High hopes for sector leaders dashed by economic and political uncertainty.

In +More: Kalshi goes to war, Robinhood retreats from New Jersey.

Light & Wonder faces more Dragon legal trouble.

The teardown: Just how accurate are sports prediction markets?

Hard Rock Bet is gearing up for 2025 with a focus on amplifying brand and product engagement. With a powerful, custom-built bonusing system and an ambition to redefine traditional CRM, we’re seeking leaders who are driven to challenge the status quo:

And other amazing positions here

March madness

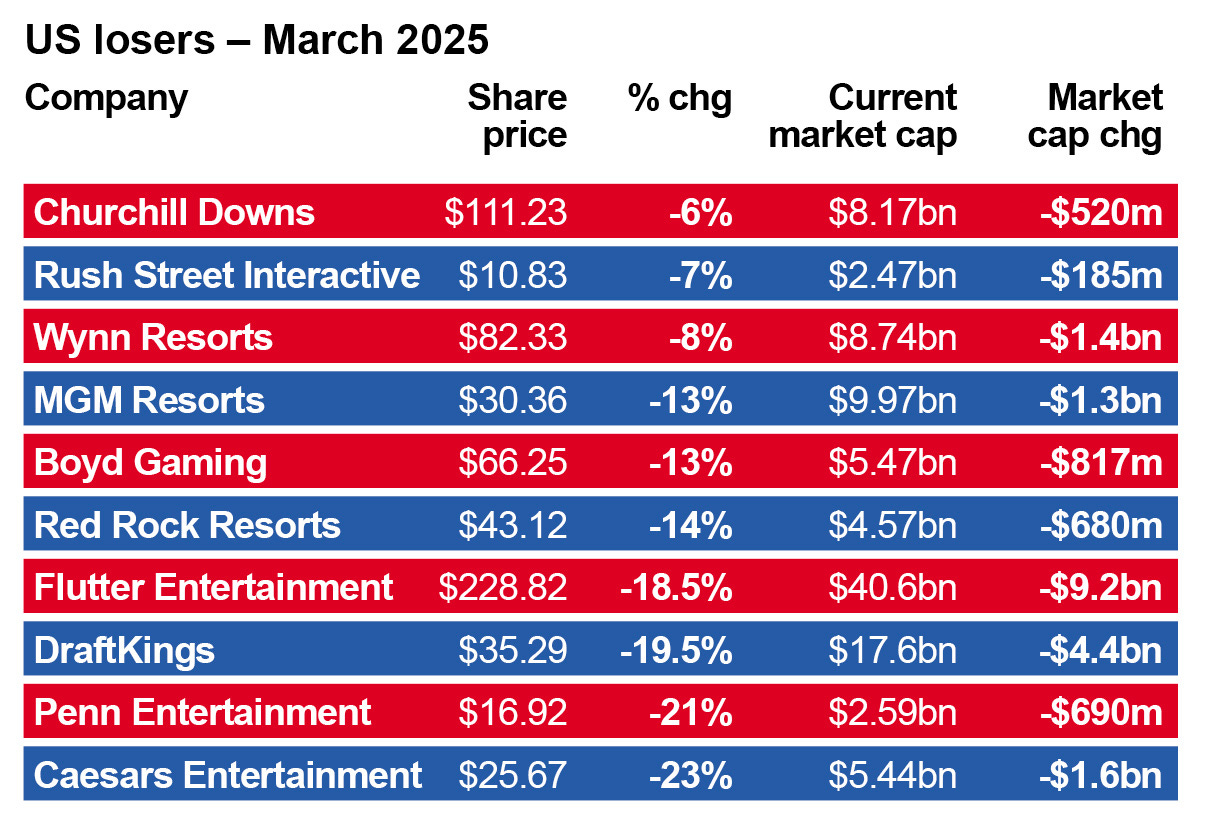

It doesn’t have to be this way: Close to $21bn has been wiped from the values of the top 10 names in the US gaming sector within the last month as share prices have slumped on fears of the impact of a consumer slowdown.

Leading the downturn in fortunes was Caesars Entertainment where the shares have dropped 23% over the course of the month.

Similarly, Penn Entertainment was down 21% and for whom the potential for a regional gaming downturn couldn’t have come at a worse time given its looming proxy battle.

Welcome to America: Accounting for almost half of the sector market cap losses, however, was Flutter. Primary-listed in the US for less than a year, it has seen its market cap briefly climb to over $50bn in mid-February before crashing back down nearly 25% in the six weeks since.

Nice market cap you’ve got there, a shame if something were to happen to it: In March, the company lost $9.2bn of market cap leaving it hovering just above the $40bn level.

DraftKings fared no better, down nearly 20% on the month and losing $4.4bn of market cap.

