The decision to seek a primary US listing is vindicated.

In +More: Galaxy preps a Bangkok IR.

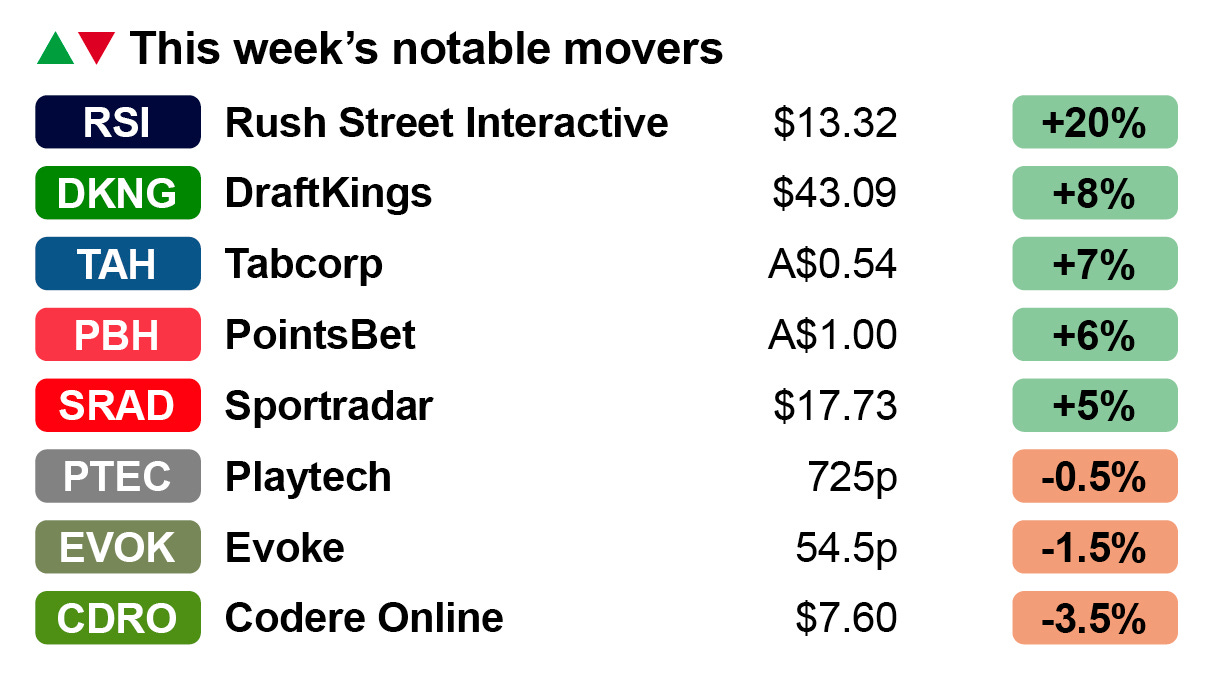

Rush job: RSI up 20% in the past week.

By the numbers: the increase in promo spend is not universal.

Everything I want the world to be is now comin' true especially for me.

Hard Rock Bet is gearing up for 2025 with a focus on amplifying brand and product engagement. With a powerful, custom-built bonusing system and an ambition to redefine traditional CRM, we're seeking leaders who are driven to challenge the status quo:

And other amazing positions here

Woof!

Status symbol: Flutter Entertainment has cemented its status as the most valuable gambling company in the world and is closing in on a market cap of $50bn just six months after achieving a primary listing in the US.

The shares rose 3% in New York on Friday, leaving them trading at $276, meaning the company is currently worth $49bn.

Its value has surged 30% since it switched its primary listing to New York and in US dollar terms, the company is now 60% more valuable than it was a year ago.

🦴 The surge: Flutter Entertainment in the past six months

Follow the money: Flutter completed the primary listing switch in May this year with the stated aim of broadening its institutional investor base and accessing larger pools of capital. It is a strategy that appears to have paid off.

