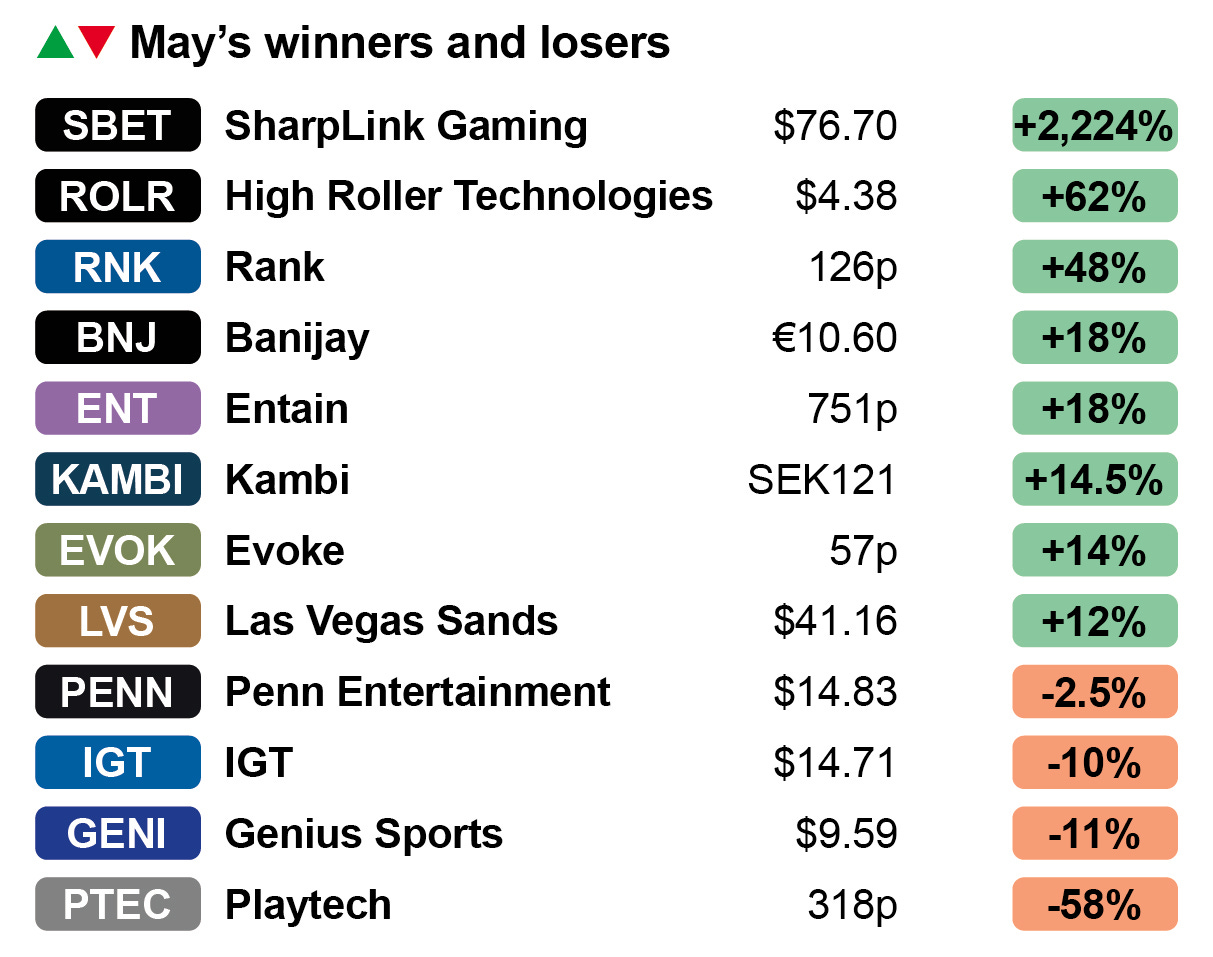

Markets: Entain and Evoke also enjoy double-digit monthly gains.

Illinois raises last-minute taxes on the OSB sector once more.

The earnings edit: Las Vegas Sands CEO talks Macau disappointment.

Puts & takes: CBRE takes a trip to the Gulf Coast.

Hard Rock Bet is growing – we know you know! And we want to bring in some more maestros to make beautiful music in our Sportsbook. You need to be among the very best in the industry to be considered for these roles. Are you up to it?

Flying the flag

Restoration comedy: Driven by a widespread sense that the worst of the regulatory foul-ups may be behind them, the leading remaining UK-listed betting and gaming operators enjoyed double-digit gains in the past month.

Leading the way was largely UK casino and bingo operator Rank, up 48% for May.

House rules: The shares were pushed along by the news that the government’s land-based reforms, which will allow for more gaming machines in B&M casinos as well as sports betting, will move through Parliament in July via a statutory instrument procedure.

What’s in a word? Meanwhile, hints that the UK Gambling Commission is somewhat walking back the rhetoric on ‘affordability’ measures – with the regulator now insisting somewhat bizarrely that it never used the word – have helped UK stalwarts Entain and Evoke.

Interstella: Each benefitted also from positively received earnings statements, and in Entain’s case the news of the permanent appointment of Stella David as CEO.

