Caesars bets on Palace boost

Caesars’ tough comps, IGT headway, Betr pivot, Golden Entertainment and Melco briefs +More

Good morning. On today’s agenda:

Caesars hits a digital milestone but misses in Vegas.

Gaming and digital up but lottery down for IGT.

Betr makes a fantasy sports pivot.

Earnings in brief from Golden, Melco and Bet-at-home.

And you won't see me around the town because I spent last night on a roundabout.

Swings and roundabouts

Caesars’ digital operation posts a profit but Las Vegas misses forecasts.

Palace coup: The launch of the standalone iCasino app Caesars Palace and the recent transition of the Nevada sportsbook to the Liberty platform were among the highlights for a digital operation that posted its first profit since the launch of the rebranded Caesars Sportsbook.

But strong comps in Las Vegas meant that the engine driver for the business sputtered, with earnings missing forecasts.

The Vegas segment was down 1% YoY at $1.28bn and regionals was flat at $1.46bn but digital revenue rose 42% to $216m, meaning total revenue was up 2% to $2.88bn.

Adj. EBITDA rose 3% to $1bn despite a 6.4% fall in Las Vegas adj. EBITDA to $512m. Digital adj. EBITDA was $11m.

No excuses: Noting the June figures for Nevada, CEO Tom Reeg said “I don't particularly like to talk about hold, but it's notable enough that I should in this quarter.”

“We're in the gambling business,” he added. “What we're looking for is the volumes to come through the property. And they came through; we just didn't hold in June, like we did in the past.”

But he noted that F1 in November would be “very, very strong for us” and that forward business for the Super Bowl in February was “dramatically ahead”.

Target practice: Reeg was keen to suggest the debut digital profit was just the start for the business. Noting the widespread skepticism regarding the target of $500m in digital profit by 2025, he said he remained “100% confident” the target would be hit but noted that in the short term it was a “coin flip” as to whether the unit would breakeven in Q3.

He believed that the Caesars Palace offering was “light years beyond” what the company had been working with previously.

“We are fully aware that we have seen significant competition in the iCasino space, we don't expect that we're just going to come in and run everybody over,” he added.

Reeg also warned against expecting a huge uptick in marketing for the iCasino product.

“You should expect us to be visible in terms of promoting the app but nothing anywhere close to what you saw when we launched the sports app,” he said.

Reeg added that the move to the Liberty platform in Nevada also represented a significant tech advance.

Quantum leap: “We were operating on the equivalent of a Commodore 64 computer in the old technology,” he said. “This is a dramatic leap for us in Nevada.”

Free the cash: Noting that Caesars was “not short on cash”, Reeg suggested that domestic M&A might be on the agenda although, in terms of land-based, finding targets was not easy.

Analysts at Wells Fargo noted the strong track record and said Reeg’s comments were a reminder of the company’s preference for accretive M&A over share buybacks.

** SPONSOR’S MESSAGE ** BettingJobs is the global leading recruitment solutions provider to the iGaming, Sports Betting and Lotteries sectors. Boasting a 20-year track record supporting the iGaming industry, and with a team of experts and world class knowledge, it’s no surprise BettingJobs is experiencing rapid growth with outstanding results. Does your company have plans to expand teams to cope with strong growth and demand?

Contact BettingJobs.com today where their dedicated team members will help you find exactly what you are looking for.

