CEO not telling the whole truth over how trading works on Kalshi platform.

In +More: Aristocrat reported to be closing in on $1bn Interblock deal.

Earnings in brief: FDJ United disappoints, Rivalry’s struggles continue.

The teardown: What’s priced in for the recent share price declines?

Hard Rock Bet is gearing up for 2025 with a focus on amplifying brand and product engagement. With a powerful, custom-built bonusing system and an ambition to redefine traditional CRM, we’re seeking leaders who are driven to challenge the status quo:

And other amazing positions here

Smoke and mirrors

Show your workings: The legal arguments over sports prediction markets have dominated the headlines ahead of the upcoming Commodity Futures Trading Commission roundtable, but the mechanics of prediction markets are now starting to receive more critical attention.

We are all traders now: Comments from Tarek Mansour, the CEO and founder of the leading onshore provider in the space Kalshi, to Axios last week repeated his contentious claim that what his company offers is trading and not sports betting.

“In our markets, you’re trading in an open financial marketplace,” he claimed. “You’re trading against other people.”

“If you go to a traditional model, you’re betting against a sportsbook. They’re setting the odds and they make money if you’re losing money."

Maker’s mark: But Mansour skirted over one of the most important factors behind Kalshi and that is where it gets its liquidity. As ex-Deutsche Bank and now independent analyst Alfonso Straffon pointed out in an X post, this argument is “flawed and misleading.”

“Last I checked you have market makers,” he said in comments directed at Mansour.

“You said, yourself, last year you had onboarded Susquehanna. We all know SIG has been making markets in sports for a good while already.”

Off to meet the wizard: In April last year, Kalshi announced that Susquehanna Government Products, part of the Susquehanna International Group (SIG), had become its first “dedicated institutional market marker” within its ecosystem.

In the press release Mansour said the hook up with SIG “changes everything,” representing the “inaugural debut of institutional grade liquidity to prediction markets.”

Not to be confused with: the Susquehanna Hat Company.

Didn’t we meet somewhere before? Susquehanna was previously on the radar screens in 2022 when it bought a 12.5% stake in PointsBet, before that company sold its US business to Fanatics.

As part of that deal, it was announced that SIG-owned sports trading outfit Nellie Analytics would be providing sports analytics and quantitative modelling services to PointsBet’s Banach Technology.

Yass Sir, I can boogie: SIG is owned by Jeff Yass, a Trump supporting billionaire and devotee of free markets theorist Milton Friedman. An FT article last October pointed out that on “any given day” SIG’s exposure to the options market was “upward of half-a-trillion dollars.”

We wanna be free: The FT reported that when asked in 2021 about protections for traders who lose more than they can afford, Yass said it “comes down to do you believe in liberty or not.”

To do what we wanna do: “If you’re not adult enough to go buy or sell stocks, if you don’t have the freedom to do that, how much freedom do you really have?”

A fair exchange: The SIG Sports Analytics subsidiary, run out of Dublin, is a market maker on Betfair. Its annual report for the year to Dec23 showed it made a trading profit of $5.8m, but after admin costs it made a pre-tax loss of $4.6m.

Ain’t that the truth, Ruth: The idea that a large institutional trading house is on the other side of a large percentage of the trades on Kalshi “does somewhat shoot down the ‘source of truth’ stuff,” argued Paul Leyland from Regulus Partners.

“A market maker is a bookmaker,” he told E+M. “The only difference is the product they are trading.”

Spread and butter: E+M approached Kalshi for comment on market makers. A spokesperson said, as with financial exchanges, market makers exist within the Kalshi ecosystem to “provide liquidity and ensure that users can exit positions at any time for a fair market price.”

“They are a key reason the exchange is able to produce the tight spreads that Kalshi is famous for,” the spokesperson added.

Thinking it over: Separately, Bloomberg noted DraftKings has withdrawn an application for a license to sell derivatives.

In a statement, the company said it “continues to monitor developments related to prediction markets as an emerging product that reflects evolving consumer engagement and warrants thoughtful consideration.”

👀 Meanwhile, Bloomberg also reported the Trump administration was stepping up its efforts to bring independent agencies such as the CFTC under White House control.

We Rebuilt The Bet Builder

Faster speeds. Deeper market coverage. Zero downtime. Billions of combinations — all in one place.

Try the NEW OpticOdds Bet Builder now ⚡

+More

Block party: Aristocrat is reportedly closing in on an acquisition of Slovenia-based electronic tables games provider Interblock for $1bn. According to The Australian, a deal – which would significantly increase Aristocrat’s footprint in the ETG sector – could be announced when the company presents to investors in May.

Accel has announced it has soft opened its first Illinois casino at Fairmount Park, its first entry into the racino market. Accel completed the $35m acquisition of Fairmount Park, which runs the FanDuel Sportsbook & Racetrack in Collinsville, in December.