Entain was up 18%, with its Q1 earnings showing NGR at the UK & Ireland business up 23% YoY.

Not going backwards at least: Evoke was up 14% despite somewhat less impressive figures, with UK & Ireland revenues down 1% in Q1, but with its international operations seeing an 11% improvement.

Treading water: After a tumultuous couple of months following President Trump’s Liberation Day announcement, the major US-listed gaming stocks somewhat meandered in May as fears over a tariff-induced recession faded.

MGM Resorts and Caesars Entertainment were both effectively flat over the month.

More productively, Las Vegas Sands was up 12%, despite – or because of – its exit from the race in New York (see ‘The earnings edit’ below).

Someday this war’s gonna end: Penn saw its shares fall 2.5% this month against a backdrop of increasingly bitter exchanges between the company and activist investor HG Vora.

The proxy battle will come to a conclusion at the AGM scheduled for June 17.

Losing out on the lottery: Also down in May was IGT, which was adjudged to have been forced to pay more for its Italian lottery license renewal than perhaps it would have liked. It suffered a 10% decline on the month.

The sharp end: Topping the table this month is the gaming affiliate turned ETH treasury play SharpLink Gaming. It enjoyed a 2,224% rise, including a hugely volatile day on Friday when it swung up to $121 at one point before settling back to the $76 mark.

The odds of it retaining an interest in the gaming affiliate space now it has become a crypto-plaything are now very long.

On a high: iCasino minnow High Roller Technologies enjoyed a bumper return this past Friday, up 60% on the day, leaving the stock up 62% for the month. The latest news from the company was that it is now pursuing a license in Ontario.

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

Illinois tax hike

Still IL: The Illinois budget process concluded over the weekend, adding what Citizens said was “another negative surprise” for the OSB sector, which will see the progressive tax rate for any operator generating over $20m in GGR annually hit by a new 50% top rate. The new rate will become applicable on July 1.

Why is it always me? As the analysts pointed out, only DraftKings and FanDuel exceeded $20m in the last 12 months, “implying the tax was created to hurt those two companies more than the mid-scale companies,” said Citizens.

This is gonna hurt: The team added that, under the terms of the budget measure, they estimate DraftKings will take a $79m hit to 2026 estimated EBITDA, or about 5.4%, while FanDuel’s damage will be ~$86m, or 2% of estimated EBITDA.

The team added that mid-tier operators will have less than a $5m impact each, which they believe can be “nearly offset with mitigation efforts” given the smaller dollar impact.

Not rolling with the punches: This is the second successive year of tax rate tampering in Illinois and, while the sector spoke about mitigation efforts this time last year, Citizens said the impact for DraftKings and FanDuel would be “harder the second time around.”

Citizens noted the industry has spoken about the introduction of iCasino as an “offset” when states need tax revenue.

“But that has not come to fruition, and small businesses and the providers of gaming establishments on major routes in the state still have enough power to withstand any effort to get iCasino over the finish line.”

You made me do it: Citizens said the tax negative “plays into” its thesis that operators will use the eventual launch of prediction markets to divert players away from sports betting in higher-tax states.

Truist noted prediction markets offered the chance to “sidestep taxation entirely.”

Citizens added this “appears more likely than not” that it will happen either later this year or in 2026.

Read across: See Friday’s E+M on how DraftKings and FanDuel are already nervous about getting beaten to the punch on prediction markets.

+More

File under ‘are you sure?’ DraftKings “will not be taking over” the Las Vegas Sands’ now-exited New York casino plan in Nassau County, according to Newsday. “There is no deal between the companies nor will there be,” sources told the paper. “DraftKings will not be taking over the Sands’ bid.”

The Fontainebleau Las Vegas is reported to have laid off “dozens” of table dealers, as the company said it continues to “evaluate our business needs and adjust our hiring strategy accordingly.” The casino is one of three Strip properties that have been the subject of regulatory sanctions of late over alleged AML violations.

Macau data points: GGR was up 5% YoY to $2.34bn, the largest monthly total for 2025 so far and also for the post-pandemic period. The total represents just under 82% of the May 2019 level, helped by a surprisingly strong Golden Week period at the start of the month.

What we’re reading

Dominate tricks: “Our ambition is to build prediction markets into the largest form of financial markets. If we do that, the outcome is going to be very, very large.” Tarek Mansour on how Kalshi has “taken a battering ram to the regulatory establishment in its bid to give Americans the inalienable right to bet on just about everything. In Bloomberg.

The earnings edit

Las Vegas Sands

Drag city: CEO Robert Goldstein skirted the opportunity to blame tariffs for the recent share price underperformance and instead said it was perceptions for the prospects in Macau, due to China’s drawn-out recovery from the pandemic, that is proving to be more of a drag.

“I’m not sure tariffs are that critical right now to our stock price,” he told analysts from Bernstein during an investor conference.

Goldstein admitted Macau was a market that LVS had “struggled with a bit.”

Speaking ahead of the May numbers, he said: “It’s been a very challenging couple of years, not just during the Trump tariff era.”

He was altogether happier with Singapore, which he termed as Asia’s “shining market.”

