Increased share buybacks don’t come without controversy.

In +More: Underdog pays New York fine, exits state.

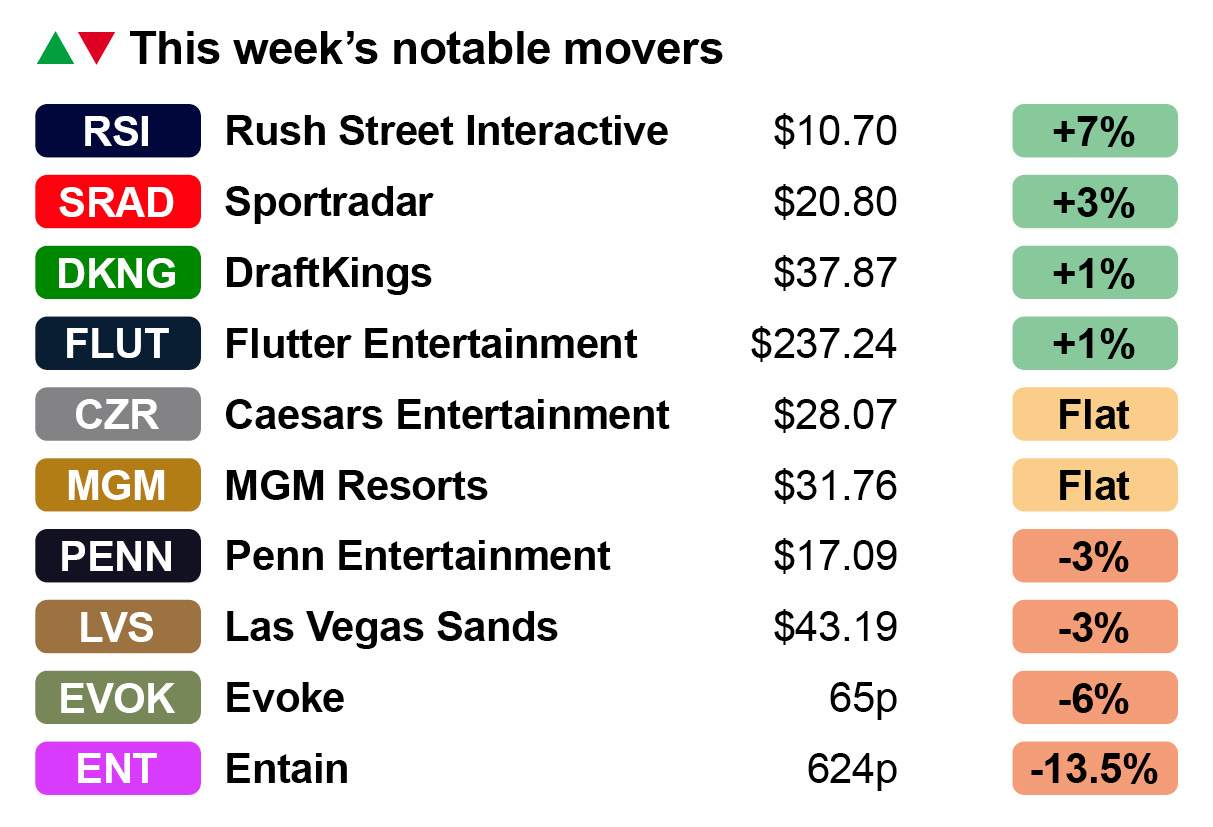

Market watch: gaming stocks weather the storm.

The teardown: handle over the course of the NFL season.

Hard Rock Bet is gearing up for 2025 with a focus on amplifying brand and product engagement. With a powerful, custom-built bonusing system and an ambition to redefine traditional CRM, we’re seeking leaders who are driven to challenge the status quo:

And other amazing positions here

Buying spree

Paying the price: The gaming sector’s sharing of corporate America’s enthusiasm for stock buybacks may come at an unplanned cost, with the practice coming under attack.

Make Gaming Great Again: Talking during a podcast appearance last week with California Gov. Gavin Newsom, MAGA magus Steve Bannon said corporations should not benefit from President Trump’s projected tax cuts “if they are just going to do stock buybacks.”