“Flutter had simply outgrown London and followed the capital flows,” said Paul Leyland from Regulus.

Catch the wave: Goldman Sachs initiated on Flutter just last week with a Buy rating and a $320 target price suggesting investors were undervaluing the company’s US prospects. Recall, in its recent Q3 earnings, Flutter said adj. EBITDA at its US businesses would come in at $670m-$750m this year while ex-US adj. EBITDA would hit between $1.77bn and $1.87bn.

Notably, the changes in personnel at the UK & Ireland business announced last week also involved that arm being subsumed within the wider international segment.

“That suggests it is a US business with an international arm, not a US and UK business with an international bit,” noted one industry source.

Buy the best: Conversely, it is the international business that has been at the forefront of Flutter’s recent M&A activity, including two deals announced within a week of each other in September.

The first announced was the $350m deal for a majority stake in Brazilian-facing Betnacional.

The second was the $2.3bn buyout of Italian betting and gaming operator Snaitech from Playtech.

Gimme more: Neither deal is the end of its ambitions, suggested sources. Both the September deals were in line with Flutter’s stated ambition to buy podium position operators in sizable markets and more such acquisitions are expected.

Flutter has a “track record of springing surprising acquisitions” on the market, said one corporate advisor.

“So does it buy Betclic? Tipico? Fortuna?” the source added, running through potential options. “Whatever it does next will be interesting.”

No more worlds to conquer: Options in the US would appear to be more limited, although moves in the online space can’t be ruled out. But the expansion of the FanDuel brand into other markets might well be an option.

“Which of DraftKings or FanDuel is best-placed to take their brand international?” asked one industry source. “It’s FanDuel 100% because Flutter is already international.”

Flutter “has all the tools” to take FanDuel into any other territory it wishes.

Long may it reign over us? Those tools would appear to be manifold, suggested Leyland. What Flutter “gets right” is that it does “all the little things” well and makes fewer mistakes than its competitors.

This is ”possibly the most under-rated but most successful growth strategy humans have yet produced,” he added.

But the question of how long Flutter will maintain its dominance is up for debate. “Being the biggest and best in a maturing market tends to erode entrepreneurial spirit and reinforce a tendency to control,” said Leyland.

But he added that “this is a generational issue.”

“We may predict 10 years of absolute success and another 25 years of relative resilience before we start talking about today’s Flutter in the past tense.”

Is your organization managing licensing submissions across several jurisdictions? Are redundant licensing tasks and scattered personal data slowing you down?

Now you can unlock new jurisdictional licensing within weeks, not months, with OneComply. By reducing application time from days to just minutes, OneComply improves efficiency by up to 99%.

Click here to connect with us and discover how much more you can get done with OneComply.

+More

Goldman Sachs is reported to have revealed via a recent analyst note that Galaxy Entertainment is interested in pursuing a potential development in Bangkok, Thailand.

WLTM: The report said that after meeting with management, the analysts came away with the impression Galaxy was “open” to partnering with a local company with good connections.

Recall, the Thai government is working on getting the draft bill that will legalize casino resorts passed by the country’s parliament by the end of next year,

Playtech will repay its outstanding €350m bond due March 2026 after it closed on the sale of Snaitech to Flutter, with €200m redeemed at par in December and the rest to follow early next year.

Aim-listed minnow Webis, the operator of the WatchandWager ADW offering in the US, is to end its long-standing life as a listed entity after a review. The proposal goes before shareholders next month.

Markets watch

A rush and a push: Rush Street Interactive heads up the winners this week after a 20%-plus surge, including a 10% leap on Thursday. The lack of any substantial newsflow this week would suggest speculation took hold of a stock where the pluses and minuses of RSI as a potential acquisition target have been a well-worn theme of analyst chatter.

RSI management will be talking later today during the Needham Consumer Tech & Ecommerce conference.

Evoke ended the week in negative territory but it enjoyed a 7% uplift on Friday. Meanwhile, the news that Playtech has put a for sale sign on German-facing Happybet, the remnant of its B2C operations following the sale of Snai, came too late in the day to move its share price any.