As for the US, Goldstein said that following the news it had given up on the New York bid, it considered its homeland as a bust. “We tried and failed,” he said.

See Friday’s Earnings Extra (PRO subscribers only).

In brief

Intralot: Revenue rose 11% YoY to €94.4m while EBITDA was static at €30.2m, with revenues helped majorly by a 23% increase in the B2B management contract segment – now representing 89% of total revenues – which was largely down to a 61% increase in sports betting in Turkey. B2C licensed operations revenues – 11% of total revenues – were 65% ahead due to improved conditions in Argentina.

EveryMatrix delivers iGaming software, solutions, content and services for casino, sports betting, payments, and affiliate/agent management to 300+ global Tier-1 operators and newer brands. The platform is modular, scalable, and compliant, allowing operators to choose the optimal solution depending on their needs.

EveryMatrix empowers clients to unleash bold ideas and deliver outstanding player experiences in regulated markets.

Puts & takes

Taking the laurels

On your own two feet: Caesars’ iCasino business “continues to be one of the more impressive storylines in the digital space” on the back of the launch of, first, the Caesars Palace and, latterly, the Horseshoe standalone apps, suggested Citizens.

The analysts noted iCasino revenue increased 40% in Q1 after a 59% increase in Q424.

After meeting with management, they added that the current quarter is shaping up to see another impressive performance” with revenue tracking >50%.

Keeping up with the leaders: However, for all the advances in terms of revenue, the market share data for Q1 and for April would suggest Caesars is merely managing to keep up with the pace of iCasino growth.

Data collated by Deutsche Bank showed that in Q1 its GGR total across New Jersey, Michigan, Pennsylvania and West Virginia totaled $153m while April hit $53.1m.

Marginal gains: This translates to a market share across all states of 6.6% for the first four months of the year, the same percentage as Q424 and 20bps ahead of the overall 2024 number.

Quick takes

Banijay

Tuning in: In an initiation note, Deutsche Bank said the Paris-listed media to gaming entity Banijay owns in Betclic a leading player in the European sportsbook space with “superior product and technology,” which enables it to outperform in terms of market share in the countries where it has a presence.

Majorly this is in France, which the analysts noted is “under-penetrated” and with more room to grow, particularly as and when France regulates iCasino.

At that point, the competitive picture will inevitably alter, although the team added that FDJ – now with the Unibet/Kindred brands in its armory – might not be able to “fully exploit” the value of its lottery database and brand, due to restrictions on cross-selling.

Gulf of somewhere

We could drive down to another beach: After taking a tour of the Gulf Coast, the analysts at CBRE have returned with talk of casino managers being "comfortable with the consumer” and a “reasonable” competitive environment.

The team pointed out the $2bn market has seen notable investments in recent years, including ~$435m at Caesars New Orleans and ~$100m at Boyd-owned Treasure Chest.

Soon the restaurants will open up: CBRE noted the lower-income southern gaming markets are often thought of as being “among the first regions to reveal cracks in consumer health,” thus the trip was particularly relevant given the ongoing fear of recession.

Soon the bars will light their lights: Instead, the team found Caesars New Orleans was “back on track” after a weather-disrupted start to 2025.

Meanwhile, the Treasure Chest was on track to deliver 25% ROI on Boyd’s ~$100m investment.

“While some of Treasure Chest’s success is unique, we view the project as emblematic of the opportunity for broader move-to-land efforts,” the team added.

The social dumpster

“If they can do this on such a minor game as the Champions League final just imagine what they will do for a midweek League 2 game in November.” Alun Bowden from EKG on LinkedIn responds to a Tarek Mansour posting about Kalshi’s Champions League Final liquidity. And file under headlines we never thought we’d see: ‘Has McTominay overtaken Mbappe for the Ballon D’Or.’ In The Athletic. Finally, Betfair payout on PSG beating Spurs in the Super Cup final. Via X.

We Rebuilt The Bet Builder – See It Live at SiGMA Asia

Faster speeds. deeper market coverage. zero downtime. billions of combinations, live bet settlement — all in one place.

Try the NEW OpticOdds Bet Builder now ⚡

Check out our other solutions –> opticodds.com

Odds Screen | Sports Betting API | Automated Trading Tools

Heading to SiGMA Asia? Let’s meet!

Upcoming earnings

Jun 6: Allwyn

Jun 17: Penn Entertainment AGM

Jun 24: FDJ United investor meeting

Jul 17: Evolution

Jul 18: Betsson

Jul 23: Kambi, Las Vegas Sands

Increase Operator Margins with EDGE Boost Today!

EDGE Boost is the first dedicated bank account for bettors.

Increase Cash Access: On/Offline with $250k/day debit limits

No Integration or Costs: Compatible today with all operators via VISA debit rails

Incremental Non-Gaming Revenue: Up to 1% operator rebate on transactions

Lower Costs: Increase debit throughput to reduce costs against ACH/Wallets

Eliminate Chargebacks and Disputes

Eliminate Debit Declines

Built-in Responsible Gaming tools

To learn more, contact Matthew Cullen, chief strategy officer: Matthew@edgemarkets.io

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.