Player surcharge retreat fuels speculation of RSI bid return.

Oakvale confirms it has been given the mandate to sell OpenBet.

Business is booming for the financial bookies.

Startup focus for this week is betting simulator HotTakes.

You go back, Jack, do it again.

Hard Rock Bet is all about fun and innovation. With a top ranked sportsbook & casino product, unique access to US states, and a globally recognized brand, join our team to help shape the online experiences that millions love. We’re currently seeking:

And other amazing positions here.

M&A speculation

Back on the table: DraftKings’ player surcharge setback last week could be the trigger for another speculative tilt at buying rival operator Rush Street Interactive, suggested investment sources.

DraftKings was previously linked with a potential buyout in March in a Bloomberg article, which stated it had been approached as part of RSI’s recent strategic review.

But the recent sale of shares by Rush Street CEO Richard Schwartz and CFO Kyle Sauers indicated “any potential sale is off the table,” according to the analysts at JMP.

Now where were we? Yet, as one source summed up the situation, it “makes sense” that DraftKings might have changed its mind about potential M&A given the failure to get the surcharge away.

“Discussions can be revived,” the source said. “It’s what happens: they might get somewhere, they might fall apart and then, if and when the time is right, they start back up again.”

Specifically, the source suggested DraftKings might be spurred on by what appears to be a “battle to defend its medium-term guidance.”

“That is arguably what the surcharge was about,” they added. Now, if it buys RSI, it “hits guidance and it can be cute about the figure going forward.”

Pick of the Bluhm: Other sources remain doubtful, however. One investment expert speculated the rise of the RSI share price – triple its low of $2.96 in May 2023 – precluded a potential bid. Even coming off its recent high above $10, it still values the business at over $2.1bn.

Shareholders would likely only accept a bid with at least a 30% premium to those levels, suggesting any bid would necessarily be closer to $3bn.

As with the Golden Nugget deal, any offer would likely be a combination of cash and shares.

Key to any discussion would be the attitude of RSI’s controlling shareholder Neil Bluhm, the owner of the unlisted B&M operator Rush Street Gaming.

IL tidings: Skeptics also pointed out that buying RSI would add to DraftKings’ problems in Illinois, where the institution of the progressive tax regime lay behind the company’s fateful decision to look at a player surcharge.

Then there is the question of DraftKings’ willingness to buy a business that has a substantial footprint in Latin America.

Asked on the Q2 about whether it held any ambitions in the region, CEO Jason Robins said his company was “really focused on winning the US online gaming opportunity.”

Unlock new jurisdictional licensing in weeks, not months with OneComply! Your gateway to effortless licensing and compliance management.

Say goodbye to the complexity of submissions and hello to 95% efficiency from start to finish! Complete your first licensing application 50% faster, get real-time alerts for immediate compliance actions, and slash legal fee costs by up to 90% with no more duplicate tasks.

Click here to connect with us and discover how much more you can accomplish with OneComply.

OpenBet sale process

The acorn doesn’t fall far from the tree: M&A advisory firm Oakvale has confirmed it has been given the mandate to seek a buyer for the OpenBet business from owner Endeavor, which officially said the business was up for sale last week alongside stablemate IMG Arena.

Oakvale was also on the ticket when Endeavor bought the business from Light & Wonder (then Scientific Games) in 2021 for $800m, knocked down from an original $1.2bn.

Endeavor is in the process of being taken over by majority shareholder Silver Lake and the betting supply business is deemed as surplus to requirements.

Sold as seen: It is thought the two elements of the business are likely to be sold separately, though the list of buyers for each isn’t long.

Sources pointed out it will be hard to separate the sports-betting data provider IMG Arena and its rights properties, particularly PGA golf, from the sports agency IMG.

Meanwhile, the legacy sports-betting tech of OpenBet might also be a hard sell despite an enviable list of clients, including Flutter and Entain and a number of World Lottery Association members.

+More

Icahn and I will: Activist investor and shareholder in Caesars Entertainment, Carl Icahn, is in hot water with the SEC for failing to disclose he had pledged company securities as collateral for personal loans.