Bannon’s views chime with those of the progressive left that companies should be using excess cash to put more into R&D and “building new factories.”

Translated to the gaming sector, the criticism is more nuanced, with some analysts and commentators arguing companies could do more with the cash by way of M&A.

Catch a falling knife: In the teeth of the current macro uncertainty and with share prices suffering as a result, the leading companies in the gaming sector are continuing and extending their share buyback programs.

In the past week, Churchill Downs announced a new $500m share repurchase program to supersede its previous buyback authorization.

This follows on from news during the Q4 earnings season about planned or completed share repurchases from Flutter, Penn, Caesars and (hinting at least) DraftKings.

Home is where the heart is: One of the most prolific buyers of its own shares is MGM Resorts, which said in its Q4 earnings it has spent $1.4bn on buybacks in 2024 and that since 2021 it has snaffled up 40% of the available shares.

According to the company’s 10-K, since FY22 it has paid out $6.5bn on share repurchases.

As of the end of December, it had $826m of its November 2023 authorization left, but since December it has subsequently bought up $307m worth of shares, nudging the authorization left down to just over $500m.

Come back to what you know: On the Q4 call, CFO Jonathan Halkyard repeated the reasoning for share repurchases. “We think there is a tremendous value in the shares right now,” he said.

MGM has half-a-billion in headroom left and is more than likely to seek further authorization.

Lazyitis: Buybacks have always been a contested area, with critics complaining they are inefficient – buying rarely takes place during the price troughs – and come with corporate governance concerns.

For Paul Leyland, founder of Regulus Partners, the argument against share buybacks is that they “feel a bit lazy.”

To the mattresses: Yet, hoarding cash is also frowned upon. “Just keeping cash on your corporate balance sheet is somewhat dead money,” said Leyland. “And you don't necessarily want to pay down your debt too fast, either.”

“If you deleverage too much, you make yourself a target: PE will buy you,” Leyland added.

Balancing act: Instead, Leyland pointed out, companies such as MGM can achieve a mix of paying down some debt, keeping shareholders happy and having plenty of dry powder available for any potential M&A.

“It's not an either/or in practical terms,” he said. “The buyback only costs the equivalent of pocket change. If you want to do a big deal, you stop the buyback. It’s really flexible.”

Join 100s of operators automating their trading with OpticOdds.

Backed by the resources of $GAMB, OpticOdds has the industry's most advanced, comprehensive odds data and is poised to drive innovation and growth like never before.

+More

Underdog has paid a fine of $17.5m to the New York State Gaming Commission and withdrawn its offering from state residents at least temporarily in a settlement with the state authorities. The NYSGC has determined that Underdog was offering contests “not set forth” in the temporary license given to Synkt in 2016, a company that Underdog bought in 2022. Separately, Underdog has announced it is launching its Pick‘em Champions product in New Jersey and Delaware. For more on Underdog’s New York exit, see tomorrow’s Compliance+More.

Prediction market provider Kalshi has been granted more time by the Nevada Gaming Control Board to respond to the cease-and-desist letter issued earlier this month. Posting on X, the NGCB said the request for a limited extension came from the company.

New Jersey: B&M gaming in February was down 4% YoY to $204m, iCasino rose once again, up 14% YoY to $208m, and sports-betting GGR was up 9% to $73.6m. Handle fell 8.5% and hold stood at 7.4%, up over 1 ppt.

New York: February OSB GGR was up 41% to $185m on handle that rose 11% and hold that came in at 9.4%, which was up 2 ppts vs. what was a much tougher Super Bowl month in 2024. FanDuel extended its lead by GGR share to over 50%, up 5 ppts from the prior month.

In brief: GAN said Q4 revenues were up 3% to $31.7m, helped by a 20% rise in B2C to $22.7m. The B2B business, however, declined 24% to $9m. FY24 revenues were up 4% to $135m, with adj. EBITDA making a profit of $8.6m compared to a loss the previous year of $8.4m. The completion of the buyout by Sega Sammy is due in H1.

The week ahead

The Q4 earnings season continues with Inspired Entertainment, Sportradar, Gambling.com and Opap. For Sportradar, the team at Deutsche Bank guided to revenues of $290m and adj. EBITDA of $54.8m. For Gambling.com, meanwhile, Jefferies said in late February that after meeting with management they believed the integration of Odds Holdings was “going solidly well.”