Quick takes

Wynn Resorts: The question of what happens next with the near-9% stake in the company owned by co-founder Elaine Wynn, who died last week, is occupying the minds of investors, according to Jefferies. A standstill agreement was in place from the time of Steve Wynn’s departure, but Tilmann Fertitta recently increased his stake to 11% and the analysts said it was “fair for investors to contemplate the outcome.”

Data points

New Jersey: iCasino cemented its position as the dominant form of gaming in the state after the March figures showed GGR rising 24% YoY to $244m. In comparison, B&M gaming was down 4% to $230m. For Q1 as a whole, iCasino rose 20% YoY. OSB was down 20.5% YoY at $71.3m on handle that fell 17% YoY to $1.11bn. In sports, the notable market share move in March was a 12ppt drop for FanDuel, giving share to every competitor.

Michigan: iCasino’s forward momentum also continued in Michigan in March, up 21% YoY to $261m. The Q125 percentage YoY increase was 25%. Less positive were the OSB numbers with GGR falling 21% to $33m off handle down 1% to $475m, implying hold of 6.9%. Promos rose 20%, representing 56% of GGR and 3.9% of handle.

The week ahead

Welcome back to earnings season: Q1 reporting proper gets going this week with Las Vegas Sands on Wednesday AMC. Recall, the analysts at Deutsche Bank recently trimmed their forecasts for Q1 for Macau, based on lower wider market growth and “more subdued market share expansion.”

Churchill Downs reports its earnings on Wednesday evening with the accompanying call coming the next day, BMO. Citizens recently tweaked its Q1 estimates to reflect inclement weather issues across several assets in the portfolio, with EBITDA now pegged as $245m or 2% below consensus.

After New York closes on Thursday, regionals operator Boyd Gaming will release its numbers. In late March, the team a Truist lowered their Q1 EBITDA forecast to $326m with changes across the board.

Chief Operating Officer – Dubai

Head of Marketing – Malta

Senior Account Manager – Gibraltar

Earnings in brief

FDJ United

Champions League, you’re having a laugh: The French lottery operator’s ambitions to broaden its scope to be a European player suffered some glancing blows in Q1, as regulatory barriers erected in the Netherlands and the UK continued to hit its online business.

Revenues for online fell 10% in the first three months of the year to €231m, pushing pro-forma revenue for the group down 1% to €925m.

Brighter news came from French lottery and retail betting, which rose 4% to €460m, helped by lottery point of sale revenues rising 2% to €561m.

Dam, fingers, etc: Ex the UK and the Netherlands, the online business was up 8%, helped in particular by revenues from the sports-betting business in France. But significantly, the Dutch business saw a 41% decline in YoY revenues.

The company blamed the new monthly deposit limits, the increase in tax from Jan 1 to over 34% and unfavorable sports results.

The UK business, meanwhile, dived by 27%, which FDJ said reflected the implementation of regulatory measures in 2024.

Rivalry

Tailormade: The esports and Gen Z-focused operator, which is currently undergoing a strategic review, suggested the proof of its efforts to cut its cloth to suit its circumstances came with what it said was a 65% reduction in running costs in Q1.

🔬However, net revenue was down to a minuscule C$1.3m ($939k) and net revenue margin fell to just 2.3% vs. 4.4% in FY24.

CEO Stephen Salz claimed unconvincingly that the KPIs “are telling the real story."

