More going on than just hold issues, argues Deutsche Bank.

In +More: Nevada senator fears Trump effect on tourism.

A worrying precedent set by legislators in Kansas.

The teardown: Tariffs could hurt the gaming machine sector.

Hard Rock Bet is gearing up for 2025 with a focus on amplifying brand and product engagement. With a powerful, custom-built bonusing system and an ambition to redefine traditional CRM, we’re seeking leaders who are driven to challenge the status quo:

And other amazing positions here

Chop chop

Careful with that axe, Eugene: Analysts have slashed their forecasts for DraftKings’ Q1 adj. EBITDA, but while the team at Jefferies remained “bullish” despite the low-visibility environment, their rivals at Deutsche Bank argued the company has deeper long-term issues.

Jefferies lowered their Q1 adj. EBITDA guidance to $154m vs. its prior $224m estimate or a 31% reduction.

But the cut at Deutsche Bank was more dramatic, down 48% to $113m vs. the prior $216m.

Low baller: The team at Jefferies attributed their cut to March Madness weakness. The evidence from New York in the last week of March – and the final week of the quarter – showed the hold percentage fell to just 1.6%.

Predicting Q1 forecast changes, Jefferies said previously that recent hold performance raises a “longer-term question of how operators evolve product mix and execution to manage hold volatility over time.”

They went thataway: In contrast, the DB team said that while hold was an issue, lower OSB handle and “slightly” lower iCasino take have also played a part. Moreover, they suggested the hold dynamic has been “dramatically overplayed” and is a “distraction.”

Diversionary tactics: “We think fixating on hold, and simply moving on, is a bit disingenuous,” said the team.

Swing when you’re winning: Noting it is the nature of the sports-betting business that it is “not a random number generator in a slot machine,” the Deutsche Bank team pointed out it should be obvious that “luck will swing” in sports betting.

However, given the starting point of aiming at a high structural hold percentage – DraftKings is forecasting 11% for 2025 vs. the actual hold percentage of 9.4% last year – the swings “will more often be to the downside.”

Indeed, the team noted hold has been blamed for five adj. EBITDA misses out of the last six quarters, including the $279m miss in Q4.

Handle with care: But the team at Deutsche Bank argued that as much spotlight should be concentrated on recent handle trends and, as far as DraftKings is concerned, what they might mean for its financial target for this year.

Been beat up and battered ’round: As the DB team suggested, the sluggish handle trends in the past few months have “gone on for too long to excuse away at this point.” Q1 handle to date is likely to come in at around 13% for the states where DraftKings is operating.

But the team made the point that for DraftKings to hit its revenue and adj. EBITDA targets for 2025, it needs handle growth of 17%.

For this to be achieved, the team added, DraftKings would need to see an acceleration of handle growth in H2 allied to growth in its now Simplebet-powered micro-betting offering.

That 17% growth, therefore, “appears heavily back-half weighted.”

Looking ahead: DraftKings is yet to announce the date when it will report its Q1 earnings. Recall, it is guiding to revenue in 2025 of $6.3bn-$6.6bn and adj. EBITDA of $900m-$1bn. The implied midpoint revenue growth rate would be 35%.

Gambling.com Group [Nasdaq: GAMB] is fueling the online gambling industry with unmatched performance marketing solutions. Leveraging proprietary technology, a diverse portfolio of premium websites, and the newly acquired consumer-facing OddsJam and B2B service provider, OpticOdds, $GAMB connects operators to high-value players across the globe.

Positioned as a dynamic leader in the sector, Gambling.com Group is an engine of growth and profitability, backed by a proven track record of driving revenue for operators in sports betting, iGaming, and beyond.

Visit our investor page to see why it’s the platform behind the industry’s most successful operators.

+More

New York managed an OSB hold revival in the week of the Final Four games from the NCAA Championships, up to 7.9% from the low of 1.3% the week previous, leading to GGR of $44.4m. The Jefferies team noted DraftKings GGR surged to 37% market share, taking over #1 spot from FanDuel, and that Fanatics enjoyed 9% share for the third straight week.

Passports please: Nevada senator Catherine Cortez Masto has sent a letter to various Trump administration officials demanding clarity on how recent administration actions will impact tourism. According to a letter seen by the Las Vegas Sun, Cortez Masto took issue with tariffs, “increasingly aggressive” tactics used by customs officials and cuts at federal agencies that support tourism.

