Questions asked about Flutter’s US TAM estimates.

Playtech releases H1 earnings.

Star Entertainment releases delayed earnings, shares tank.

Chinese stimulus sees Macaustocks add billions in value.

Don't believe me if I tell you.

Hard Rock Bet is all about fun and innovation. With a top ranked sportsbook & casino product, unique access to US states, and a globally recognized brand, join our team to help shape the online experiences that millions love. We’re currently seeking:

And other amazing positions here.

Hype report

Tell me lies, tell me sweet little lies: Questions have arisen over the assumptions relied upon by Flutter last week in its TAM estimates for the US sportsbook and iCasino markets, after it upgraded its estimate for the size of the opportunity in 2030 by 75% to $70bn.

This compares with the estimate of $40bn for the size of the 2030 market forecasted just two years ago.

Sports betting is now tipped to be worth $39bn in six years’ time while the company hopes iCasino will be worth $24bn.

Flutter also added $7bn of potential Canadian revenues for the first time.

🔮 Flutter takes a stab at calling the size of the NA online market in 2030

On the call, FanDuel CEO Amy Howe made the point that neither of its assumptions on sportsbook or iCasino penetration rates had changed between 2022 and this new estimate.

What has changed, she said, is that FanDuel says it is seeing higher player values – 45% higher on previous estimates – than was expected in 2022.

Second, she said that while expected sportsbook penetration remains unchanged, we’re actually seeing a higher level of gaming penetration in the market than we previously expected.

Shaky ground: But Chris Krafcik, MD at EKG Gaming, noted his concerns on LinkedIn last week about some of the underpinning for Flutter’s numbers, especially when it comes to iCasino expansion and the implied GGR per adult.

Squaring the circle: Getting to 25% of the US population with access to legalized iCasino by 2030 implies one new state per year.

That rate of expansion “just does not square” with either the current levels of iCasino (11%) and the “current impasse over cannibalization.”.

Krafcik argued that he does not see how Flutter gets to “this kind of a TAM build without some very aggressive, non-consensus state expansion assumptions.”

The other stumbling block is the implied per adult participation. With a “reasonable” assumption for the over-21 population of the US of 275m by 2030, the $63bn of US TAM implies per adult spend of $177 for sportsbook and $349 per adult for iCasino.

“That, by current comps, is pretty high,” says Krafcik. For context, he noted the only market currently doing “anywhere near” these levels is New Jersey, which in the LTM sits at $163 for sportsbook and $310 for iCasino per adult.

Yet, as Krafcik noted, New Jersey is a “massive outlier for so many reasons.”

Anchor, man: He noted Flutter “rightfully” is optimistic about the trajectory of the US market and its place within that market. But the implied level of GGR per-adult spend in the updated TAM “do not seem to be anchored or even proximate to any non-New Jersey comps.”

“Taking all of this together,” he concluded, it is a TAM that “looks very, very aggressive,” and one that he considers to be “on the outermost edge of plausible.”

Also commenting on Flutter’s estimates, Paul Leyland at Regulus said “there are only three things we can be sure of in terms of longer-term US TAM estimates.”

“They will be wrong, if they are based on GGR, they are misleading in terms of revenue potential and they won’t shape corporate performance.”

Kero is a premier micro-betting provider, powering more than 150 operators across the globe.

Our extensive coverage of fast markets in Football, Basketball, Baseball, and Soccer is a proven method for increasing in-play handle and hold.

Talk to us about how we utilize algorithmic recommendation to power highly contextual micro markets for the ultimate in-play experience.

More Flutter takes

Talking turkey: It is FanDuel’s current dominance of the US online space that impressed the analysts and which, said the team at Wells Fargo, will see it “continue gobbling up OSB market share.”

While FanDuel is the “undisputed #1 in the US,” the team added its higher structural hold target and clarity on promo levels “could flush out smaller competitors” and accelerate the stream of market exits.

Morgan Stanley suggested the read-across for DraftKings was positive, arguing that just by matching FanDuel’s higher win rates it would highlight DraftKings’ “upside potential.” But it is less than good news for BetMGM, Caesars and Penn/ESPN Bet.

The “sheer magnitude” of FanDuel’s medium-term goal of 20% promotional reinvestment “creates far more capacity for reinvestment” than its peers.

The delta compounds at the level of marketing, product and tech, and sales and admin spending.

Juggling: Meanwhile, CBRE suggested parent Flutter was well-placed to manage the balancing act of leaning into the US opportunity, pursuing further M&A, returning cash to shareholders and still maintaining low enough debt levels that “preserves plenty of dry powder for new opportunities.”

+More

ESPN Bet has enjoyed its first weekend of operations in New York after a soft launch late last week. It means New York is now back to its full complement of nine operators.

DraftKings has been fined $200,000 by the SEC for posting financial information selectively on social media ahead of an upcoming earnings release.

