Potential buyers rebuffed by rich multiple demands, say sources.

In +More: Tyson-Paul fallout, Nevada tourism’s bumps in the road.

Markets watch: Gambling.com soars as affiliate space bifurcates.

Maryland data highlights hold differential, ESPN Bet failure.

This world's essentially an absurd place to be living in.

Hard Rock Bet is gearing up for 2025 with a focus on amplifying brand and product engagement. With a powerful, custom-built bonusing system and an ambition to redefine traditional CRM, we're seeking leaders who are driven to challenge the status quo:

And other amazing positions here

French disko

’clic and collect: A name that continues to be mentioned as a potential buyout candidate for larger operators on both sides of the Atlantic is the largely France-facing Betclic, which is currently a part of the Amsterdam-listed Banijay Group.

Mountain to climb: Multiple sources suggested the business has had numerous approaches but every suitor has hit the stumbling block of valuation.

“It’s a good business but the multiple is just too rich,” said one investment advisory source. “I think they want 14x-16x earnings, which is simply too steep.”

An eyeful: Betclic was one part of the SPAC deal that brought together its previous parent FL Entertainment and the Banijay TV and media group. Now known as Banijay Gaming, it produced revenues of €992m in 2023 and adj. EBITDA of €252m.

In its latest numbers for the nine months to September, Banijay Gaming saw revenue rise 44% YoY to €1.04bn while adj. EBITDA was up 44% to €266m.

Chef de la course: Betclic is the market leader in the French sports-betting market and also has leading positions in Portugal and most recently established a position in Poland. The company is run out of Bordeaux by long-standing CEO Nicolas Béraud.

As is appropriate for a largely France-facing company, Betclic is sportsbook-led, accounting for €558 of revenue in 2023

iCasino generated €107m with poker and horserace betting making up the remaining €53.2m.

Also nestled within the Banijay Gaming unit is the more problematic Germany-facing Bet-at-home.

👍: One industry M&A expert said Betclic was a “very good business, a great management team, with good in-house technology and nice positioning in France, Portugal and Poland.” Within Banijay, however, the business “sticks out like a sore thumb.”

Best in show: The combination of a good betting and gaming business buried within a larger conglomerate explains why there are thought to have been approaches within the few years about potential takeovers.

“Trust me, everyone has had a look,” said one investment banking source.

Luxury item: Among those thought to have ultimately passed up the opportunity are Flutter, MGM, Entain (when it had cash to spend) and DraftKings, while one source suggested a merger with Kindred was considered before FDJ bought that business.

“The problem is the multiple,” said one consultancy source, while the investment banking source suggested the “high expectations might be where the rubber hits the road.”

Adj. EBITDA upwards of €300m indicates a price tag of over €4bn, based on the rumored multiple ask of at least 14x and potentially as much as 16x.

“Even Flutter has to be price sensitive,” said another executive with M&A experience. “It’s just crazy expensive and you are reliant on one market.”

Bait and switch: As the exec added, now the sellers will be “dangling the prospect” of French iCasino in front of potential buyers. “But that could end up being like Belgium where you need to own a land-based casino to stand a chance of getting a license.”

“A buyer could end up laying out for Betclic and even then not getting a license,” the M&A exec added.

Our platform empowers operators to scale efficiently in highly-competitive and regulated markets utilising a unique set of capabilities, including:

Total Brand Autonomy: The freedom of having your own in-house sportsbook

True Personalisation: Pricing and product tailored to every customer's expectations and preferences

On-demand User Observability: Access to every single customer interaction, helping you make more informed decisions

Operate Multiple-Jurisdictions Quickly & Easily: Purpose-built tech to effortlessly scale internationally

Grow faster. Reduce costs. Challenge market-leaders with confidence.

Find out more today, book a demo.

+More

The fumble in the rumble: Netflix said 60 million households watched Tyson-Paul – or at least attempted to. Netflix has a month to do better. But the bookies were happy.

Clouds on the horizon: Nevada’s tourist economy could hit some “bumps in the road” in the next few years, according to a report from UNLV’s Center of Business and Economic Research.