Earlier this week an SEC filing said Icahn Enterprises held 2.4m shares or a 1% stake in Caesars. Icahn revealed in May he had bought a “sizable stake” in the business.

New Zealand-listed Sky City Entertainment said it will take an A$86m ($58m) impairment charge against the value of its Adelaide casino due to the introduction of further legal and compliance costs. The company has also announced an extension to its debt facilities.

By the numbers – Michigan and Pennsylvania

Michigan: iCasino GGR rose 25% YoY in July to $191m while sports-betting GGR was up 31% to $29.4m on handle that came in 25% up at $250m. B&M gaming was down 0.4% to $106m.

BetMGM led the GGR chart on 26.5%, followed by FanDuel (24%), DraftKings (19%) and Caesars (6%)

In sports-betting GGR, FanDuel led on 41% (down from 47% in June), followed by DraftKings (27%), BetMGM (14%) and Penn/ESPN (5%).

Pennsylvania: iCasino rose 31% to $174m while OSB GGR was up 36% to $49.5m on handle up 24% to $382m. Promo spend was up 94%. B&M gaming was down 5% to $284m.

iCasino market shares saw FanDuel take 26%, followed by DraftKings (18%), Rivers (17%) and BetMGM (15%).

In OSB, FanDuel led on 44%, followed by DraftKings on 24% and BetMGM (6%).

Financial bookies

A big plus: The evolution of the retail financial trading sector – what used to be called financial spread betting – is typified by the progress made by Israel-based and London-listed Plus500, which this week reported a 8% jump in H1 revenues to $398m.

As the company said, it has been transformed since it first listed 11 years ago from being a single-product company when it dealt largely in the now verboten financial binary bets.

Now it is a “multi-asset fintech” with an OTC business that covers a range of seven assets and a futures business, which can be split into B2C and B2B.

Higher plane: Notable is the company’s success in nurturing its higher-value customers. The average deposits per active user stood at $8,400 and ARPU was at $2,264. Also, 64% of revenue came from customers who have been trading with the firm for more than three years.

CEO David Zruia said the company was able to make money regardless of a lack of market volatility.

“I think this is very much an area of strength,” he said. “The ability to generate a very strong set of results when market conditions are not within their peak (volatility).”

Older and wiser: The outlook was not quite so rosy for Breon Corcoran, the former boss at the then Paddy Power Betfair and now six months into his post as CEO at IG. Reporting its FY24 earnings in late July, the company said revenue was down 3% to £987m.

On the earnings call he said the challenge was to “get closer to our customers to deliver better products that are tailored to their needs, and we need to do that more quickly.”

More promising was the 23% rise in revenue for the US-facing exchange-traded option offering Tastytrade. Corcoran said on the call the product was now being rolled out internationally.

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

Venture playground

Learn first-hand experiences from gaming founders on high-growth tips and network with the most influential investors, founders and leaders. Click here to register.

Funding news

When the going get weird, the weird turn Pro: The company behind CarJitsu and Power Slap, Pro League Network or PLN, has raised $4.2m in a seed funding round led by KB Partners and with the participation of previous investors Eberg Capital, Kevin Garnett & Big Ticket Sports, John Brenkus, Chris Grove and Ezra Kucharz.

PLN has produced more than 100 hours of live sports and shoulder programming in the past year and will use the new money to build towards its long-term goal of being a 24/7 network for purpose-built live sports.

Keith Bank from KB Partners said PLN has seen where “sports fans’ attentions are going.”

He said PLN was “ahead of the curve on meeting audience demands, creating new, emerging sports that have clear paths to long-term success.”

Evo.io: Asian sportsbook Saba Sports has announced it has invested $3m in the crypto casino Evo.io. According to Inside Asian Gaming, Saba said Evo.io will launch in September.

Startup focus – HotTakes

Who are you? The free-to-play betting simulator was founded by three best friends from high school, who share an interest in sports betting – Tyler Amirault, CEO, James White, COO, and Kevin Jing, CFO.