Are we human or are we dancer? The Australian B2C sector saw rises across the board, with Tabcorp up 7%, PointsBet rising 6% and minnow BlueBet enjoying an 8% uplift on Friday, leaving it 4% up on the week.

Trigger happy: The Tabcorp boost came despite former CEO Adam Rytenskild saying in an interview with the Australian Financial Review that the board “canceled” his career over disputed allegations regarding a “vulgar remark” to the Victorian regulator.

“They loaded the gun, they pulled the trigger and they put me six feet under,” Rytenskild said of the Tabcorp board.

Complaining about his treatment, he added that “CEOs are humans too.”

“Boards owe it to CEOs to offer fairness to them as well as everyone else,” he added.

Analyst takes

Cutting crew: Softer trends in both Las Vegas and within regional gaming in the Q3 earnings announcements have caused the analysts at Morgan Stanley to wield the scalpel across some of its gaming stocks, revising down its price targets but leaving its recommendations intact.

In Vegas, the team noted that "challenging comparisons remain on the horizon” in Vegas while the regional market is bifurcated but sluggish overall.

Raleigh-ing to the cause: A key debate from there, they argued, is whether the new administration of President-elect Trump will “reinvigorate” the domestic gaming growth outlook.

“While the election has renewed calls for a ‘new cycle’, gaming has lagged likely owing to a combination of the core consumer not likely to see the benefits and/or policies likely to sustain high-for-longer rates,” said the MS team.

👀 In digital, they suggested the focus is, first, whether sportsbook hold will recover in Q4 and, second, if Flutter will “further distance itself” even from DraftKings.

Does your Bet Builder supplier or in-house Same Game Multiple solution support 13 sports, including all of the main global betting sports, plus local variants and even eSports? Does your product allow your end-users to place both pre-match and In-Play Bet Builders across multiple sports? Can you offer cashout across all Bet Builder transactions? Does your solution use your own odds to generate Same Game Multiple calculations rather than another opinion of the market? If the answer to any of these is ‘no’ then come and find out why over 170 operators are using the Algosport Bet Builder solution today.

To understand how we could help create more revenue get in touch at www.algosport.co.uk

By the numbers

Giving it all away: Operators have been giving away more in free bets and other promotional offers since the start of the football season, according to data from the four states that produce promo level stats.

We are not the same: However, analysis of the trends from Pennsylvania, Michigan, Connecticut and Kansas undertaken on the part of Deutsche Bank showed not all operators have indulged their customers to the same extent.

That promos are growing faster than handle is “not the ideal dynamic, especially multiple football seasons post launch for these states,” said the team

But they went on to note that while the dynamic was true for the market as a whole, it was not the case with every market participant.

While FanDuel and BetMGM have definitely curbed promos, Caesars is effectively flat and DraftKings has seen a modest increase, the bulk of the increase in the promo metric is attributable to ESPN Bet (up 146 bps) and the others segment (up 335 bps).

AGA tracker

The AGA’s summary for Q3 showed the commercial gaming sector achieved GGR of $17.7bn, the 15th consecutive quarter of YoY growth, while the total for the YTD stood at $53.2bn, up 8% YoY.

Within the overall growth number, there was a disparity in growth rates with B&M gaming at just shy of 1%, sports betting up 42% and iCasino rising 30%

We simplify game development by doing the heavy lifting, so you can focus on creativity.

Whether you’re an emerging studio or an established one looking to relieve development pressure, we ’ve got you covered.

Flexible Build Support: We bring your math sheets to life and handle rollout across RGS instances.

Rapid Deployment: Get your content live in as little as 2 months.

Wide Distribution: Access key US & European markets via an extensive network of distributors and integration with chosen operators.

Future-Proof Growth: Secure a path to owning your own platform with our source code license option.

Earnings calendar

Nov 27: Codere Online

Nov 29: Rivalry

Dec 3: NorthStar Gaming

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.