The report said visitor traffic is set to fall by 5% in 2025 and a further 7% in 2026.

BetMGM has extended its agreement to be the official betting partner of the Vegas Golden Knights. The new deal with the NHL team runs through the 2026-27 season.

Earnings in brief: Gaming affiliate minnow SharpLink Gaming said revenue was down 34% to less than $900k. Following the sale of SportsHub for $22.5m earlier in the year, the company is now debt-free.

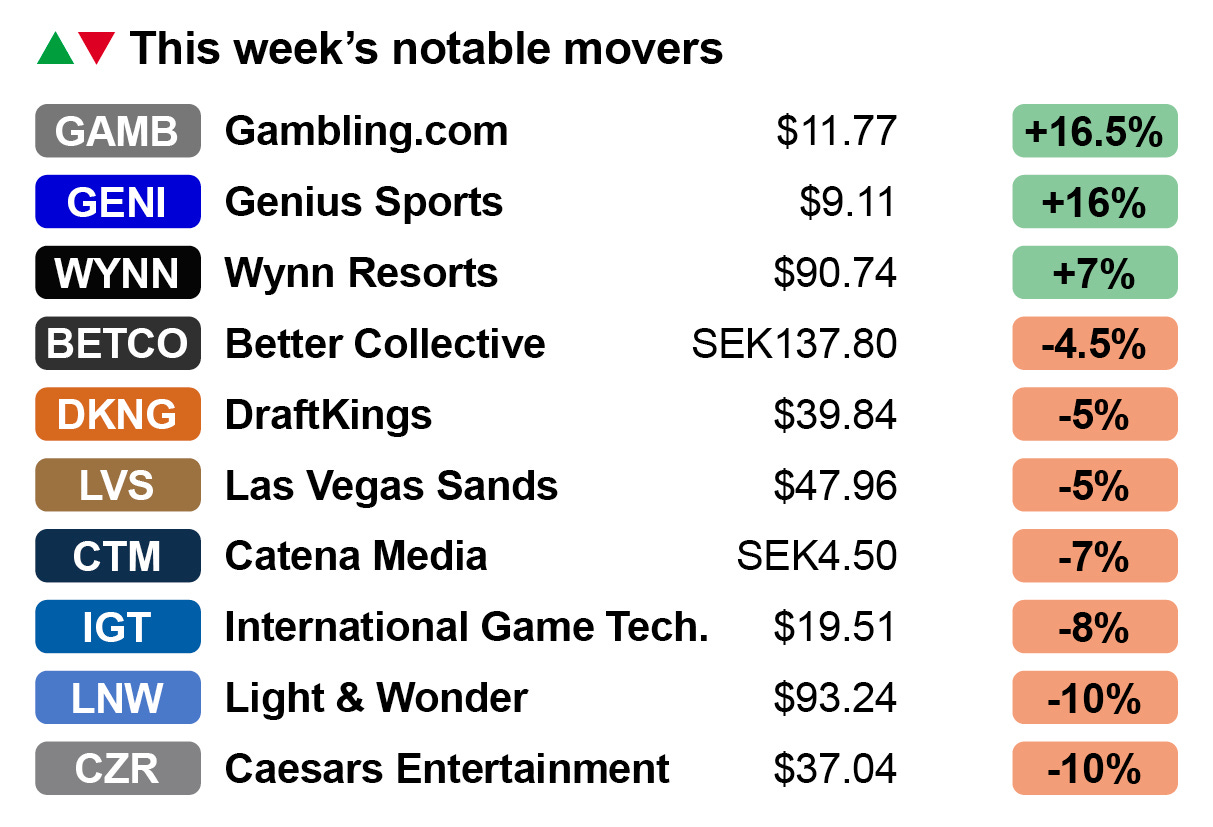

Markets watch

Bread & butter: The prospect of the Federal Reserve pulling a handbrake turn on interest rates in order to stifle a renewal of inflation was enough to kill the Trump victory buzz across the markets on Friday, and the major gaming stocks were no exception.

Booming US retail sales did the damage with both the S&P 500 and the Nasdaq taking tumbles and dragging with it the likes of Caesars, down 10% last week after a 5% fall on Friday.