🤮 The Trump trade: Flutter’s peak – and by extension the rest of the sector’s – came in February when optimism regarding what the Trump presidency might mean for business and the wider US economy was at its highest.

Since then, though, the vibe shift has reversed due to fears over the impact of tariffs on the US economy and a renewal of runaway inflation.

“There isn’t one answer to the share price falls,” said Jordan Bender, analyst at Citizens. “But one is that the optimism has scaled back.”

Ask questions later: “The way that gaming investors act in general is that when it comes to a slow down in the consumer, it is to sell the stock now and get out of the way until they see some evidence," Bender added.

Uncharted waters: This apparently extends to online where there is not enough history on what consumer weakness looks like for online gambling in the US. “What does a recession look like for online?” Bender asked.

“As far as we know, our view is that it won’t affect growth all that much. But it is still not a great backdrop.”

Up the bracket: But Bender did suggest sector-specific worries might be playing into the performance of Flutter and DraftKings. Notably, he said sports results have gone against the books in recent weeks including during the first couple of rounds of March Madness.

Expectations of a Q1 beat turned first to neutral and now investors fear potential for the operators to miss on guidance for the second successive quarter.

“We believe investors moved past a terrible Q4, but now we are back in the position of missing the quarter again,” said Bender. “That will create angst among investors after 2024.”

Just one more question: On top of this, Bender said investors are increasingly asking questions about the impact of the rise of prediction markets. Recall, he said after meeting DraftKings management within the past fortnight that it was raring to enter the fray.

“Our checks point to operators aren’t seeing any impact,” he said.

“That said, we are getting questions from investors asking the positive or negative impacts for the sports-betting companies if prediction markets are allowed to operate.”

See +More ‘Kalshi goes to war’ below for how the predictions debate is playing out.

Fincore delivers innovative technology solutions for operators and gaming studios.

Built on decades of expertise in Sportsbook and iGaming, driven by a passion for problem-solving, and powered by the latest ML technology.

Our modular and custom solutions empower you to scale, adapt, and thrive in our fast-paced industry while giving you the control and flexibility to own your platform and tailor it to your unique needs.

+More

Kalshi goes to war: The prediction market provider is challenging the premise that states can have any oversight of what CFTC-regulated entities may offer in the way of sports markets. In filings with the federal courts in Nevada and New Jersey the company argued the actions of the gaming regulators “seek to undermine not just Kalshi’s contracts, but the authority granted by Congress to the Commodity Futures Trading Commission.”

I predict a riot: See Compliance+More this morning, ‘Will Kalshi continue to offer 50 state betting? Yes/No.’

Angels fear to tread: Separately, Robinhood confirmed late last week that it would not be taking bets on NCAA markets in New Jersey after it also received a cease-and-desist letter from the Department of Gaming Enforcement.

Sands China has repaid its $1bn subordinated term loan to parent Las Vegas Sands three years early. Sands China secured a $4.18bn credit facility last October. That debt matures in 2029.

Earnings in brief

Bet-at-home said revenue for 2024 rose 13% to €52.3m while adj. EBITDA more than doubled to €4.85m. Looking ahead to 2025, however, the company expects revenues to likely come in below 2024 at €46m-€54m while adj. EBITDA will be between breakeven and €4m. The company blamed tax rises in Austria.

Gaming Realms: The UK-listed games provider said FY24 revenue increased by 22% to £28.5m while adj. EBITDA increased by 30% to £13.1m. The company said it released 12 new Slingo variants during the year and launched with 44 new partners globally, including with FanDuel and Fanatics in the US and with Danske Spil and Betclic in Europe.

Lights out

Here by dragons: The worst performer on Friday was Light & Wonder, which saw its share price drop by over 10%, which analysts at Macquarie ascribed to investor fears that a second L&W game could be subject to the ongoing Dragon Train litigation with rival Aristocrat.

Having spoken to L&W, the analysts reported the company as saying there had been “additional legal communication” regarding Jewel of the Dragon.

That game was originally cited in the legal action instigated last March, suggesting it also shares similarities with Aristocrat’s Dragon Link.

Jewel purpose: However, the Macquarie team said that after speaking with L&W they got the impression Jewel of the Dragon was only a “fraction” of the importance to its business as Dragon Train. Notably, L&W has sold 10k of those units in Australia but a recent legal ruling meant the company did not have to turn these machines off or have them replaced.

L&W did have to turn off and replace the machines in the US but there are “far fewer” of the Jewel version in circulation.

The team added they “do not expect that this will materially impact” L&W’s ability to achieve its $1.4bn 2025 EBITDA target.

Riddle me this: Macquarie said the move to pursue further legal action towards Jewel of the Dragon when “signs point to any potential impact to L&W’s business as de minimis” raises questions, but they did not speculate as to what they might be.