FanDuel has renewed its multi-year retail sports-betting agreement with IGT, with the supplier’s PlaySports offering being the exclusive provider for North America through September 2028.

Betting exchange Sporttrade has launched in Arizona, its fourth state.

888Africa has become the official sports-betting partner of Portuguese soccer club SL Benfica in Mozambique and Angola.

Sega Sammy has received regulatory approval from the Nevada Gaming Commission for the acquisition of GAN.

Positives for Playtech

B2Boost: Having recently disclosed the sale of Snaitech to Flutter for €2.3bn, Playtech got around this morning to disclosing its H1 earnings, which showed revenue up 5% to €907m and adj. EBITDA up 11% to €243m.

Rock on: The company said the performance of the continuing B2B business was “very strong” with revenue up 14% to €382m, helped by a 42% increase in the Americas – largely CaliPlay – to €142m.

Notably, the company also increased the fair value of its low single-digit stake in Hard Rock Digital to €118.5m from €77m previously, a 54% uplift. Revenues from the US and Canada rose 200%.

Looking ahead, Playtech said the B2B unit was on track to hit its 2024 Adj. EBITDA target of €200m-€250m in 2024.

What Flutter gets: The B2C business saw flat revenues at €532m while adj. EBITDA fell 6% to €131m. Within that, Snaitech revenues fell 1% to €484m with retail down 2% and online off by 1%. Revenue at Sun Bingo and other B2C was up 17% to €39.9m.

Diary note: Playtech will host a call with analysts later this morning, which E+M will report on later in the week.

Catch a falling Star

Hang tough: “We've had a tough time, for a long time,” said incoming CEO Steve McCann as Star Entertainment was finally able to publish its delayed H2 earnings, which saw the company post a loss after tax of A$1.69bn ($1.17bn).

The shares fell over 44% on the day of the earnings.

The losses included a A$1.44bn writedown caused by trading conditions as well as regulatory changes derived from the recent Bell II enquiry. The trading performance in the second half of FY24 deteriorated with revenue down by 10% to A$1.68bn.

The earnings statement was delayed until the company reached an agreement with its lenders over a new A$200m debt facility.

The company has also sent its response to the New South Wales regulator’s ‘show cause’ notice. See tomorrow’s Compliance+More for details.

Earnings in brief

XLMedia: The gaming affiliate said revenue from its continuing, largely North American-focused, business plummeted over 38% to $10.4m. Adj. EBITDA was down 72% to $0.9m.

Recall, the company sold its European and Canada-facing operation to Gambling.com earlier in the year for up to $42.5m.

👀 The company said the “usual acceleration” at the start of the NFL season had failed to materialize and had been “slower than expected.”