What we’re reading

The New Yorker on Jake and Logan Paul’s new reality TV venture: “Compared to the Pauls’ previous outputs, ‘Paul American' is practically ‘The Brothers Karamazov’.”

Kan-sus

You might not be in Kansas anymore: The news “seemingly out of nowhere” from Kansas that legislators in the state House have voted to disallow the lottery from renegotiating licenses with the Sunflower State’s six operators in 2027 “leave[s] room for negotiation,” suggested the team at Citizens.

The team cited sources as saying the legislators are “not happy” with the tax revenue given the near-industry low 10% tax rate.

Hence, they are looking to move toward a single-operator model to compensate.

You’ve got my number: As the Citizens team said, desiring more tax revenue while reducing the number of operators “does not add up,” pointing to data showing average revenue per adult in single operator states stands at $45 vs. the multi-operator average of $92.

It presents a “clear example” why it has become so difficult to predict the outcome of legislative processes, whether related to tax increases or new state legalization.

The news from Kansas produces a “negative undertone” for stocks in the sector even outside the financial impact, as the ”line of sight on these decisions are becoming nonexistent.”

Donor kebab: Seeking positives, the Citizens team looked to neighboring state Missouri, which they suggested was previously the donor of 15-20% of revenue from punters crossing state lines to bet.

The reverse could be true with Missouri open in time for any disruption to the current market leaders after 2027.

Meanwhile, the last operator standing would be able to exploit a market free of competition and associate marketing expenses.

