Premium charge redux: DraftKings adds boosted parlays subscription service.

In +More: Codere Online’s class action threat.

Markets watch: Boyd Gaming gets a New Year boost.

By the numbers: November’s promo pullback and lacklustre handle.

Hard Rock Bet is gearing up for 2025 with a focus on amplifying brand and product engagement. With a powerful, custom-built bonusing system and an ambition to redefine traditional CRM, we're seeking leaders who are driven to challenge the status quo:

And other amazing positions here

Paying for the privilege

Turn left or turn back: DraftKings has added a subscription service to its offering in the high tax state of New York, where in return for a monthly fee of $20 players can receive “stepped up” odds boosts on all parlays.

Are you not entertained? DraftKings said in a statement to Sportico that the new service was “designed to offer our customers an enhanced fan experience, creating more excitement and value to our extensive parlay offering.”

The statement added that the offering would start with “select, eligible customers” only in New York, but offered no specifics on who would qualify.

Under the terms of the subscription service, players who place parlay bets where the individual legs are -500 or narrower receive tiered returns, with profits for two-leg parlays increased by 10%, moving up to double the profit for parlays with 11 legs or more.

Crucially, the company is thought to believe the income from the subscription service will be free from New York’s punishing 51% tax rate.

If at first you don’t succeed: Recall, DraftKings attempted to introduce a player surcharge for high tax jurisdictions last summer, but following “customer feedback” – and a comment from Flutter that it had no intention of following the move – the plan was quickly buried.

In subsequent comments at an investor conference, CEO Jason Robins made it plain the company was still looking at clawing back a portion of the higher taxes.

“There might be some other sort of solution ultimately that we pursue that does get a more favorable response,” he said in September. “There’s multiple levers we can pull.”

Ways to skin a cat: In the midst of the run of customer-friendly sports results in October, Robins said during another investor conference that the maximization of hold was only one lever at the company’s disposal to generate profits.

“There are multiple levers that go into driving monetization and LTV of a player,” he said.

“And that’s really what we’re trying to maximize here, not just one metric.”

One industry commentator suggested to E+M that DraftKings was trying to build a better mousetrap “but probably it’s still a mousetrap.”

“The logic of pay to win more only works for the consumer if you win more than you pay – i.e. it’s a genuine discount to encourage volume and loyalty. But if it is, then it doesn’t work for DraftKings,” the source, who opted for anonymity, argued.

Moreover, if the subscription is “directly linked to gambling activity then it is probably taxable,” they added.

How’s this landed, boss? The reaction on social media was, well, mixed. And very mixed. And even more mixed.

In no way related: Separately, in a note last week analysts at JP Morgan lowered their DraftKings’ Q4 revenue target, down to just under $1.4bn from $1.5bn, due to the customer-friendly sporting results in October.

The team said DraftKings saw much higher than normal rates of customer winnings across its betting lines, including its parlay offerings.

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

+More

Codere Online is being threatened with a class action lawsuit from disgruntled shareholders alleging securities fraud following its December 27 admission that its auditor Marcum had resigned citing an “inability to complete certain audit procedures.”

A new auditor, MaloneBailey, has since been appointed.

The company also has a hearing on January 16 regarding a threatened Nasdaq delisting.

DraftKings and its former executive Michael Hermalyn, who moved to Fanatics, reached a settlement last month regarding the lawsuit over the ex-employee’s non-compete clause.

According to Reuters, the settlement was resolved privately after both DraftKings and Hermalyn applied for stays on the suit in October.

Recall, DraftKings had accused Hermalyn of stealing trade secrets before he quit his job to help build out rival Fanatics’ nascent team catering to VIP clients.

No longer in exile on Main Street: The RSN Diamond Sports has emerged from its Chapter 11 bankruptcy proceedings under the new name Main Street Sports. It will now operate 16 regional sports networks as the FanDuel Sports Network under the terms of the previously announced naming rights agreement.

