Boyd’s bet on FanDuel has paid off while Penn continues to struggle.

Bally’s sells its Japan-facing online business via an MBO.

Robinhood’s speedy move into futures betting.

MGM Resorts out of favor with investors on peak Vegas fears.

By the numbers: hold factor analyzed, Macau in October

You and I travel to the beat of a different drum.

Hard Rock Bet is gearing up for 2025 with a focus on amplifying brand and product engagement. With a powerful, custom-built bonusing system and an ambition to redefine traditional CRM, we're seeking leaders who are driven to challenge the status quo:

And other amazing positions here

Different strokes

A tale of two balance sheets: Compares and contrasts don’t come much starker than that between two of the biggest regional casino operators in the US and their respective digital strategies.

It was the best of times: In its recent Q3 earnings report, Boyd Gaming raised its guidance for 2024 online adj. EBITDA to $75m from $65m-$70m previously.

It was the worst of times: In comparison, at Penn’s investor event at G2E it said Q3 adj. EBITDA losses would come in at $90m-$100m.

No end to the bleeding: Albeit an improvement on its previous guidance, it still means that when added to the $299m loss from the first six months of the year, and with Q4 yet to come, the interactive unit is on course to make a 2024 adj. EBITDA loss of close to half-a-billion dollars.

Access all areas: This difference in outcome stems from strategic decisions taken at the beginning of the OSB and iCasino era in the US. Peak hype, regional players found themselves in the position of being able to offer (then valuable) market access and each did long-term deals with what turned out to be the big online winners.

#1: Boyd agreed a deal with FanDuel in August 2018 for access to all its 10 operational states (ex-Nevada) plus five more under the terms of a contra-deal with MGM.

#2: Meanwhile, in July 2019 Penn signed a 10-year access partnership with DraftKings for seven states.

Stick or twist: But from that point the two companies’ strategies with regard to sports betting diverged significantly.

As part of its deal with FanDuel, Boyd gained a 5% stake in the business alongside a profit share and it made no subsequent attempt to enter any OSB market under its own steam.

Penn took a wildly different path. It failed to negotiate any equity in DraftKings but did take a stake in PointsBet and also theScore, which it later ended up paying $2bn to acquire.

It also embarked on a failed tie-up with Barstool that cost it ~$500m and now with ESPN Bet it is just over a year into a 10-year $1.5bn licensing deal with Disney.

Boyd was “conservative” in its initial stance on sports betting, sources said. Penn was less so and undertook a series of risky bets culminating in its gamble on ESPN Bet, one that recent market share evidence suggests is yet to show signs of paying off.

Linked in: Penn’s hopes are now pinned on the accounting linking of the ESPN mothership with ESPN Bet, announced last week to some fanfare.

But a lot is hanging on this: Penn said in October it can make a profit in OSB with just 6% of the market. Yet, it remains mired at levels below 3%.

Conversely, Penn has relative strength in iCasino – unlike Boyd – via its Hollywood brand and may yet “do a Wynn and fold back on an iCasino-only strategy,” as one industry consultant put it.

Boyd, meanwhile, was rumored earlier in the year to be weighing up a bid for Penn. It is likely any approach was rebuffed but it is known that Penn investors remain antsy.

A return to the table can be discounted, particularly with the Penn management and board facing increasing scrutiny over their stewardship.

What happens next? Penn reports its Q3 earnings on Thursday.

We simplify game development by doing the heavy lifting, so you can focus on creativity.

Whether you’re an emerging studio or an established one looking to relieve development pressure, we ’ve got you covered.

Flexible Build Support: We bring your math sheets to life and handle rollout across RGS instances.

Rapid Deployment: Get your content live in as little as 2 months.

Wide Distribution: Access key US & European markets via an extensive network of distributors and integration with chosen operators.

Future-Proof Growth: Secure a path to owning your own platform with our source code license option.

Bally’s Asian unit sale

One remove: Late on Friday, Bally’s announced the sale of the Asian-facing elements of its interactive business to members of the management team for an undisclosed sum.

The carved-out business will receive a five-year brand license, subject to an extension.

Bally’s said it will have no role in the management, operations or governance of the business.

The company said the management team was acquiring the carved-out business in exchange for a note and added that the financial impact of the deal was not expected to be material to adj. EBITDA or free cash flow.

It said the “modest decline” it would see will be mitigated by “cost actions to simplify Bally’s organizational structure and other cost reductions.”

Going forward, Bally’s will recognise licensing and royalty revenues from the licensing.

(Not so) big in Japan: The unit in question is the Vera & John business, which is thought to be the leading iCasino brand in the ‘gray’ Japanese-facing market. According to a presentation from Gamesys, Asia was worth £98.9m in H120 or ~27% of total revenues.