Shares watch

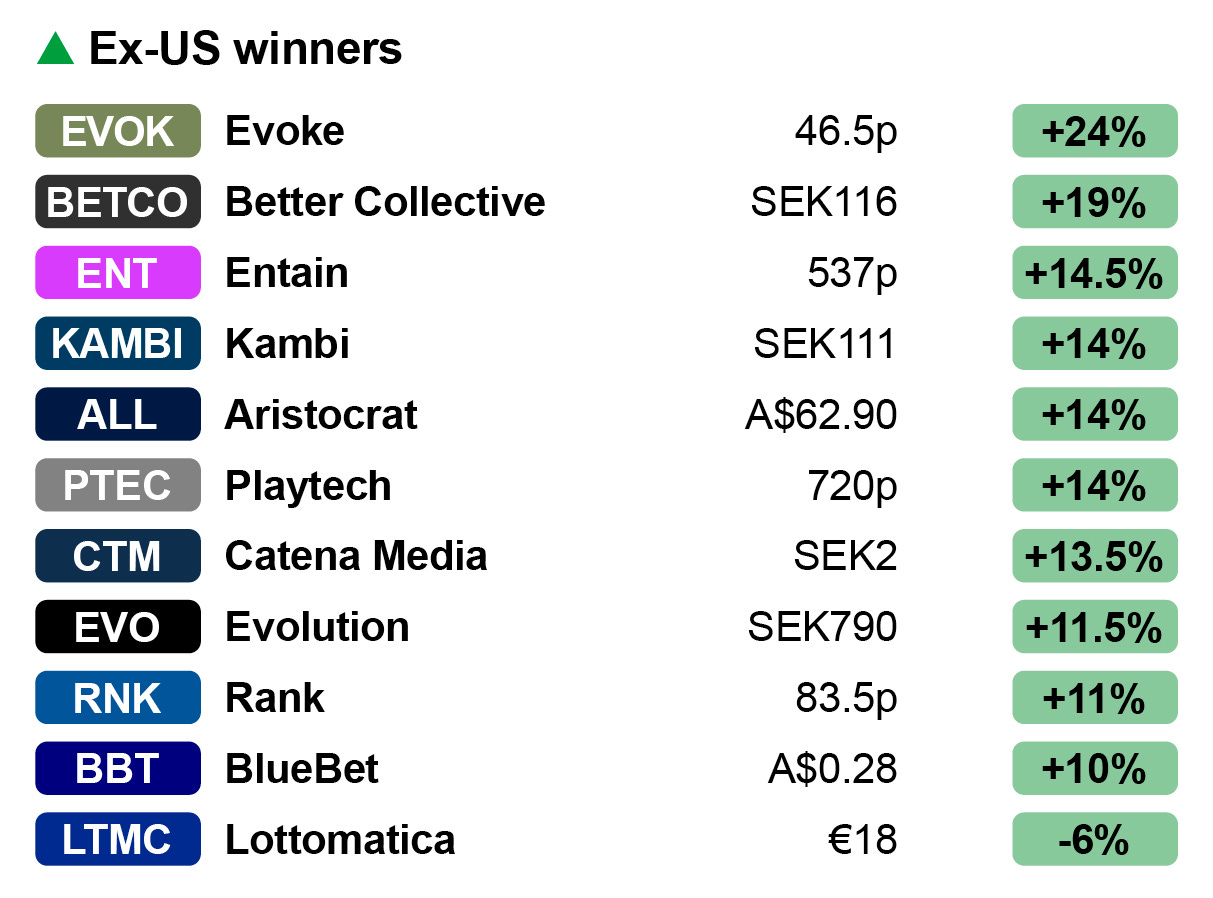

Wall of worry: Away from the maelstrom in the US, the global listed gaming stocks more than weathered the storm earlier in the week and ended it in positive territory, with many of the bigger names registering double-digit increases.

Leading the way was the previously very much beleaguered Evoke, which posted a 24% gain for the week.

The move justified the faith put in the company by the analysts at Peel Hunt who said the 30% share price decline after its late March earnings “does not reflect its prospects.”

The crest of a (small) wave: A revival will also be very much welcomed by Better Collective shareholders where the near 19% increase last week leaves the shares almost level YTD, down just under 2%. However, the slight return has barely made a dent in the 52-week performance, down over 60%.

Bumping along the bottom: Similarly managing a double-digit uplift was fellow affiliate Catena Media, albeit from a very low base. The stock is still down 26% this month and 46% YTD.

Suppliers Evolution (+11.5%), Aristocrat (+14%) and Kambi (+14%) all enjoyed good weeks, the first being something of a dead cat bounce from its 52-week low the week before.

Top ranking: UK B&M casino to bingo operator Rank enjoyed a good week off the back of its trading update, with the shares rising 11%.

Fincore delivers innovative technology solutions for operators and gaming studios.

Built on decades of expertise in Sportsbook and iGaming, driven by a passion for problem-solving, and powered by the latest ML technology.

Our modular and custom solutions empower you to scale, adapt, and thrive in our fast-paced industry while giving you the control and flexibility to own your platform and tailor it to your unique needs.

The teardown

When the levy breaks: Speaking to the experts at ReelMetrics, the team at Truist reported that the issue of US tariffs was creating uncertainty among the gaming machine providers, despite post-pandemic efforts to diversify their supply chains.

“If blanket tariffs are kept in place, [ReelMatrics] predicts a material rise in the cost of slot machines that are near-certain to be passed on to gaming operators,” said the Truist team.

The inflationary effect would feed into concerns over customer spending plans. “There remains some uncertainty around the underlying demand by customers for gaming in general,” Truist added.

Lease of life: If slot prices rise, it might lead more customers to look at leasing, Truist reported. “This could potentially drive some expansion of premium lease mix as an alternative to upfront product sales,” the analysts added.

However, the macro environment “remains very noisy” and fears of a recession have seemingly increased, even though wagering levels are yet to be impacted..

Premier league: Truist also reported on the imbalance now evident between the performance of premium game titles and the rest. According to the ReelMetrics data, half of all slot winnings were garnered by just 10% of game titles.

Conversely, 55% of slot positions were generating only two minutes of play per hour.

Such imbalances around premium games “limit revenue potential,” the Truist team added.

However, the premium skew will likely benefit the big three of Aristocrat, Light & Wonder, and IGT.

The social dumpster

‘The craziest growth hack I’ve ever seen’: How Stake floods the zone with X. Heads up: ‘Please know that volume that gets reported by Kalshi is not directly comparable to what states report as handle,’ Alfonso Straffon on X. Also Straffon on X: Maybe some states are ‘starting to realize they got the shitty end of the deal’ on gambling taxes. Cruisin’: Andrew Scott gets first-class service at Marina Bay Sands.

Does your Bet Builder supplier or in-house Same Game Multi solution support 13 sports, including all of the main global betting sports, plus local variants and even eSports? Does your product allow your end-users to place both Pre-Match and In:Play Bet Builders across multiple sports? Can you offer cashout across all Bet Builder transactions? Does your solution use your own odds rather than another opinion of the market? If the answer to any of these is ‘no’ then come and find out why over 170 operators are using the Algosport Bet Builder solution today.

Upcoming earnings

Apr 23: Churchill Downs (earnings)

Apr 24: Churchill Downs (call), Boyd Gaming

April 25: Gaming & Leisure Properties

Apr 29: Caesars Entertainment

Apr 30: MGM Resorts, Rush Street

May 1: VICI Properties

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.