The uncertainty weighing on the markets is starting to impact trading.

In +More: Bally’s Chicago IPO do-over, Penn’s riverboat makeover.

Earnings TL;DR: Churchill Downs, Boyd Gaming, Las Vegas Sands.

Evoke says Q1 revenues below target but EBITDA profits are up.

Hard Rock Bet is gearing up for 2025 with a focus on amplifying brand and product engagement. With a powerful, custom-built bonusing system and an ambition to redefine traditional CRM, we’re seeking leaders who are driven to challenge the status quo:

And other amazing positions here

Crash barriers

It’s the economy, stupid: Churchill Downs CEO Bill Carstanjen laid the blame for the pause it announced on $900m worth of development projects at the door of the White House, suggesting the tariff threats made it all but impossible to forecast costs.

The comments on the earnings call yesterday sent the company’s share price diving by 16% on the day.

A price for everything: “A lot has changed, including increased general economic uncertainty and risk of significant inflation,” he told the analysts, including the tariffs announced by President Trump.

“We don’t like to have the additional variable of ‘what is this thing going to cost us to build?’,” he added.

“Right now, we can’t do that on a major project because of the macro environment.”

Stuttering: To make matters worse, Carstanjen also suggested the company was seeing some “hesitancy” – a word he used seven times on the call – on the part of its consumers. Jordan Bender, an analyst at Citizens, told E+M that while the April data was not yet in, “one conclusion is that it could be coming in worse than expected.”

He noted the company had previously been guiding to some level of revenue growth for this year’s running of the Kentucky Derby.

But Bender said the company was now “expecting no growth, bringing into question how much of a deterioration in pricing occurred in the month and a half leading into the race.”

Pillow talk: Tariffs were also part of the discussion the day previously during Las Vegas Sands’ call, with CEO Rob Goldstein insisting he was not having sleepless nights over the worsening relationship between the US and China over trade.

“We have an incredible relationship with Beijing,” he told the analysts. “And we’ve worked on it for many, many years. Hopefully, we can get back on track.”

I see a dark handsome stranger: Fears over the health of the US economy have impacted stocks in recent weeks. Now, those fears look like they are being realized, Bender said it was “a little surprising that brick-and-mortar gaming stocks aren’t down more on those comments.”

Bender said that predicting what happens next was all but impossible. “This is a moving target right now,” he said. “At the moment, we just don’t know what next week looks like.”

“Yesterday the administration said seven different things about tariffs,” he added. “But positive news from the administration doesn’t necessarily percolate through quite so quickly to the consumer.”

Asked whether companies might now take advantage of the more pessimistic messaging from their peers, Bender said it “could be that kind of situation.”

“This is peak uncertainty and this might be the excuse for getting the bad news out there,” he added.

“It might not turn out to be so bad later in the year and if companies overcompensate to the downside, stocks could improve once we have more clarity.”

April skies: However, Boyd Gaming signally didn’t take this option and CEO Keith Smith said the company was “encouraged by the consistency of the trends in our business,” with the first three weeks of April consistent with the trends in March.

“As we try as best we can to look through the noise that occurred during the first quarter, we see our core customer frankly continuing to grow,” he said.

He noted, however, that the uncertain economic backdrop would see the company be “more conservative” with regard to its share buyback program.

Hard bargain: The battering suffered by the gaming sector in the past month caused by external shocks such as the Trump tariff wars and fears of a potential US economic slowdown has left gaming stocks at bargain basement levels.

Analysts at Truist issued a note this week suggesting that gaming was among the “best positioned” consumer sectors to weather any macro storms.

Sixth sense: “We see bargains everywhere,” the team wrote, highlighting the gaming REITs, asset-heavy stocks such as Churchill Downs and the leading online operators.

Does your Bet Builder supplier or in-house Same Game Multi solution support 13 sports, including all of the main global betting sports, plus local variants and even eSports? Does your product allow your end-users to place both Pre-Match and In:Play Bet Builders across multiple sports? Can you offer cashout across all Bet Builder transactions? Does your solution use your own odds rather than another opinion of the market? If the answer to any of these is ‘no’ then come and find out why over 170 operators are using the Algosport Bet Builder solution today.

