Billions of value lost as fears over the US economy gather pace.

In +More: Everi’s industry crypto first.

Betclic parent bemoans “anti-competitive” tax hike.

The long take: Assessing the Florida iCasino opportunity for Hard Rock.

Hard Rock Bet is gearing up for 2025 with a focus on amplifying brand and product engagement. With a powerful, custom-built bonusing system and an ambition to redefine traditional CRM, we’re seeking leaders who are driven to challenge the status quo:

And other amazing positions here

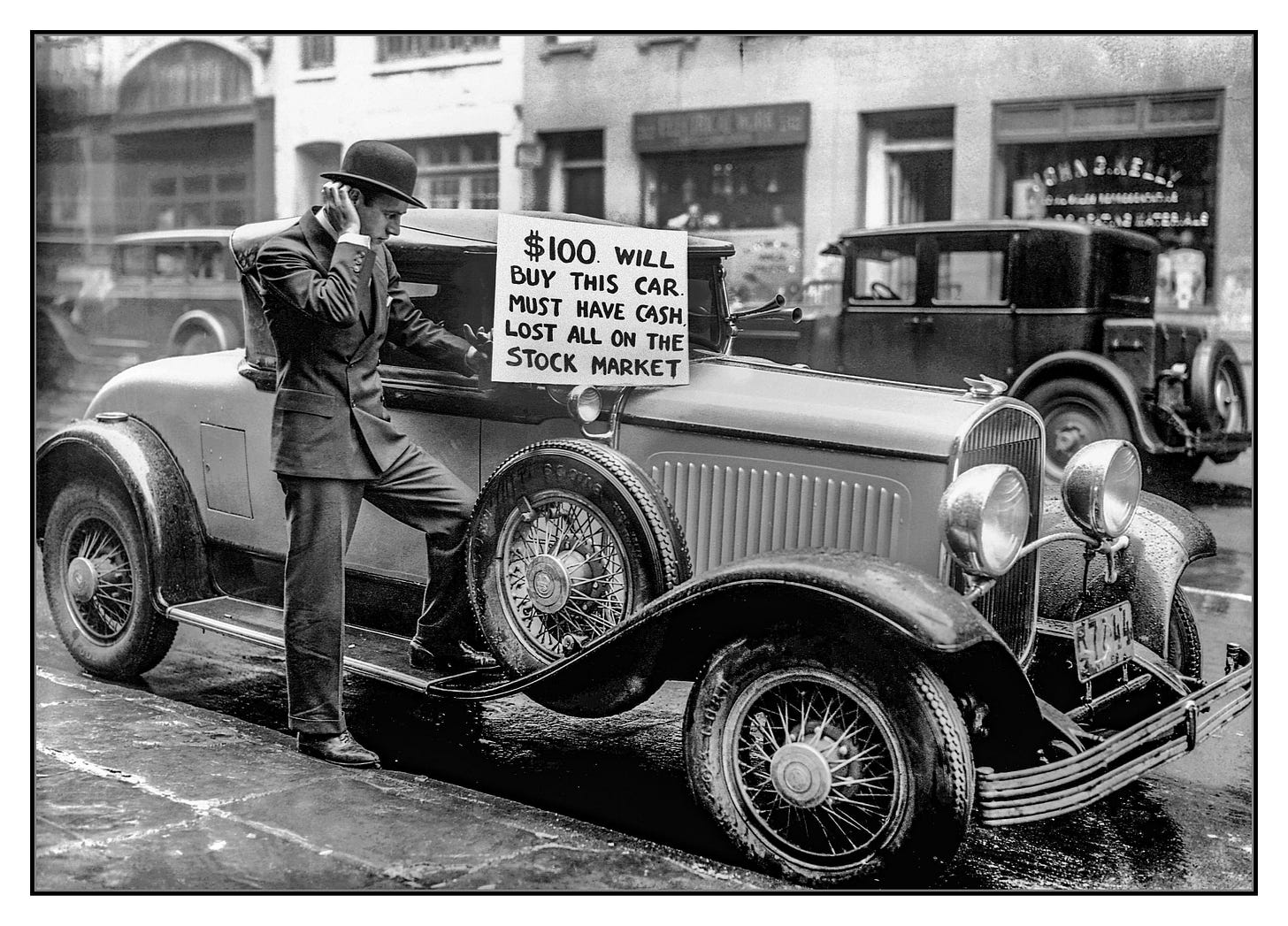

Value destruction

There goes the fear again: Valuations across the sector took a hammering in the week just gone as fears over the health of the US consumer pulled the rug under many of the big names in the gaming sector.

Sector leader Flutter Entertainment has lost over $5bn of market cap since the shares hit an all-time high in mid-February of just shy of $300.