However, subsequently the business is known to have gone into reverse under pressure from blocking actions undertaken by the Japanese authorities.

At the time of the Q2 earnings announcement, CEO Robeson Reeves said, though there were signs of the region beginning to “stabilize,” it “now appears likely that challenges will remain for the foreseeable future.”

+More

US-based pre-IPO specialist investment manager Nevada Gaming said it has acquired Spacesiks, a Ukrainian company that owns a site called Cosmolot, which it claims is the country’s largest operator.

The week ahead

Penn aside, the other big release this week comes from DraftKings, which will release its Q3 earnings AMC on Thursday with the analyst call set for BMO the next day.

The analysts at Bank of America estimated last week that Q3 revenues will be 36% ahead at $1.08bn, slightly below consensus, while adj. EBITDA losses will be in line at $75m.

This will be driven by $45m-$60m of headwinds from October’s poor hold performance (see ‘By the numbers’ below).

The BoA team expects the company to reiterate its FY25 EBITDA guide of $900m-$1bn off a revenue guidance of $6.15bn-$6.45bn, representing growth of 25%.

Also reporting this week, Wynn Resorts, which will likely offer more detail about its UAE plans, Kambi and affiliate provider Catena Media.

Moved fast, broke things

Hood wink: Robinhood’s move into the prediction market space – launched just last week ahead of tomorrow’s presidential election – was lightning fast. The launch of markets on whether it will be Kamala Harris or Donald Trump who will triumph tomorrow was planned less than a month ago, according to CEO Vlad Tenev.

“The path to offer this product was paved really less than 30 days ago,” he told analysts on the trading company’s Q3 call.

He said the company saw 10m contracts traded on the first full day last Tuesday with double that on the following day, Wednesday.

Robinhood’s move came after a flurry of news surrounding Kalshi, which recently won a high-profile legal case against the CFTC, and offshore blockchain-based provider Polymarket.

Read across: See last Wednesday’s The Token Word for more on the ascendency of prediction markets.

Winningest: Notably, Tenev said Robinhood’s number one priority was “winning the active trader market.” The election bets are the first iteration of the Robinhood Derivatives offshoot.

It operates under license from the Commodity Futures Trading Commission, with the trading infrastructure produced in partnership with ForecastEx.

Call recall – VICI

Sick of it all: “It’s an extreme world we’re currently living in, isn’t it?” was how VICI CEO Ed Pitoniak opened up the company Q3 call with analysts. Noting the bout volatility after the recent 50 points cut in US base rates, he said the moves in the market had been “kind of nauseating.”

This is reflected in the levels of “indecision and inaction” on the part of market participants.

You can always hope: Maybe forlornly, he said that following this week’s vote he said VICI was “among those in both America and globally who hope things really kind of calm down next week.”

He said “people are just so distracted and stressed out” that they are not even switching on the TV to watch the NFL.

By the numbers: Pitoniak was speaking after VICI said Q3 revenues increased 6.7% YoY to $965m while AFFO attributable to common stockholders increased 8.4% to $594m.

Regional concern: One specific business area cited by Pitoniak as causing concern were certain regional gaming markets.

Name-checking an investment essay on oversupply, he said certain states were in danger of “authorizing the creation of more capacity than the market really should be able to sustain.”

He added that the likes of Illinois and Indiana were states where all participants should be “mindful of when is enough, enough?”

