Gambling’s big news week

Entain call recall, Penn analyst takes, Flutter share price watch, GAN gets nibbles +More

Good morning. On the Weekender agenda:

Entain struggles to contain HMRC fire.

Penn scores early analyst wins with its ESPN Bet news.

Flutter can’t catch a break on the UK stock market.

GAN says it has had nibbles of interest.

Plus Genting Singapore, Acroud and Bragg earnings.

Cold turkey has got me on the run.

Big news week

Flutter is trumped by Penn before a whopping fine for Entain steals the show.

News flow: Still digesting DraftKings’ news from late last week, Flutter was destined to lead the news this week with its H1 results before Penn Entertainment stepped in with its breaking news about its partnership with ESPN. Yet, without giving much time to let that settle in, Entain’s H1 disclosed that it would be stumping up £585m for past management misdemeanors.

Entain chair Barry Gibson was keen to put as much water between the current Entain and the previous management team at the then GVC as was possible.

The spin was that Entain was “very pleased indeed we’re making good progress towards drawing a line under this historical issue”.

The reality is that the company will be provisioning at least £585m to pay for the Deferred Prosecution Agreement with HMRC and the Crown Prosecution Service.

Gibson said on the call “it’s a large figure” because it relates to a business that for a long period of time “made a lot of profit”.

“More of it will become apparent when it comes out in the mid-October period because, eventually, there will be a statement of fact, which will be laid before a court, and they will become effectively public,” he added.

Can’t be clearer: Hoping to move swiftly on, Gibson reiterated Entain’s current modus operandi of only operating in “regulated or regulating” markets. “If a market isn’t showing signs of having a clear road to regulation, then we leave,” he added. “It’s as simple as that.”

Entain has been helped in that claim by the developments in Brazil. CEO Jette Nygaard-Andersen kicked off her part of the call by saying Entain was “pleased to see that regulation has now been passed”.

But the other side of the regulatory coin was highlighted by CFO Rob Wood, who spoke about the “increasingly challenging” backdrop for licensed operators in Germany.

He added that the “uneven playing field” on regulatory limits had driven NGR declines.

Meanwhile, in the Netherlands, BetCity’s NGR was down YoY reflecting the re-entry of previous gray market leader Kindred.

Whoa there: Entain was recently subject to investor criticism over its M&A policy, particularly with regard to the £750m acquisition of STS. Nygaard-Andersen said that “after a busy period of strategic M&A”, which also included deals for 365Scores and Angstrom, Entain was expecting a “slower pace of activity ahead”.