On Friday the shares closed 11.5% down on the week at $248, leaving the home of FanDuel valued at $44.2bn.

Reverse gear: The falls across the US gaming sector stand in marked contrast to early February when share prices across the sector were chalking up double-digit gains. Moreover, the collapse could have been worse: the markets generally made a partial recovery after US Treasury chief Jay Powell played down fears over the health of the US economy.

Flutter was down 6% in early trading on Friday before recovering slightly to a 3.5% decline by the end of the day.

DraftKings fell 9% in the morning session before recovering to end the day down only 2%.

But it was down 11% on the week, leaving the company valued at $19.2bn – 26% below its 52-week high of early February – having shed ~$6bn in market cap.

Not seeing it: The fall for Flutter comes despite relatively well-received earnings last week in which the company said 2025 had “started well,” with US handle growth having “stepped up” from the levels seen in Q4.

Getting defensive: Asked on the accompanying call about the potential for macro headwinds to damage the outlook, CEO Peter Jackson reiterated the business was “actually very defensive.”

“We’re not seeing any bearing on our historical cohorts here in the US,” he added.

Domestic dispute: Worst hit on Friday were the regional casino operators due to their exposure to US consumer spending. Penn Entertainment was down 15% on the week, falling 8% in the morning before paring back the losses to 5%. The company is now valued at $2.8bn.

Passing on your left, an iceberg: On the Penn Q4 earnings call, Todd George, VP of operations, said that following the uncertainty around election time consumers were “coming out and still taking time to be entertained.”

Choppy waters: Boyd Gaming was down 10% for the week but restricted its Friday losses to 4% after an initial 6% fall. Its valuation is now down to $6.1bn. On his company’s call in early February, CEO Keith Smith also suggested that post-election the consumer was a “little bit better today” but “not materially.”

Caesars Entertainment suffered a similar fate, down 14% for the week but managing to sneak through Friday with just a 1.5% loss.

A note from Deutsche Bank on Friday said that, “in a sea of red,” Caesars stood out as a compelling long-term play despite a share price that near term was likely to “remain choppy.”

Collateral damage: Coming through relatively unscathed on Friday was MGM Resorts, which actually managed a 1% uplift on the day but was still down 9% on the week. Similarly, Rush Street was flat on the day but was also off 9% on the week.

An unsafe European home: Away from the US, the newly renamed FDJ United was down 10.5% for the week after investors reacted badly to its yearly report.

Are payments getting in the way of your progress? A poor payments experience can lead to many operational problems, including higher fraud, increased player churn, low conversion rates and more.

PayNearMe is a payments experience management platform that enables you to streamline deposits and withdrawals, increase acceptance rates and radically drive down your total cost of acceptance—all with a single, modern platform.

Take the first step toward progress: www.paynearme.com

+More

Star Entertainment has received an unsolicited proposal from Bally’s, which the latter claims offers an “alternative path” for Star in its search for solvency, involving a A$250m ($158m) capital raise and the issuing of convertible shares. Bally’s added it remained “very open” to discussing a larger transaction. This follows last week’s news that a A$250m bridging facility had been secured from King Street Capital Management. Star also said last week it was selling its 50% stake in the Queen’s Wharf project in Brisbane to its Hong Kong partners, Far East Consortium International and Chow Tai Fook Enterprises.

BlueBet has proposed a counter-offer to Mixi’s board-approved offer for PointsBet with a mix-and-match proposal valued at A$1.28 per share, which represents a 45% premium to the prevailing share price before the Mixi bid that valued PointsBet at A1.06 a share. BlueBet added its bid delivers “upside exposure” to the synergy and growth potential of the combined business that the Mixi proposal does not.

A first: Games supplier and payments tech provider Everi has announced what it claims is an industry first, teaming up with BitLine to allow Choctaw Casino & Resorts to use cryptocurrencies as a “source of liquidity” for patrons. The agreement integrates the BitLine solution with the Everi CashClub and offers a “transferable blueprint” for other casino operators. Richard Jones, CEO at BitLine, said it was a “historical moment.”

Lottery.com has regained full compliance with Nasdaq listing rules after the share price managed to close above $1 for the last 20 business days, with its outstanding shares reaching a market value of above $5m.

Quick takes: The announcement that Robert Goldstein will be leaving Las Vegas Sands in a year’s time will "undoubtedly leave a void,” suggested the team at Deutsche Bank, arguing he is of the the few left standing from the early days of Macau and the formation of LVS as the market knows the company today. But no one is irreplaceable and LVS will be left in capable hands with COO Patrick Dumont stepping up.

Coming up on E+M PRO

Amplification: In tomorrow’s Mining the 10-K edition, Flutter Entertainment’s average monthly player, or AMP, data is analyzed, showing the differing underlying patterns behind the company’s major segments. Plus, a look at what M&A added to the top line in 2024 and what might happen in 2025.