What’s the big idea? Believing sportsbook onboarding has become expensive and saturated, and that “many Americans have adopted an anti-sportsbook mentality due to the overwhelming volume of advertising,” the HotTakes app offers a free trial to users curious about sports betting.

We are providing “the thrilling experience of wagering without any financial risk,” says Amirault.

The approach “simplifies the onboarding process, demystifies sports-betting terminology and ensures swift withdrawals, streamlining every user’s first sports-betting experience.”

What they say: “Our users learn intuitively in our sandboxed environment when they optimize their strategy to win more prizes, competing against friends and climbing the leaderboards along the way.”

Funding backgrounder: The founders closed an internal funding round last month, which brought in $275k to ensure a “smooth launch” in the US.

Growth company news

Ex-Pinnacle CEO Paris Smith has joined the board of AI-powered sports-betting modeling startup Rithmm, which offers a predictive analytics model to guide sports bettors in wagering more effectively.

US startup failures

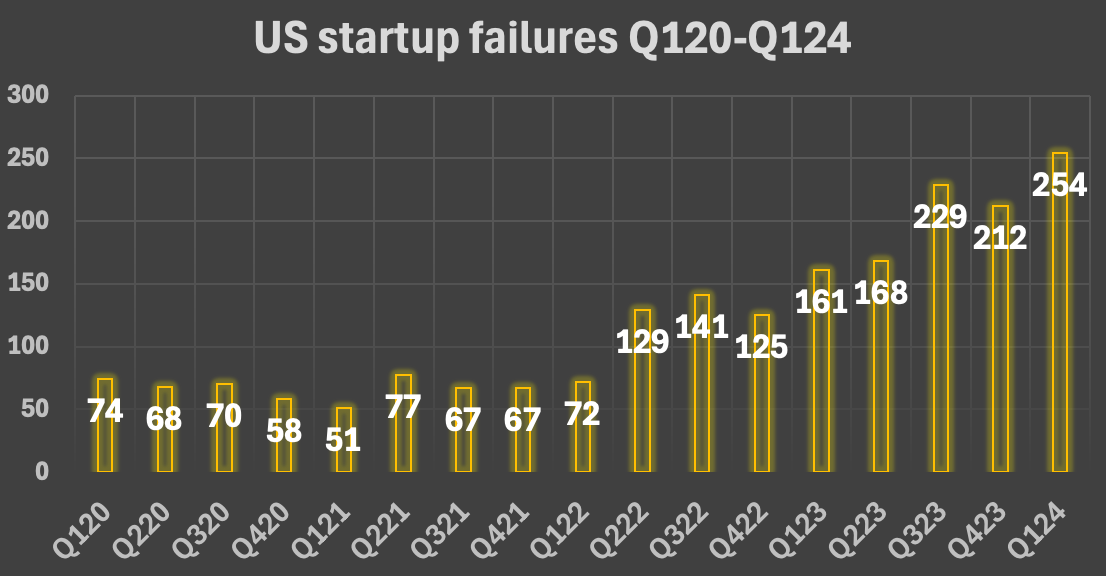

US startup failures rose by 60% YoY to a new post-funding boom high of 254 in Q1, according to growth company shareholder services provider Carta.

Carta said the shift in the founding landscape lies behind the rising number of startup failures, and companies that raised in 2021 and early 2022 are now struggling to come up with follow-up funding.

Metric’s new multi-tenant sportsbook technology provides a shortcut to crafting a bespoke, premium sportsbook from the ground up, complete with operator-owned IP and built on highly performant technology, free of technical debt.

Our philosophy is to deeply understand our partner’s business and treat it with similar care to our own. We aim to collaborate with ambitious brands to help them realise their long-term growth potential in regulated markets, globally.

For sports betting businesses looking to finally take control of their sportsbook, there is no faster route to competing on product and price.

To find out more, visit www.metricgaming.com

Events calendar

Sep 2-4: Sigma East Europe, Budapest

Sep 24-26: SBC Summit, Lisbon

Oct 7-10: G2E, Las Vegas

Oct 21-24: World Lottery Summit, Paris

Nov 5: Gaming in Germany, Berlin

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.