Penn Entertainment is rumored to have hired Goldman Sachs and Evercore.

Time for heroes: FansUnite sells Betting Hero to management and GeoComply.

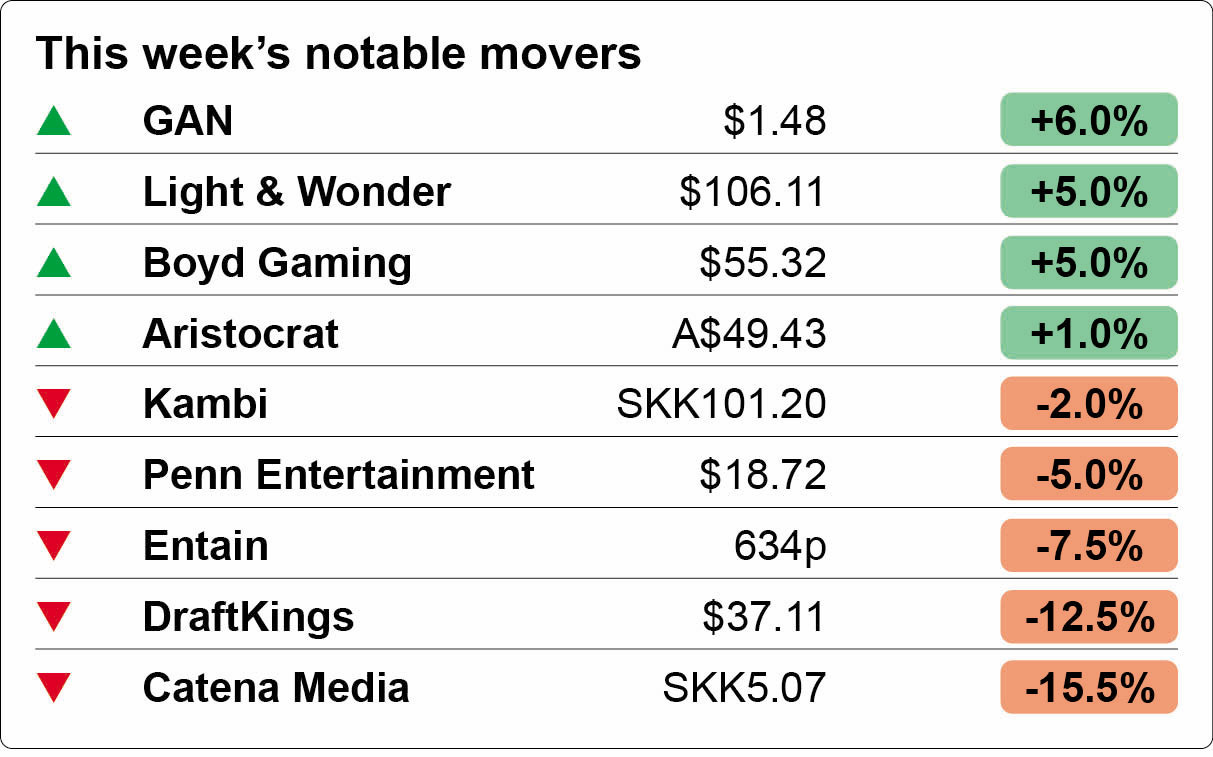

In the shares week: DraftKings gets spanked, Aristocrat hits highs.

Sizing Alberta: JMP looks at the potential in Canada’s fourth-largest province.

I can teach you, but I have to charge.

Penn positioning

My milkshake brings all the Boyds to the yard: Despite analyst skepticism around the complexities of any deal, sources indicated this week that activist investors on the shareholder register at Penn would be supportive of a deal at ~$25 a share if it involved cash and a proportion of Boyd shares.

“The activists would maybe be enticed by having a holding in a better-run company with better prospects,” suggested one investment source to E+M on condition of anonymity.

Council of war: There was also the suggestion that further bidders might be lining up approaches, though it is thought Hard Rock is not among them. It is believed Penn has hired bankers at Goldman Sachs and Evercore to advise on the company’s options.