Clunk ’clic

To the barricades: Even as the CEO of Betclic’s holding company proclaimed an "outstanding” year for the betting and gaming arm of Banijay, he railed at the anti-competitive tax increases to be introduced by the French government in the summer.

Reporting its FY24 earnings, Banijay said Betclic saw revenues rise 45% to €1.46bn while adj. EBITDA rose in line, up 50% to €380m, helped by favorable sports results.

But it was the “more painful” topic of the upcoming tax hikes included in the new French government’s budget proposals, which will come into force in July, that got François Riahi riled.

All for one: Pointing at rival FDJ, Riahi said the difference in treatment between OSB and retail betting “is only benefiting one company.”

Under the proposals, the rate of tax on retail betting will rise to 42%, alongside a 7% of GGR social security levy.

But the OSB tax rate will rise to 59% while the social security levy will be raised to 15% from 10.6% of GGR.

System of a down: Banijay guided to new tax rates costing Betclic €20m in adj. EBITDA in 2025 or ~2% of the guided FY25 adj. EBITDA figure. On its own call last week, FDJ said the tax increases, which include a 1% lottery tax increase, would cost it €45m in EBITDA in 2025.

“We deem the new taxes as anti-competitive and will contest them with the relevant authorities,” said Riahi.

Earnings TL;DR – Full House Resorts

Place holder: With the legal challenge in Illinois dismissed, Full House is now set to finance and build the permanent American Place Casino in Waukegan, Illinois to replace its temporary ‘big tent’ facility.

All you can eat: Having recently opened the refurbished Chamonix property in Cripple Creek, Colorado, the company has also moved to replace the management team to rectify initial teething troubles including a loss-making buffet.

Still, Q4 revenue rose 21% YoY across the group to $73m while adj. EBITDA rose 42% to $10.4m, but CEO Dan Lee promised more to come.

Back of a napkin: Noting the current lowly valuation, he said that by his reckoning the company was substantially undervalued.

“If we just execute on what we have, we will have one of the best-performing casino stocks in the next five years,” he claimed.

For more see Friday’s Earnings Extra. E+M PRO subscribers only.

EDGE Boost is a dedicated bank account for bettors with a daily debit limit of $250,000 and 100% approval for all gaming activity. Money movement in gaming has never been a payments problem, it's been a banking problem. With no integration (Runs on VISA rails) and no costs, EDGE can impact Operator margin by lowering processings costs and reducing chargebacks while growing revenue through increased cash access and a 1% rebate on all transactions.

To find out more, go to www.edgeboost.bet

The long take

Hard Rock in Florida

Community treasure chest: Hard Rock could generate up to $1.1bn from Florida alone if the state were to open up to iCasino on the same monopoly basis as the current sports-betting market, according to the analysts at Citizens.

The team believes that only having the one operator would continue to act as a retardant on growth.

But their base for adding iCasino to sports betting suggests that on 2024 figures Florida would have been the third-largest online state behind Michigan and New Jersey.

A crack of light: As the team noted, Jim Allen, CEO of Seminole Gaming, which owns Hard Rock, said in October last year the company was potentially open to the opening up of Florida to third-party operators.

However, the team suggested it was “more likely than not” that Hard Rock would retain the monopoly when it decides to go the iCasino route.

Firstly, any competition would hurt Hard Rock’s P&L. Secondly, issues around cannibalization would not apply as it is also the main B&M operator in the state.

Lastly, with the Hard Rock Las Vegas slated for a 2027 opening, it could act as a driver of digital cross-sell from Florida into Las Vegas in the coming years.

Does your Bet Builder supplier or in-house Same Game Multi solution support 13 sports, including all of the main global betting sports, plus local variants and even eSports? Does your product allow your end-users to place both Pre-Match and In:Play Bet Builders across multiple sports? Can you offer cashout across all Bet Builder transactions? Does your solution use your own odds rather than another opinion of the market? If the answer to any of these is ‘no’ then come and find out why over 170 operators are using the Algosport Bet Builder solution today.

Upcoming earnings

Mar 10: Playstudios

Mar 17: Inspired Entertainment

Mar 19: Opap, Sportradar

Mar 20: Bragg Gaming

Mar 21: Gambling.com

Mar 26: Playtech, Evoke

Join 100s of operators automating their trading with OpticOdds.

Backed by the resources of $GAMB, OpticOdds has the industry's most advanced, comprehensive odds data and is poised to drive innovation and growth like never before.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.

Fact Check Article:

How is Hard Rock the only B&M in FL? In 2023 the Magic City Casino was bought by Wind Creek Hospitality.