Earnings TL;DR

Investor call – MGM

Taste the difference: Talking during an investor conference, MGM Resorts CEO Bill Hornbuckle suggested that if “there’s any single thing this year that will stand out” it is his company’s focus on its online business.

That is what will “make a difference,” he told the analysts from JP Morgan, going on to suggest BetMGM has “stopped losing share.”

“We see a lot of green shoots, particularly in January, February and March,” he added.

Strip strength: Meanwhile, in Las Vegas, Hornbuckle said January had been “incredibly strong” despite the tough comps with the Super Bowl last year.

Golden triangle: Talking about the sports event and entertainment schedule on the Strip, he said MGM was benefiting from having 36,000 rooms within a mile of the ‘Golden Triangle’ of the T-Mobile Arena, the Allegiant Stadium and, soon, the A’s baseball stadium.

Market watch

Weathering the storm: In line with the wider markets, shares within the gaming sector got some respite on Friday from a punishing few weeks, after what the FT termed as a “sentiment shock.”

DraftKings and Flutter each managed a rise of 2.5% on Friday to also match each other with a 1% weekly uplift. But they were still down 26% and 20% since mid-February respectively.

The best performance on Friday came from Rush Street, which managed a 10.5% rebound on Friday, leaving it up near 7% on the week. But it is down 33% on the month.

The new normal: It’s no better for the leading domestic gaming giants. Caesars Entertainment rose 5% on Friday but ended up flat on the week and is down 30% over the last month. MGM Resorts matched its rival with a 5% rise on Friday but was down 16.5% in the past 30 days.

Rotate: In the wider markets, one trend has been a rotation into European stocks. But not for the gaming sector, at least not last week, with the woes of the leading lights of the UK-listed sector once again on display.

Evoke was off by 6% and Entain down 13.5% on the week.

However, Lottomatica, helped by positive noises from the analysts, was up 7% on the week

Protect your players and grow your tribal gaming business with GeoComply.

Looking to implement mobile Class II gaming? We go beyond simple compliance, delivering seamless player experiences and ironclad security.

If your casino is going cashless, is someone monitoring the activity on the mobile device while it transfers funds to your casino? That’s what we do. We detect device integrity issues and give you actionable insights to mitigate any AML, OFAC, and CTF risks.

Book a meeting with us at the Indian Gaming Tradeshow & Convention (Booth #2541) and discover how GeoComply will bring you more customers, fight fraud, and protect your revenue.

The teardown – NFL handle

Line of scrimmage: The NFL season just gone was clearly one that had its ups and downs when it comes to GGR but, as the team at Wells Fargo pointed out in a note on the January OSB data, the same state handle figure over the course of the season was also disappointing.

Looking at the YoY comparison, handle in September was up 14% but it then fell to 13% in October, 7% in November, 8% in December and 7% in January.

It may yet turn out to be a blip: Wells Fargo noted that February should see a re-acceleration after a ”very strong” Super Bowl and renewed interest in the NBA.

As you were: The data for sports betting and iCasino in January showed no surprises, with FanDuel on top with 37%, up 2 ppts, DraftKings second and flat on 31%, and BetMGM down 2 ppts at 11%.

Sports betting: FanDuel was down 1 ppt at 42%, DraftKings was also down 1 ppt at 33%, while BetMGM and Caesars were each up 1 ppt at 8% and 6% respectively. ESPN Bet was flat.

iCasino: Wells Fargo estimated FanDuel monthly share at 27%, up 1 ppt, DraftKings flat on 26% and BetMGM on 20%.

Fincore delivers innovative technology solutions for operators and gaming studios.

Built on decades of expertise in Sportsbook and iGaming, driven by a passion for problem-solving, and powered by the latest ML technology.

Our modular and custom solutions empower you to scale, adapt, and thrive in our fast-paced industry while giving you the control and flexibility to own your platform and tailor it to your unique needs.

Upcoming earnings

Mar 17: Inspired Entertainment

Mar 19: Opap, Sportradar

Mar 20: Gambling.com, Bragg Gaming

Mar 21: Allwyn

Mar 26: Evoke

Mar 27: Playtech

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.