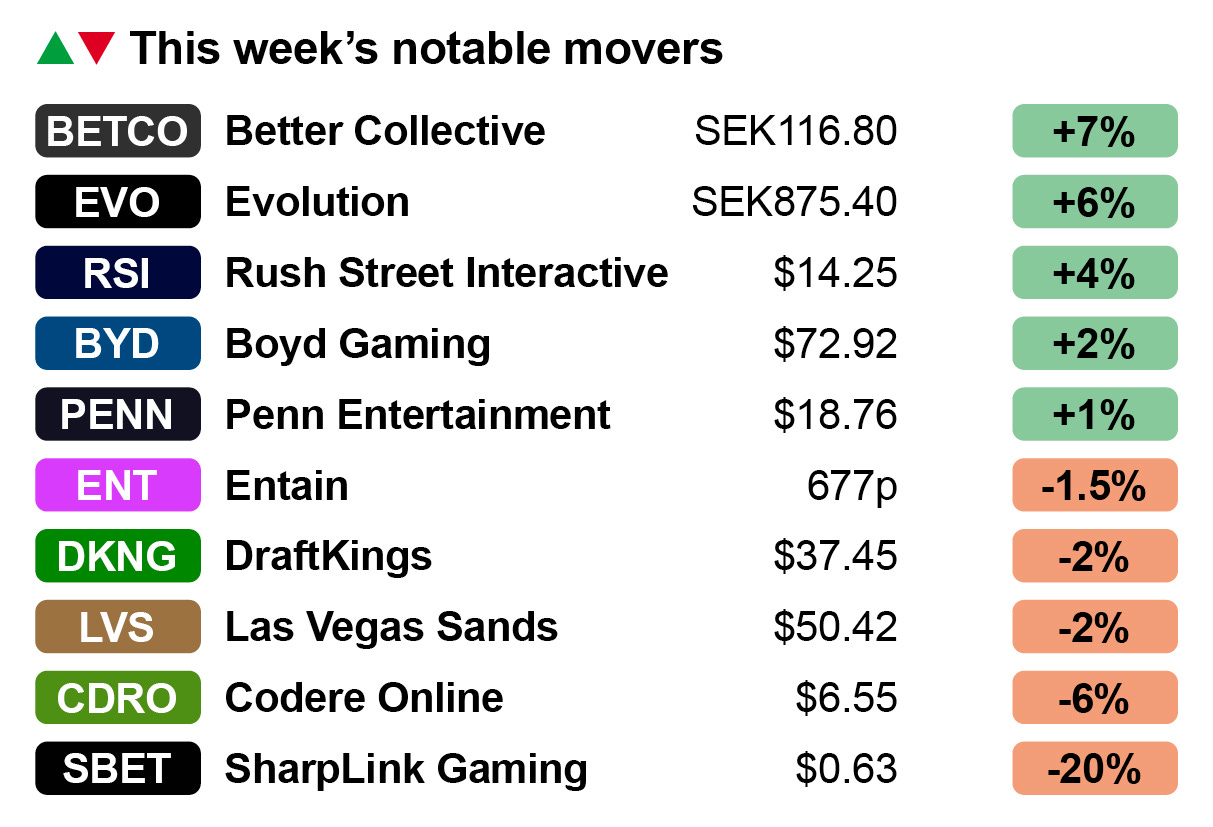

Markets watch

New year, new you: Change is coming to the land-based casino gaming sector, according to a New Year’s note from the analysts at Jefferies, who have upgraded Boyd Gaming and Las Vegas Sands.

Boyd Gaming, up 2% on the week, was identified by Jefferies as having the balance sheet to “play offense” and has “latent” digital value via the 5% FanDuel stake.

The analysts suggested Boyd will see “easing comps” in the Las vegas local market, while regionally it will be helped in late 2025 by the opening of a temporary facility in Norfolk, Virginia.

Macau remains as tricky to read as ever this year. Las Vegas Sands was down 2% despite being identified by Jefferies as likely to benefit from the improved macro condition and the strength of the mass segment consumer.

The Jefferies team pointed out recent announcements by the Chinese government to introduce monetary policy initiatives focused on improving the health of the overall consumer is a “positive development” for Macau.

Stay of execution: The analysts said both Caesars Entertainment and MGM Resorts were “too inexpensive to ignore” given their respective multiples of 6.8x and 6.2x, but they indicated they would need to see evidence of better execution in digital to get involved.

Among the gainers this week, Evolution, up 6%, managed to claw back some ground following the bruising market reaction to the news that the UK Gambling Commission was reviewing the company’s license. See last Thursday’s Compliance+More.

Also gradually attempting to regain ground was gaming affiliate Better Collective, which was up 7% on the week, but affiliate minnow SharpLink Gaming was the week’s worst performer, down 20%.

Analyst takes – LiveScore

Virgin records: The success LiveScore is enjoying with Virgin Bet – helping to drive UK revenues up 39% to £139m while group revenues increased 38% to £179m – suggests Bally’s scored an “own goal” when it failed to take the business as part of the Gamesys acquisition, suggested the analysts at Regulus.