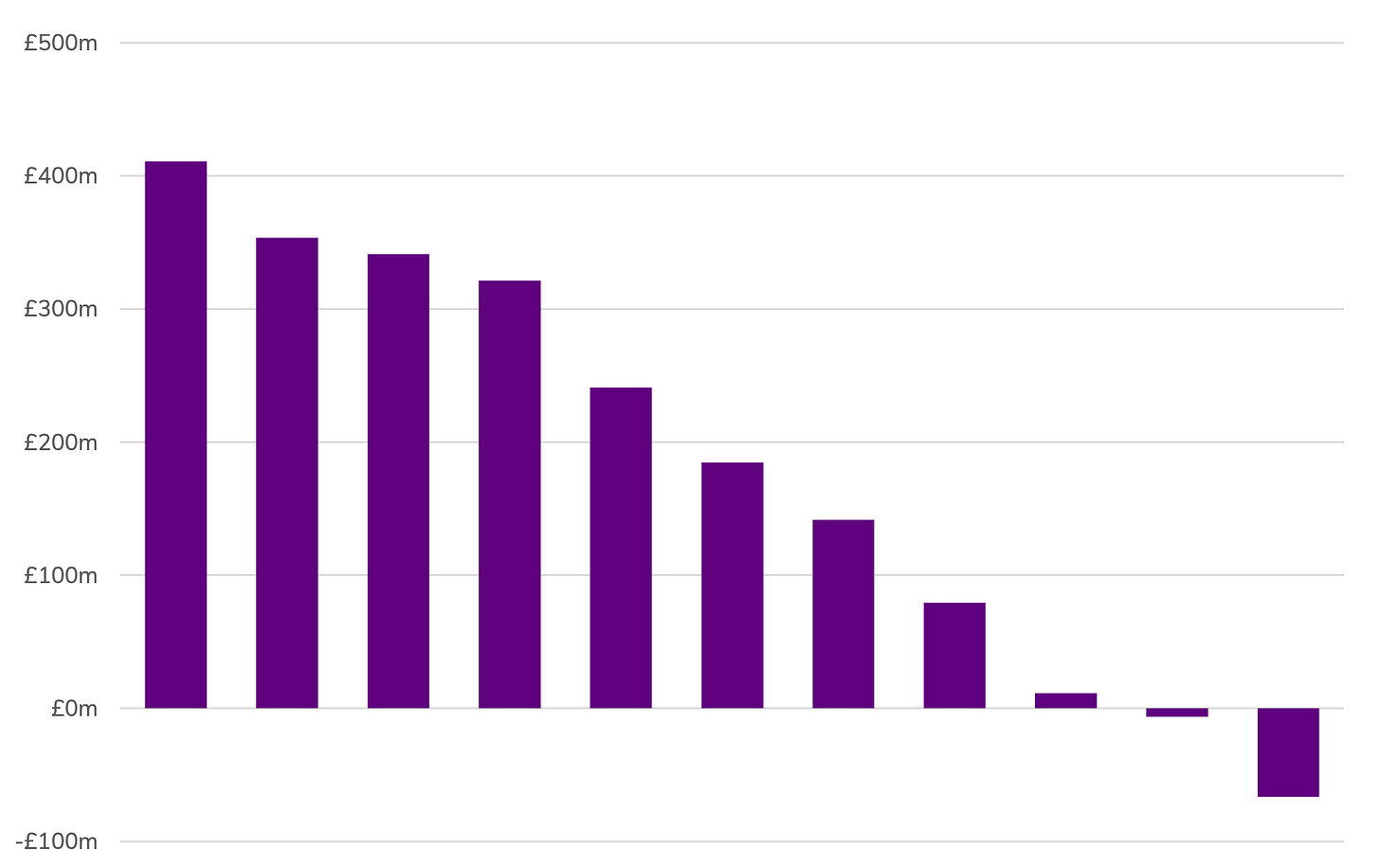

Management was questioned about a chart in the presentation for the incremental value of 11 recent deals showing values that were “sort of small” and even negative in one example.

Nygaard-Ansersen said that was caused largely by “regulation coming later than we assumed when we did the acquisition”.

“That’s very much what drives the lower valuation,” she added.

👀 Entain’s M&A incremental value after three full years of ownership

** SPONSOR’S MESSAGE **

Underdog: the most innovative company in sports gaming.

At Underdog we use our own tech stack to create the industry’s most popular games, designing products specifically for the American sports fan. Join us as we build the future of sports gaming.

Visit https://underdogfantasy.com/careers

ICYMI

It was a good week for a newsletter to focus on news from the US market. So, Straight To The Point, came out with its debut on Monday and before the week was out was using an emergency newsletter on Wednesday to cover what happens next at Barstool Sports.

On the Gambling Files this week, Jon and Fintan spoke to Tony Plaskow from Black Cow Technology. Meanwhile, at the start of the week they also chatted to Kindred's Tom Banks about the company's 0% proceeds from problem gamblers initiative.

And of course, in Compliance+More this week the Thursday edition carried the news about Entain’s £585m to HMRC provisioning as well as Penn Entertainment losing the regulatory overhang caused by Dave Portnoy.

Ratings winner

If resetting the narrative was the goal, then Penn’s ESPN Bet tie-up is already ahead.

Share and share alike: JMP said Penn’s deal for ESPN Bet boils down to one big question – how much share can Penn gain from the agreement? It has “widened the funnel”, adding millions of ESPN viewers to its internal 27m casino database. But the project will stand or fall by the quality of the product.

The team at CBRE said the old Barstool Sportsbook product “was never quite right” and that the “one operational misstep” was not investing enough in customer acquisition off-channel.

Roth MKM added that Penn’s online hopes will now be pinned on the same team that runs theScore in Ontario, which has achieved mid-teens market share.

The big sky: Much discussed is the comparison with Sky Bet. CBRE said its success “tells us two things”. First, it’s “not too late to be a contender in the space,” they suggested.

“Second, brand isn't everything. Sky really started to gain market share only after it relaunched its mobile app with key product features like build-a-bet.”

Grange Hill: Roth MKM suggested the example of Fox Bet is probably not helpful and that the conflict of interest over Flutter’s ownership “makes it a bad comp”.

“Meanwhile, we haven't seen any US media partnerships that resemble Sky Bet in the UK.”

It’s a no from me: Notably, it has been reported that the OSB market leaders passed on a deal with ESPN. “It’s unclear the extent to which Penn will upset the apple cart and cause DraftKings and FanDuel to change course,” said Wells Fargo.

The team “assume FanDuel/DraftKings/ BetMGM etc. all looked at/passed on this deal (or couldn’t get the economics to work)”.

“ESPN has clearly telegraphed a share grab; but given product/tech is driving share, not marketing budgets, we still feel good about 2025E EBITDA prospects for peers.”