Shares week

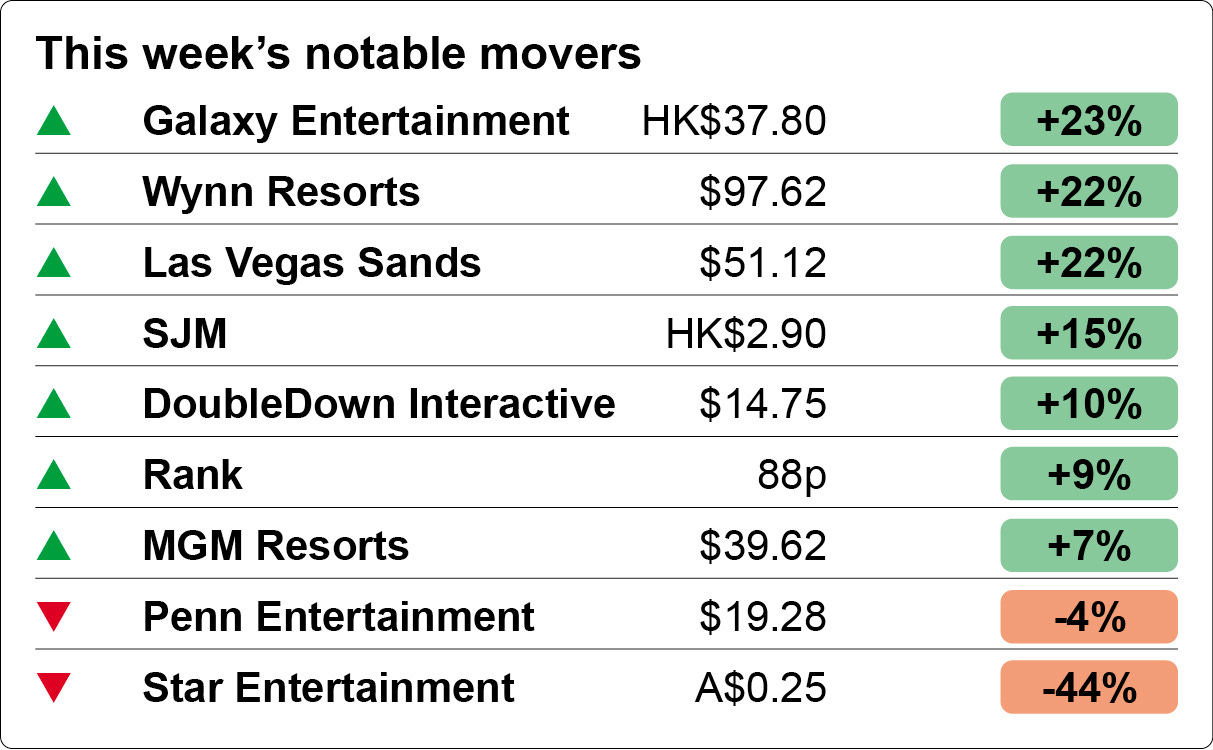

Fireworks: The long hoped-for stimulus package announced by the Chinese government last week in a bid to jumpstart the country’s economy lit a fire under Macau-related stocks this week.

The 20%+ leaps from Galaxy Entertainment, Wynn Resorts and Las Vegas Sands prove the point from the analysts at Macquarie that it had indeed “improved sentiment” towards the sector.

The Hong Kong-listed subsidiaries rose in tandem, with Sands China up 23%, Wynn Macau up 22% and MGM China up 15%.

Bull signal: A note from Morgan Stanley last week pointed out the recent Macau lows were similar to previous lows going back to 2011, adding that “every time it returned to at least double the prior market cap.”

And then there were nine: Such was the improvement this week for Wynn Resorts that the company has now joined the elite list of gaming sector companies worth over $10bn.

The 22% leap added over $2bn to its value, leaving it worth $10.9bn.

Las Vegas Sands, meanwhile, added just under $8bn of value this week while Hong Kong listed Galaxy notched up an extra ~$4bn of market cap.

Metric’s new multi-tenant sportsbook technology provides a shortcut to crafting a bespoke, premium sportsbook from the ground up, complete with operator-owned IP and built on highly performant technology, free of technical debt.

Our philosophy is to deeply understand our partner’s business and treat it with similar care to our own. We aim to collaborate with ambitious brands to help them realise their long-term growth potential in regulated markets, globally.

For sports betting businesses looking to finally take control of their sportsbook, there is no faster route to competing on product and price.

To find out more, visit www.metricgaming.com

By the numbers – Las Vegas Strip

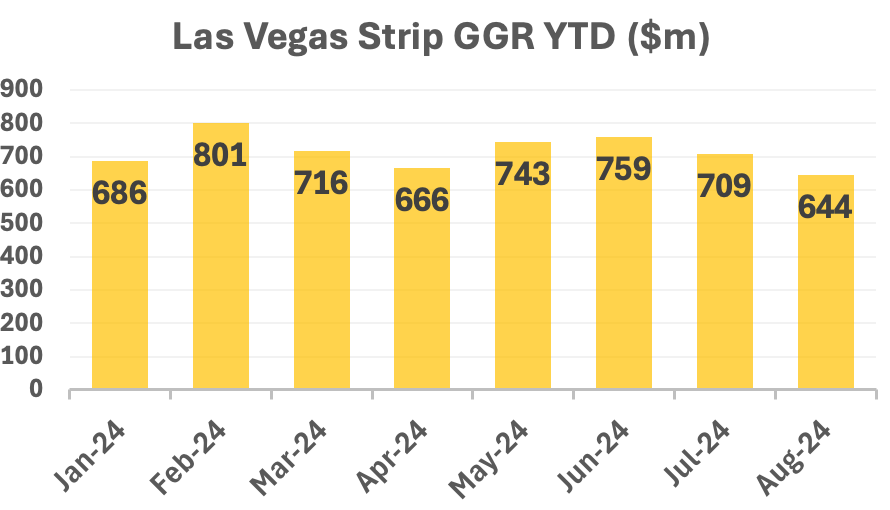

Deflating balloon: Tough comps particularly with baccarat hold left the analysts at Macquarie suggesting the “hyper growth” was now slowing.

Strip GGR was indeed down 3% YoY to $644m but the team at Deutsche Bank said the decline was “modestly better” than was forecasted.

Baccarat drop was actually up 12.5% YoY but GGR was down 34% as hold fell back to 10.5% vs. the average for 2023 of 16.6%.

A similar dynamic affected slots where handle rose over 8% but GGR was down by 40 bps.

🎈Is the party over on the Las Vegas Strip?

Data points

The North Carolina sports-betting regime has brought in $62m in tax revenue in its first six months of operation, according to Sterl Carpenter, the deputy executive director of gaming compliance and sports betting at the state’s Lottery Commission.

Lawmakers had projected the state would generate $36.1m in FY25 from sports betting.

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

Calendar

Oct 17: Entain

Oct 23: Churchill Downs (earnings)

Oct 24: Betsson, Evolution, Churchill Downs (call)

Oct 25: Kindred

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.