E+M was unable to reach Penn despite numerous inquiries.

Smooth operators: Sources also suggested other hurdles noted by the analysts could be smoothed away. Disney, for instance, would only get involved if there were a separate transaction for ESPN Bet, while Gaming & Leisure Properties wouldn’t get involved unless there was a change in lease terms and would likely be supportive of any forced property sales.

Under pressure: Likely weighing on the minds of the Penn board is the prospect of the activist investors pushing for a proxy battle next summer over board seats. The recent non-binding vote saw over a third of shareholders reject the executive compensation and a quarter refused to back the reappointment of chair David Handler.

“If you really believe the NFL season will be your magical savior, you might want to see how September and October go,” said one investment source.

“But as you get further into the year, you are getting closer to a proxy fight, which could absolutely eviscerate you.”

💥Head to head: Penn Entertainment vs. Boyd Gaming this week

Diary date: Penn announced yesterday its Q2 earnings call will be held on August 8, when it is sure to face questions over its strategy for the ESPN Bet business as it heads into the new NFL season.

Unlock new jurisdictional licensing in weeks, not months with OneComply! Your gateway to effortless licensing and compliance management.

🔍 With OneComply you can say goodbye to the complexity of submissions and hello to 95% efficiency from start to finish!

- Complete your first licensing application 50% quicker

- Get real-time alerts for immediate compliance actions

- Slash legal fee costs by up to 90% with no more duplicate tasks

+More

MGM China has issued $500m of senior notes due in 2031. The cash raised will go towards paying off an existing $493m revolving credit facility.

Steve Cohen, owner of the New York Mets, has increased his stake in Sphere Entertainment to 5.5% via his Point72 Asset Management hedge fund.

Bally’s has delayed its plans to launch Bally Bet in Massachusetts after it said it needed more time. It will now launch in early July having been slated to start this week.

DAZN Bet has gone live with the Pragmatic Play sportsbook backend in Germany.

IGT has reached an agreement to provide its central monitoring system to the Ohio Lottery Commission for VLTs in the state for the next nine years.

Genius Sports is to provide player tracking data to UEFA for its Europa League, European qualifiers and Nations League through to the 2027-28 season.

Dances with Wolves: BetMGM has secured a betting partnership with EPL side Wolverhampton Wanderers.

Earnings in brief

Danske Spil said Q1 revenue rose 2% YoY to DKK1.24bn ($178m), with DS Loteri up 5% to DKK711m but with the sports-betting and iCasino business down 1% to DKK393m. Over the period, Danske Spil sold the Swush fantasy sports unit to media outlet Ekstra Bladet.

Read across

Fishy Sunak: In Compliance+More this week, the betting scandal engulfing the UK general election could see more curbs placed on political wagering as the Gambling Commission investigation widens.

The crypto election: Politics is also front and center in The Token Word as SEC chair Gary Gensler tries, and largely fails, not to be drawn into the debate over the role crypto will play in the upcoming presidential election. Meanwhile, on the prediction markets overnight…

By the numbers – Nevada

Nevada hit a new record for May with total gaming revenue up 2.5% to $1.32bn while the Strip rose nearly 4% to $742m. The Las Vegas Locals market also jumped 5%, which was attributed by analysts to the continuing success of Red Rock’s new-ish Durango property.

The team at Macquarie said the figures boded well for the lower-end gaming consumer in Vegas where operators had previously seen some softness.

They noted the non-gaming metrics of revPAR (up 11%) and visitation (up 5%) were pointing in the right direction

Head of Online – Remote/Dubai

Head of White Label – Cyprus

South Asia Marketing Manager – Dubai

Hero action

Did you see the stylish kids in the riot? FansUnite has sold its Betting Hero fan activation and research business to its original co-founders and GeoComply in a deal worth $37.5m. The move leaves founders Jai Maw and Jeremy Jakary with 60% of the firm with the remaining 40% going to GeoComply.

The acquisition is GeoComply’s second piece of M&A following the deal to buy OneComply in May last year for an undisclosed sum.