+More

Lottomatica has raised €1.1bn of senior secured notes due 2031, with the proceeds from the issuance to be used to fully pay off the remainder of its €565m in senior secured notes due 2028. The company has also agreed amended terms of its revolving credit facility.

Bally’s is having another crack at launching a local IPO for its Bally’s Chicago permanent casino facility after its previous attempt faced a lawsuit alleging racial discrimination against white male investors. The IPO now invites investment from all Chicago and parts of Illinois residents, while Soo Kim, chair at Bally’s, said the offering had attracted a “substantial amount of interest in ownership from women and minority groups.”

Back to the land: Penn Entertainment is to spend $180m-$200m on the relocation of its Ameristar Casino Hotel Council Bluffs riverboat casino in Iowa to a new land-based property to be rebranded as Hollywood Casino Council Bluffs. The proposal has already been approved by the Iowa Racing and Gaming Commission and also got the nod from Deutsche Bank’s analysts, who said they viewed the “continued focus on the core business favorably.”

Sportradar’s selling shareholders, including CEO Carsten Koerl, offered their shares at a price of $22.50, a 6% discount to the prevailing price. Koerl sold down his holding from 5.5% to 1%, although he still retains a voting majority.

Read across

Who is Brian Quintenz? The upcoming Commodity Futures Trading Commission roundtable on April 30 is set to offer an insight into just how far the Trump administration wants to pull apart the current structure of state regulation of gambling in order to give prediction markets free rein. In Compliance+More.

Finance Business Partner – iGaming – Abu Dhabi

Senior Affiliate Manager – Limassol, Cyprus

Head of Marketing – Malta

The earnings edit

Churchill Downs

Down tools: “A lot has changed in the last nine weeks,” said CEO Bill Carstanjen in explaining away the company’s decision to call a temporary halt to its planned multi-year $900m development of the home of the Kentucky Derby.

Who to blame? Carstanjen said the decision was driven by the “general economic uncertainty and risk of significant inflation” caused by the Trump tariff.

“This has created unanticipated and currently unquantifiable expected cost increases in most materials,” he added.

He was keen, however, to suggest that once the tariff storm passes – maybe that’s an if – then it will be “full speed ahead” once again on the projects in question.

In terms of the consumer, while not speculating on the ability to spend, Carstanjen said there was a “hesitancy" among the customer base.

Derby game: But while he reassured analysts that the softness the company was seeing wouldn’t affect the financial performance of this year’s Derby weekend, investors were less than reassured and sent shares crashing over 14% in early trading.

See yesterday’s Earnings Extra edition (PRO subscribers only).

Las Vegas Sands

Diplomatic baggage: As noted above, CEO Rob Goldstein said Las Vegas Sands was “very disheartened” by the current trade tensions between the US and China but he wasn’t fearful of retaliation against US companies by the authorities in Beijing.

However, with Macau revenues falling 6% YoY, Goldstein said LVS was not happy with the earnings “in every segment,” adding “we plan to do better.”

Nobody does it better: In Singapore, Goldstein boasted that the Marina Bay Sands property produced the most EBITDA of any one single casino globally.

Don’t want to be a part of it: However, New York is now a no-go with LVS pulling its bid, claiming the threat of future iCasino imperilled the overall market opportunity.

The company is in talks to “transact the opportunity” to an unnamed B&M and iCasino operator which will take over the bid.

See yesterday’s Earnings Extra edition (PRO subscribers only).

Boyd Gaming

Nothing to see here: Boyd Gaming CEO Keith Smith brushed off fears over the health of the US gaming consumer as he insisted that trading in April had been in line with decent trends in March.

“We have not seen any meaningful shift in consumer behavior or spending patterns thus far in the second quarter,” he told the analysts.