Yet, for all the top-line growth, the post-results period move to cut 100 staff, the exit from the Netherlands and the move to the Kambi platform provides evidence of more recent “strategic cost cutting.”

“The extent to which strategic differentiation can be turned into operational success is still therefore being tested,” the team added.

Hangin’ tough: LiveScore “proves" the UK is a big enough market to “test a model and gain significant revenue” but not big enough to secure profitability without a ~5% share, a level that is “extremely tough to deliver in a competitive market.”

Meanwhile, the Netherlands exit also demonstrates that “translating successful customer engagement into other markets is also extremely tough.”

The team concluded that profitability still eludes LiveScore, with adj. EBITDA losses of £39m “partially plugged” by a £15m shareholder loan and a £19m run-down of available cash from £40m to £21m.

Does your Bet Builder supplier or in-house Same Game Multi solution support 13 sports, including all of the main global betting sports, plus local variants and even eSports? Does your product allow your end-users to place both Pre-Match and In:Play Bet Builders across multiple sports? Can you offer cashout across all Bet Builder transactions? Does your solution use your own odds rather than another opinion of the market? If the answer to any of these is ‘no’ then come and find out why over 170 operators are using the Algosport Bet Builder solution today.

Algosport will be at ICE in Barcelona in January, so to book a no-nonsense conversation about improving your product or increasing your revenue, please drop us a line at ICE2025@algosport.co.uk or visit www.algosport.co.uk

By the numbers – promo pullback

Panda eyes: The yin and yang of the lower hold in October was a reduction in promotional intensity in the following month, according to the data from the states that report promo level activity and examined by the analysts at Deutsche Bank.

According to the team, generosity levels were down 32% YoY in November as operators were able to “dramatically pull back promotions.”

This followed the 10% growth in October.

The hold disruption in October and the pullback in promos also played into the handle figure for November. As can be seen, across Deutsche Bank’s focal states, handle was up a mere 1% in November even while GGR rose a whopping 66%.

As the DB team stated, the upside was entirely related to favorable hold – 10.2% in November 2024 versus 6.2% in November 2023.

November iCasino

Going out on a high: Total iCasino GGR in November was up 29% YoY to $766m, which the team at Jefferies pointed out was 2% higher than the previous record level set in the prior month. As the team noted, that came without the benefit of incremental recycled customer winnings as would have been the case in October.

“This potentially signals a greater degree of sustainability for this new level of iGaming growth, which has now exceeded +25% in three of the last four months,” the team added.

Moreover, they pointed out that growth was at least +25% in each of the five commercial states, including in New Jersey, despite now being in its twelfth year as a regulated market.

The squeeze: In terms of market share across all states, FanDuel claimed top spot with just over 25% share, followed by DraftKings on 23.5% and BetMGM on a little over 20%.

The Jefferies team added that at 1.6 ppts, FanDuel’s lead over DraftKings is the widest since April.

At the same time, BetMGM is closing the gap on DraftKings, down to 3.4 ppts, which is the lowest margin in 18 months.

Ohio: The November sports-betting data shows GGR was up 72% to $117m on handle that was up 10% to $1.02bn. Leading the market was FanDuel on 39%, with DraftKings second on 32%.

Among those gaining ground further down the charts was Fanatics, which grabbed over 4% of GGR, and Hard Rock, which claimed over 2.2% share.

In Kentucky in November, OSB GGR rose 66% to $35.2m, with DraftKings on top with 42%, followed by FanDuel on 37%. Notably, bet365 claimed third spot with 8%.

Online gaming revenue in Portugal hit a record high in Q3, up 24% to €266m. iCasino contributed €175m of the total while sports betting was worth €91m.

Join 100s of operators automating their trading with OpticOdds.

Real-time data. Proven trading tools. Built by experts. Unlock complimentary access until year-end at www.opticodds.com.

Earnings calendar

Jan 9: Mohegan (call)

Jan 22: Las Vegas Sands

Jan 23: PointsBet

Jan 29: BlueBet

Jan 30: Evolution, Rank

Jan 31: Red Rock Resorts

We simplify game development by doing the heavy lifting, so you can focus on creativity.

Whether you’re an emerging studio or an established one looking to relieve development pressure, we ’ve got you covered.

Flexible Build Support: We bring your math sheets to life and handle rollout across RGS instances.

Rapid Deployment: Get your content live in as little as 2 months.

Wide Distribution: Access key US & European markets via an extensive network of distributors and integration with chosen operators.

Future-Proof Growth: Secure a path to owning your own platform with our source code license option.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.