Similarly in the doghouse were DraftKings, down 3% Friday, and Wynn with a 2.5% drop.

Hit & run: It was a glancing blow for Wynn whose share price enjoyed a boost last week following reports of Tilman Fertitta increasing his stake in the company and letting it be known via sources that he was unhappy with the Vegas and Macau operator’s current direction.

But analysts at CBRE questioned the premise of an underperforming share price, pointing out the shares are up 70% since Fertitta first bought a 6% stake in 2022.

The acquisition of more shares is an “attractive value investment” that could become strategic if a “unique situation arises,” such as an economic downturn.

Wheat & chaff: Heading up the winners last week was gaming affiliate provider Gambling.com, which produced well-received numbers on Thursday. The team at Macquarie said they believed Gambling.com continues to be “grouped unfairly” with its peers.

However, the differential last week between its 16.5% uplift vs. the 4.5% fall for Better Collective and the 7% drop for Catena Media suggests investors are now being more discerning.

The analysts at Jefferies noted Gambling.com's long-term target of $100m of adj. EBITDA was "realistic" given it should “out-grow” the sector.

Light & blunder: The analysts at Truist noted that post-earnings Light & Wonder might see some pressure on its share price and, lo, it came to pass, with the company’s shares down 10% for the week.

The weakness was caused by investor queasiness over the Q3 miss but the team at B Riley insisted there was no “systemic” issue despite the known issues around Dragon Train.

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

By the numbers – Maryland

A touch down: As one of the first states to report October data, there were obviously many eyes looking at the operator data to assess quite how bad the NFL results had been for the leading operators.

As befits their respective earnings commentaries, the differential between the top two in the market was quite stark with DraftKings managing a hold percentage of 7.6% vs. FanDuel’s 10.1%.

Of the competition only Fanatics got near the market leader, with a 9.8% hold percentage.

At the bottom of the heap, meanwhile, Caesars managed a measly 5.3% with BetMGM only marginally better at 6.2%.

🧐 The other aspect of the Maryland data that will be pored over is that pertaining to ESPN Bet. Those with an interest in how the Penn-managed brand is faring will note it saw a mere 2% GGR mobile share from 2.6% handle share and with hold at 6.9%.

Should this lowly percentage be replicated in other states, it means ESPN Bet will have fared no better last month than in September.

Penn management’s hopes for market share progress will jump to the November data to see if the launch of account linking will have done anything to move the needle.

+More numbers – the UK

With Flutter reporting last week, and taking in data from the UK Gambling Commission’s quarterly survey, the team at Regulus have taken a stab at estimating growth rates for the UK top 5 in Q3.

Smash and grab: As the chart suggests, Flutter is taking mass market share and "executing better" than its rivals, with Regulus arguing its 14% Q3 growth rate has translated into it grabbing a further 2% market share.

In comparison, the team suggested Entain and Evoke have each lost 1% of share, while Bally’s has held steady and bet365 has lost a small amount of ground.

In the mid-tier, Kindred has lost out, due to the implementation of affordability measures earlier in the year, but Rank (with iCasino growth) and Super Group (with Betway) are likely up.

Tail-end Charlie: One area of the market that continues to do well at the expense of various of the bigger names is the long tail, but the Regulus team believed the set of circumstances that allowed them to gain ground due to more “haphazard” regulatory enforcement won’t hold for much longer.

The analysts suggested the new £5 slot staking limit, the wider adoption of affordability checks further down the pyramid and the potential for rising taxes will hit the long tail.

“However, they will also strengthen the appeal of the black market,” the team added.

Is your organization managing licensing submissions across several jurisdictions? Are redundant licensing tasks and scattered personal data slowing you down?

Now you can unlock new jurisdictional licensing within weeks, not months, with OneComply. By reducing application time from days to just minutes, OneComply improves efficiency by up to 99%.

Click here to connect with us and discover how much more you can get done with OneComply.

Events calendar

Dec 2-4: Thai Entertainment Complex Summit, Bangkok

Dec 4: VIXIO Global Regulatory Awards

Jan 20-22: ICE, Barcelona

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.