“Looking through the noise during the first quarter, we see the core customer continuing to grow.”

Climate change: Q1 trading had been affected by adverse weather conditions for the Midwest and South regions but Las Vegas Locals was the only disappointment, up against tough Super Bowl comps.

The current climate is affecting how the company views buybacks, with Smith suggesting it would be “much more conservative” around any buying over and above its $100m-a-quarter commitment.

On message: Asked about what the current economic uncertainty means for M&A, Smith maintained message discipline about being “very cautious.”

See this morning’s Earnings Extra edition (PRO subscribers only).

We Rebuilt The Bet Builder

Faster speeds. Deeper market coverage. Zero downtime. Billions of combinations — all in one place.

Try the NEW OpticOdds Bet Builder now ⚡

Earnings in brief

Evoke

Jam tomorrow: Overall Q1 revenue was up an anemic 1% to £437m, with UK & Ireland online down 1% and retail down 6% but with international enjoying an 11% boost, helped by the acquisition of Winner.ro in Romania.

The company said that trends had accelerated in April with YTD trading up 4%.

It said Q1 EBITDA was “significantly higher” YoY, taking the trailing LTM figure to £330m.

The yin and yang of marketing: The effect of lapping the heavy promo activity this time last year meant active players were down 21% but ARPU was up 26%.

Mr consistent: CEO Per Widerström noted Q1 revenue was below the annual growth target of 5%-9%, but claimed the higher adj. EBITDA metrics reflected the group’s “focus on creating value through sustainable, profitable growth.”

Analysts at Investec were encouraged, saying that should the underlying performance continue to improve the market would be reassured and “crucially, debt reduction would follow.”

Gaming & Leisure Properties

Solid: Revenue came in at $395m, slightly below consensus, with adj. EBITDA of $360m also representing a miss. Q1 saw the funding of the conversion of Bally’s Belle of Baton Rouge Casino to a land-based location and an extension of the master lease with Boyd Gaming.

The REIT also agreed to fund improvements at Penn Entertainment’s Ameristar Casino Hotel Council Bluffs, as per the above news.

E+M PRO

Can you hear the drums, Fernando? As we noted earlier this week, the Q1 earnings season is now truly upon us and it could well prove to be the most consequential reporting period for some time.

Why not read what your competitors are reading? Buy an E+M PRO subscription now.

Connections

The big deal: Caesars and Games Global have teamed up to launch NBA Triple Double Power Combo, an online slot game featuring NBA themes. It marks the first official NBA-branded game on Caesars’ platforms. The game is exclusively live for the 2025 NBA playoffs and available on all Caesars’ iCasino brands in New Jersey, Michigan, Pennsylvania and Ontario.

Novomatic has expanded its land-based gaming product distribution under a partnership with Harvest Gaming. Playbook Fusion has received license approval in the UK to launch its flagship Playbook Football game through Games Global’s platform. ThrillTech has also received a license in the UK for its jackpot products. Playtech has launched Club Aurora, its third dedicated live studio for Evoke under a long-term partnership. Spinmatic’s online casino games are now available on Novibet’s platform in Greece under a content partnership.

Sportradar will provide its integrity monitoring for over 10,000 Brazilian soccer matches in the upcoming season under an extended partnership with the Brazilian Football Confederation.

EDGE Boost is a dedicated bank account for bettors with a daily debit limit of $250,000 and 100% approval for all gaming activity. Money movement in gaming has never been a payments problem, it's been a banking problem. With no integration (Runs on VISA rails) and no costs, EDGE can impact Operator margin by lowering processings costs and reducing chargebacks while growing revenue through increased cash access and a 1% rebate on all transactions.