Markets watch

America sneezes: It wasn’t just the US-listed companies suffering in March – the sector’s leaders in the rest of the world also caught a chill. All except Lottomatica, which continued to ride the wave of Italian gaming enthusiasm.

Think of a number, then halve it: Worst hit this month was Evoke, with all of the damage done post-earnings last week. After a 17% decline on the day of the earnings, it suffered a further 10% collapse on Friday and ended the week down by nearly 30%.

Evoke is now worth a mere $225m, albeit with £1.79bn of debt attached.

As the team at Regulus said, noting that William Hill was once in the FTSE 100, the sale of value destruction “has been extraordinary.”

The team added that the current turnaround is likely “good enough to satisfy the lenders” that they will get their money back but clearly not enough for equity investors.

A plague on all your houses: Entain was also in the doghouse in March, down 18% after failing to gain any ground despite reasonably positive FY24 earnings.

Also enduring a torrid month was “European champion” FDJ United, which saw its share price fall 21%, again after relatively positive earnings.

China syndrome 1: Europe’s largest supplier by market cap, Evolution, continues to be dogged by regulatory fears, particularly in relation to its exposure to Asia. Certainly, the news of bet365’s exit from China – the operator is a client of Evolution’s – might have had a chilling effect.

Evolution was down 5% last week – and 9% on the month – leaving its market cap at SEK160bn or ~$16bn.

China syndrome 2: Though obviously US-listed, Las Vegas Sands’ Asian exposures – and the potential for the company to be caught in the China trade wars crossfire – helps explain its near 15% decline on the month.

Join 100s of operators automating their trading with OpticOdds.

Backed by the resources of $GAMB, OpticOdds has the industry's most advanced, comprehensive odds data and is poised to drive innovation and growth like never before.

The teardown

Just give me a yes or no: New analysis from a data scientist shows that sports prediction markets available on the offshore Polymarket unsurprisingly are less accurate than non-sports based markets in being predictors of the actual outcome of an actual event.

The truth hurts: The analysis available on Dune from Alex McCullough, a New York-based onchain analyst, pointed out Polymarket “predominantly” features simply yes/no markets, “many of which are extremely long odds” and which inflate the platform’s overall accuracy.

No shit, Sherlock: But the analysis showed such long odds are “rarer in head-to-head sports markets, making Polymarket’s accuracy appear lower in this segment.”

Really, no shit: The analysis said head-to-head sports “provide what could be considered a more genuine representation of prediction market performance due to a more normal distribution of the underlying market predictions.”

Unsurprisingly to sports-betting market makers, but apparently new information for prediction market people, the analysis finds the prediction markets get more accurate as the game progresses.

When truth machines discover betting mechanics: One aspect of the prediction markets is that based on the expected vs. actual outcomes, “most events on Polymarket have historically been overpriced.”

McCullough said this may be due to a number of factors including “acquiescence bias” in that people tend to answer 'yes' more frequently when uncertain.

But he also identified the herd mentality. “When a market is trending positively in the direction that a participant wants it to resolve in, they may be more likely to pile in, driving odds further.”

Know your customer: McCullough’s “personal hunch” for the mispricing is what he calls “Degen Theory,” suggesting that the prediction market space is “full of degens who are more interested in long odds with potentially bigger returns, rather than small returns that are closer to a sure thing.”

“This could lead bettors to gamble on lower probability markets that look to offer big returns, even though they’re already overpriced,” he added.

Why are we waiting: In an accompanying article with the Polymarket blog, McCullough pointed out some sports markets take a long time to resolve after the final whistle.

Though the market does stop trading at that point, he said that even though the outcome is known “it has to go through the resolution process, which is usually two hours but sometimes it can take up to four or more to close out.”

EveryMatrix delivers iGaming software, solutions, content and services for casino, sports betting, payments, and affiliate/agent management to 300+ global Tier-1 operators and newer brands. The platform is modular, scalable, and compliant, allowing operators to choose the optimal solution depending on their needs.

EveryMatrix empowers clients to unleash bold ideas and deliver outstanding player experiences in regulated markets.

Upcoming earnings

Apr 1: Sportradar CMD

Apr 23: Churchill Downs (earnings)

Apr 24: Churchill Downs (call)

Apr 29: Caesars Entertainment

Apr 30: MGM Resorts, Evolution

EDGE Boost is a dedicated bank account for bettors with a daily debit limit of $250,000 and 100% approval for all gaming activity. Money movement in gaming has never been a payments problem, it's been a banking problem. With no integration (Runs on VISA rails) and no costs, EDGE can impact Operator margin by lowering processings costs and reducing chargebacks while growing revenue through increased cash access and a 1% rebate on all transactions.

To find out more, go to www.edgeboost.bet

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.