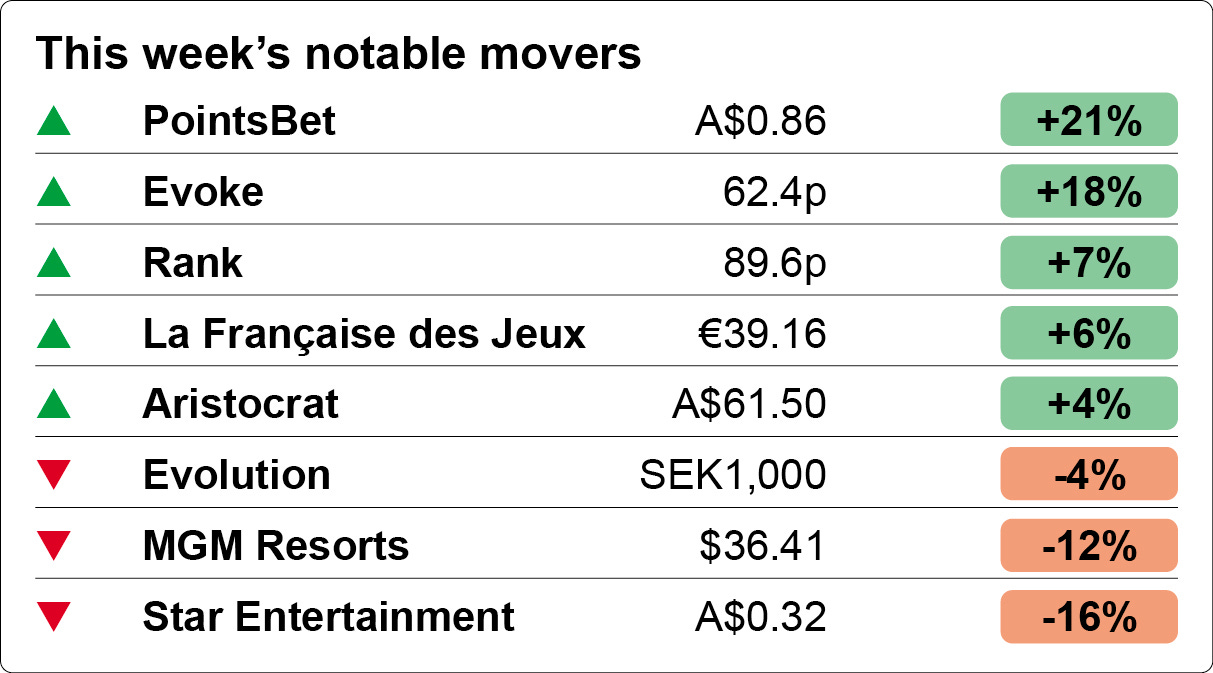

Shares watch

Coming off the top: MGM Resorts lost over a billion dollars in value last week after investors were left disappointed by the company’s Q3 earnings statement, which gave the impression Las Vegas had passed its post-pandemic peak.

The team at CBRE noted that Q3 was meant to be an easy comp given the lapping of last year’s cybersecurity issues, yet it “still missed consensus.”

The team added they expected the “noise” to continue for the next few quarters, with F1 in Q4 delivering less than last year and a Super Bowl-less Q125 also likely to provide a “tough comp.”

MGM’s potential catalysts are mostly long-dated, including the IR in Japan and potential developments in New York and the UAE, with the best opportunity for a near-term earnings inflection coming via the digital business.

La Française des Jeux gained 6% this week after a European Commission concluded after a three-year investigation that the French monopoly lottery operator’s payment to the state does not contravene EU competition rules.

The complaint had argued that FDJ’s payment of €15.2m a year fell short of market value.

The Commission recommended a 25% increase in the total fee paid for the length of the contract, which runs until 2044.

The biggest winner of the week was PointsBet. The Australian online bookie benefited from renewed investor interest following the publication of its FY25 Q1 earnings late last week, which showed revenue rising 12% to A$65.3m ($43m).

Losses were not stated but the company insisted it would be cash flow breakeven for the year.

EveryMatrix delivers iGaming software, solutions, content and services for casino, sports betting, payments, and affiliate/agent management to 300+ global Tier-1 operators and newer brands. The platform is modular, scalable, and compliant, allowing operators to choose the optimal solution depending on their needs.

EveryMatrix empowers clients to unleash bold ideas and deliver outstanding player experiences in regulated markets.

By the numbers

US sports-betting hold

A customer-friendly run of results in the early weeks of October – including what Caesars CEO Tom Reeg termed the “single worst combination of sports-betting outcomes we’ve seen since we started the business” – mean that, barring a miracle in the last week, hold across the sector will have suffered.

In a recent note, Macquarie estimated hold for the month at 5.5%, although the last weekend of football should lift that somewhat, particularly with the less volatile NBA season starting on October 22.

Deutsche Bank analysts, meanwhile, noted that while Q4 “appears to have gotten off to a somewhat bumpy start,” comparisons with a tough November 2023 means the comparison will “ease materially.”

Macau October

Glad that you’re bound to return: What the analysts at Seaport suggested was a “blowout” Golden Week in early October helped push GGR for the month up by nearly 7% YoY to $2.6bn, leaving the YTD total at 77% of the 2019 total.

For the remainder of the year, the Seaport team estimates November will register a 17% YoY increase but that the YoY uplift for December will be a bit weaker at 5% due to the scheduled visit from President Xi.

Join 100s of operators automating their trading with OpticOdds.

Real-time data. Proven trading tools. Built by experts. Increase your GGR in just one month. Join top operators at www.opticodds.com.

Earnings calendar

Nov 4: Wynn Resorts, Century Casinos

Nov 6: Kambi, Full House Resorts, Red Rock Resorts

Nov 7: Catena, Penn, DraftKings, Golden Entertainment

Nov 8: DraftKings (call)

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.