To find out more, go to www.edgeboost.bet

Upcoming earnings

Apr 28: BetMGM

Apr 29: Betsson, Caesars Entertainment, NorthStar Gaming, Entain

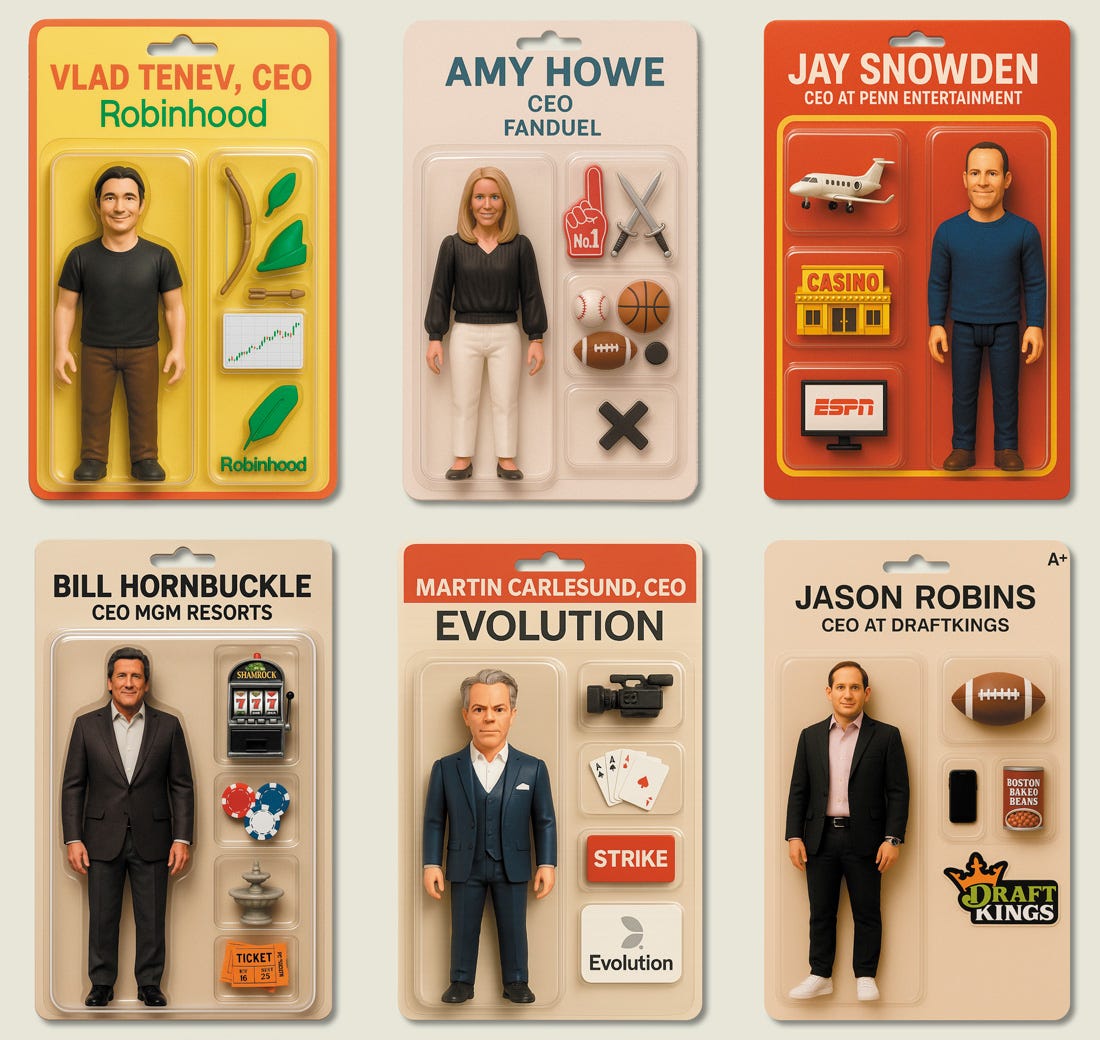

Apr 30: Kambi, MGM Resorts, Rush Street, Robinhood

May 1: VICI Properties

Fincore delivers tailored tech solutions for the gaming industry. For 25+ years, we’ve helped clients modernise legacy platforms, accelerate product roadmaps, integrate complex systems, and turn AI into real-world impact.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.