Shares watch

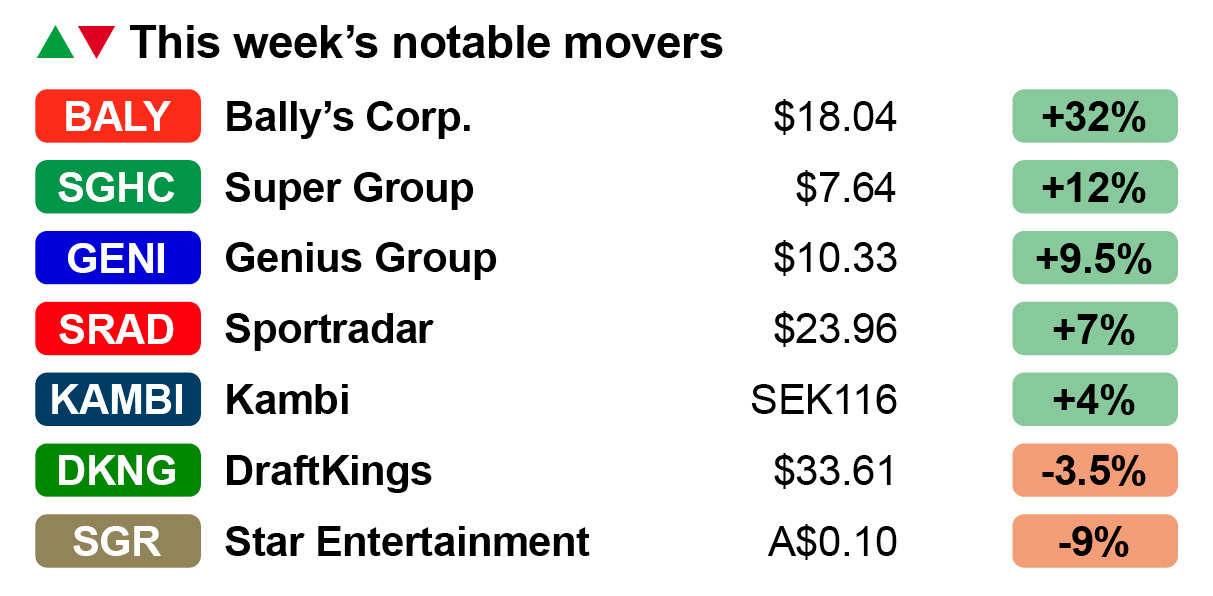

Treading water: With the initial stages of the tariff trauma so fresh in the memory, and with the next earnings season upon us, it is no surprise that many of the leading gaming stocks essentially just marked time this week.

Las Vegas Sands was up 3% ahead of its earnings this week, but MGM Resorts, Flutter, Caesars and Penn were all essentially flat.

Of the larger players, DraftKings was the only notable mover, down 3.5%.

Ballyhoo: On the up this week was Bally’s, topping the list with a 32% increase, but its recent investment, Australia’s Star Entertainment, suffered a 9% loss after it finally reported its FY24 numbers.

Enjoying a more clearly positive week were the data, AV and betting services suppliers Genius Group, up 9.5%, and Sportradar, up 7%.

EveryMatrix delivers iGaming software, solutions, content and services for casino, sports betting, payments, and affiliate/agent management to 300+ global Tier-1 operators and newer brands. The platform is modular, scalable, and compliant, allowing operators to choose the optimal solution depending on their needs.

EveryMatrix empowers clients to unleash bold ideas and deliver outstanding player experiences in regulated markets.

The teardown

A negative attitude: Looking to Q1, the analysts at Morgan Stanley said the recent corrections in gaming sector stocks in the US are pricing in substantial declines in GGR, suggesting falls of 10% YoY are now “embedded.”

You do it to yourselves, you do: The team suggested the greater pressure the leading names have found themselves under is due to the nature of the sale-and-leaseback deals the sector has largely signed up to with REITs.

Something’s gotta give: It means the business models now have increased operating leverage and face fixed costs on rent, debt and capex.

If GGR were to fall by between 5% and 10%, the analysts believe such would be the pressure on some names within the sector that it might require “tough decisions around capex.”

Test of time: On top of this, the analysts suggested the sector’s historical resilience to recessions might be tested with greater volatility should there be an economic downturn later this year.

The team pointed to the evidence from both 2001 and 2008-09 that Las Vegas Strip GGR declined by 7% and 21% respectively.

Regional casinos were more resilient, seeing GGR flat in 2001 and down 5% in 2008-09.

The team noted that, looking ahead, margins are still well above historical levels, operators are more lease-heavy, customers have skewed more high end on the Strip, and regional casinos face new alternatives with OSB and iCasino.

Turn it up to 11: “As such, cyclicality could be amplified in a future downturn,” the team concluded.

The social dumpster

Still not convinced about Kalshi? This guy is all in. The Bostonian vs. the Book talks Kalshi with lawyer Andrew Kim. Don’t mince your words Victor, say what you mean. PropSwap get slated for “trying to turn their tragic fuckup into a marketing ploy.’

Fincore delivers innovative technology solutions for operators and gaming studios.

Built on decades of expertise in Sportsbook and iGaming, driven by a passion for problem-solving, and powered by the latest ML technology.

Our modular and custom solutions empower you to scale, adapt, and thrive in our fast-paced industry while giving you the control and flexibility to own your platform and tailor it to your unique needs.

Upcoming earnings

Apr 23: Las Vegas, Sands, Churchill Downs (earnings)

Apr 24: Churchill Downs (call), Boyd Gaming

April 25: Gaming & Leisure Properties

Apr 28: BetMGM

Apr 29: Betsson, Caesars Entertainment, Northstar Gaming

Apr 30: Kambi, MGM Resorts, Rush Street, Robinhood

May 1: VICI Properties

Does your Bet Builder supplier or in-house Same Game Multi solution support 13 sports, including all of the main global betting sports, plus local variants and even eSports? Does your product allow your end-users to place both Pre-Match and In:Play Bet Builders across multiple sports? Can you offer cashout across all Bet Builder transactions? Does your solution use your own odds rather than another opinion of the market? If the answer to any of these is ‘no’ then come and find out why over 170 operators are using the Algosport Bet Builder solution today.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.