Dollar tree: Portnoy bought Barstool Sports back for a dollar.

The last resort: Was Penn Gaming ESPN’s partner of last resort?

The shares week

That’s why we’re leaving: Flutter management will no doubt point out the share price reaction to this week’s earnings as justification enough for the decision taken earlier this year to seek a dual listing in the US, ahead of a likely full listing down the track.

Yet, this week’s performance would likely have taken the same midweek turn if it had been listed in the US as it did in the UK, given the trading session on Wednesday was dominated by the news from Penn Entertainment regarding its ESPN Bet deal.

Clear blue Atlantic water: While Penn saw an initial 16% leap on Wednesday, DraftKings was down nearly 10%, which was double Flutter’s 5.5% fall.

In a note on Flutter, the team at JMP said “regardless of the positive earnings surprise, the ESPN/Penn deal dominated the trading session”.

The team retains their faith. “Flutter is a global operator, competing against various types of customer acquisition strategies, yet still has gold medal positions in most major markets it operates.”

The team at Jefferies said they “expect the Flutter narrative to pick up after the sports-heavy Q3 and ahead of the US listing”.

🇬🇧 Not buying British: Flutter’s midweek slump

** SPONSOR’S MESSAGE ** Venture capital firm Yolo Investments manages in excess of €600m in capital across 80 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive.

Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

Earnings in brief

Genting Singapore: There is more to come from Singapore given that leisure travel to the island state is still limited by flight capacity issues for travel from Asia, according to the operator of Resorts World Sentosa.

Still, revenues for H1 jumped 63% to SG$1.1bn ($815.3m) while adj. EBITDA was up 68% to SG$452m.

The company said the better performance was a result of the rebound in non-gaming business as well as a higher-than-theoretical VIP win rate.

GAN: The prognosis for the company’s B2B operations continues to worsen after it saw a 30% decline in YoY revenues to $9.9m. Putting a positive spin on the figures, CEO Dermot Smurfit noted “continued strength” in international B2C, which saw revenue rise 15% to $23.9m, meaning total revenues were down just over 3% to $33.8m.

Adj, EBITDA came in at a loss of $2m vs. a profit of $1.3m this time last year.

The company said it has received “indications of interest” for all or part of the business, adding that a board committee was evaluating the non-binding offers.

Bragg Gaming: The games provider said its 50% YoY rise in adj. EBITDA to €4.7m was aided by the continued shift to higher-margin products, including in-house proprietary content and exclusive content from third parties. Revenue rose 19% to €24.7m.

The North American push continued as it launched its content with seven operators in the US, Canada and Mexico.

In Europe, meanwhile, Bragg content is now live with 10 operators in five markets.

Acroud: The affiliate provider said it was seeing the benefit from its decision to invest in paid media, with the leading indicator of NDCs hitting a record of 117k while revenues rose 43% to €10.3m. However, adj. EBITDA was down 10% to €1.6m.

CEO Robert Andersson noted that recent acquisitions Voonix and Matching Visions had “outperformed our wildest expectations”.

But he added that this means higher earnouts, hence the recent moves to amortize a bond issue, renegotiate the contingent deals, issue 9% of shares for €13.5m and get a further equity injection of SEK22m (€1.9m).

The company also reorganized its core business and moved it to Serbia.

“This is due to the fact that we haven't been able to create the growth we need in that business,” Andersson said.

** SPONSOR’S MESSAGE **

The geolocation data and device insights you need to fight fraud.

Trusted by the world’s leading platforms and operators for over 10 years.

The OneComply 360° licensing management solution

Industry-leading KYC pass rates of 95%

The gold standard of geolocation for barring sanctioned countries

The most comprehensive global database of devices linked to fraud

Visit geocomply.com.

Newslines

Seven go to post: The seven operators that have applied for a license in Kentucky are DraftKings, FanDuel, BetMGM, bet365, Caesars, Circa and Penn.

Wynn Resorts is redeeming $300m of senior notes, launching a cash offer to noteholders.

NeoGames’ BtoBet subsidiary is making its debut into the North American market under a long-term sportsbook partnership with Alberta Gaming, Liquor & Cannabis to provide an OSB solution for PlayAlberta.ca.

Catena Media has entered into partnership with The Sporting News to strengthen its position in both North and Latin America. The three-year deal will see Catena Media create editorial and advertorial content as the exclusive betting partner of The Sporting News.

Calendar

Aug 14: Playmaker (e)

Aug 15: 888, FansUnite (call), Playmaker (call)

Aug 16: GiG

Aug 17: Rank, Raketech, Gambling.com, Super Group

Loyalty marketing manager – Europe

Development manager – Eastern Europe

Head of VIP – LatAm/North America

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.