Shell-like: Following the transaction, the Toronto-listed FansUnite will pass on $20m of the proceeds to shareholders, leaving it, after fees and certain liabilities, with no functional business and about $500k in cash.

Nicely done: Explaining the move into being invested in gaming affiliation, Anna Sainsbury, CEO at GeoComply, told E+M that, in terms of how the company sees the M&A landscape, it will invest in or acquire assets that are “nicely adjacent” and market-leaders in what they do.

She added that GeoComply had been a customer of Betting Hero and it had been “blown away” by the quality of its player activation and UX research.

“Nobody is as good as they are at what they do, and that made them a very attractive investment target for us.”

EveryMatrix delivers iGaming software, solutions, content and services for casino, sports betting, payments, and affiliate/agent management to 300+ global Tier-1 operators and newer brands. The platform is modular, scalable, and compliant, allowing operators to choose the optimal solution depending on their needs.

EveryMatrix empowers clients to unleash bold ideas and deliver outstanding player experiences in regulated markets.

The shares week

Spanked: DraftKings shares endured a 12% slump this week as the story of a lawsuit involving allegations – furiously denied by the company – that it somehow aided and abetted an extortion plot went viral.

The stock won’t have been helped by a couple of negative analyst notes, with the team at Wells Fargo lowering their expected Q2 adj. EBITDA forecast to $118m from $150m.

Similarly, the team at Jefferies suggested their estimates should be lowered, with the analysts blaming a spike in downloads and new sign-ups for the Golden Nugget app.

They suggested this was “greater than anticipated,” as was the amount of promo sign-ups.

Aristocrat reached 52-week highs this week, helped by the launch of its new interactive division covering the waterfront of iCasino, OSB and iLottery products. In an investor presentation this week, it said the interactive unit generated H124 revenues of A$109.4m ($72.5m) and a profit of A$30.3m.

Rival Light & Wonder was also up this week, helped by a Jefferies note that suggested the company’s messaging on hitting its 2025 target for adj EBITDA of $1.4bn had “evolved” with greater clarity on how it would be achieved.

GAN rose 6% on Thursday after it received clearance from the Committee on Foreign Investment in the United States for the proposed merger with Sega Sammy. The merger still needs various state approvals and is expected to complete in late 2024 or early 2025.

Sportsbook backend supplier Kambi is down just over 2% for the week, but it could have been worse. An end of week revival – up over 6% yesterday – meant it finished the week roughly where it started despite the news on Monday that its client LeoVegas, via owner MGM Resorts, has bought the Tipico US platform.

Analyst takes

Alberta monumental: The potential for Canada’s fourth-largest province to follow Ontario and open up the market to commercial operators could be a catalyst for the share prices of major global operators, according to the team at JMP.

Suggesting the market could be worth over $700m at maturity, the JMP team noted this would make it the eighth-largest jurisdiction in North America. With sports betting potentially worth ~$200m and iCasino producing up to $533m.

Pattern recognition: JMP said the existing gray market and DFS brands would likely dominate any regulated market, suggesting it would likely follow the pattern of Ontario where bet365 and theScore have been successful.

Recall, EKG said recently that Stake.com was currently the dominant player in the gray Canadian market with ~20% market share.

On call

Jul 19: Evolution

Jui 24: Churchill Downs (earnings)

Jul 25: Churchill Downs (call)

Jul 31: MGM Resorts

Aug 8: Penn Entertainment

Sportsbook platforms don’t go live every day, and certainly not ones as sophisticated as this…

Purpose-built technology, without compromise

Our new technology is built to replicate the autonomy and control of owning your own platform through a smart and convenient outsourced solution

A competitive advantage

This freedom allows our customers to exploit growth opportunities previously reserved only for those with in-house tech and deep expertise.

All without the compliance or operational overheads of ownership, nor the inflexibility and service limitations of alternative providers.

Sounds interesting? Find out more here: www.metricgaming.com

Metric Gaming - Your in-house sportsbook, outsourced.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.

Hi - I have been following Penn situation very closely and your article is very close to my view. Would you like to trade notes?