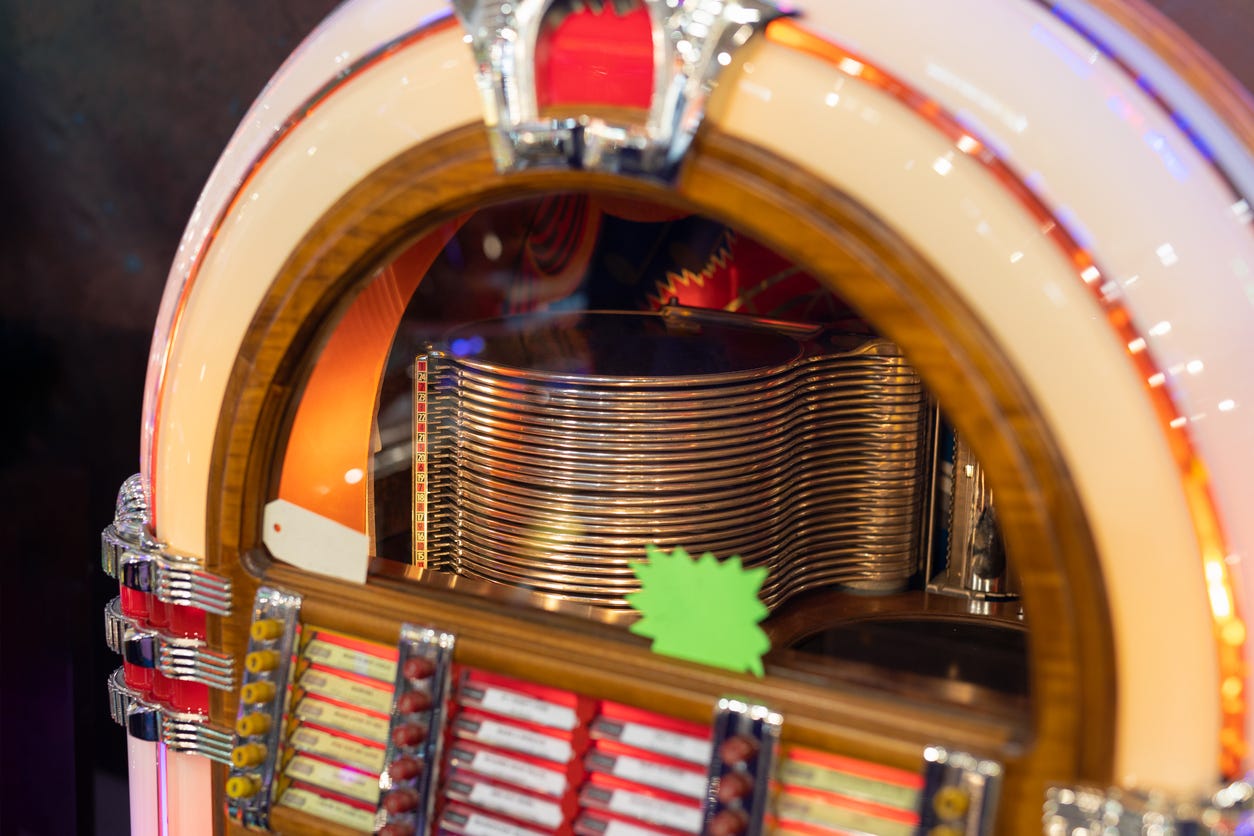

Machine music

Gaming and digital “belong together”, says IGT CEO.

Lock and key: CEO Vince Sadusky stuck to the script on the strategic review of the future of the digital and gaming businesses, saying there was no update to offer but that the goal is to “unlock the full value of IGT's market-leading assets, which we don't believe is accurately reflected in the share price”.

“Gaming and PlayDigital, there’s a lot of synergies and those businesses belong together,” he said.

“In terms of synergies between lottery and gaming, not that many,” he added. “So, I think an easy, fairly easy separation.”

Barometer reading: IGT’s gaming machine and digital units enabled the group to record above-consensus revenues in Q2, Sadusky said, adding that “another strong quarter” showed the strength of the divisions. Revenues rose 3% YoY to $1bn and adj. EBITDA was up 8% to $443m.

Sadusky attributed this to a faster “rebound” in the US and Canada and, despite tougher comps, slot GGR from the Las Vegas Strip was up 4% in June.

“Las Vegas Strip GGR is a great barometer of the health of the industry,” he said. In North America, IGT “shipped more units than the company's ever shipped before”.

Macro conditions were still impacting European and Latin American markets but this is being viewed as a delayed recovery.

“That creates the potential for growth in future quarters internationally.”

IGT’s PlayDigital enjoyed a revenue rise of 38% to $59m.

Lottery blow: Lottery revenues fell 4% to $624m. Last week, IGT saw a legal suit over the awarding of the next UK National Lottery to Allwyn thrown out by the High Court. Sadusky claimed that was a “unique situation”.

He pointed to IGT’s 20-year joint venture with Scientific Games to operate the lottery in Minas Gerais, Brazil’s fourth largest state, as a sign of the growth potential of the segment.

Unico gioco in città: Noting the pullback in Italy, Sadusky said it was “as anticipated given the spectacular results during the COVID period and the closure of the gaming halls, and it really being the only gaming opportunity”.

Betr pivot

Announcing the launch of Betr Picks, the startup makes an all-in-one-pitch.

Pick and mix: Betr CEO Joey levy took to social media to say that Betr’s new Picks product, which will be launched in California, Texas and Florida, will enable the company to “more fully capitalize” on its media brand-driven nationwide audience.

Levy added that consumers will also notice that Betr is “no longer positioned as a micro-betting app only”.

“This is step one towards building a real money gaming super app,” he added.

Stepping into controversy: By entering the fantasy space with a picks offering, Betr is also venturing into somewhat contested and controversial territory. Levy noted the launch of Betr Picks would be the “first time a regulated sportsbook and fantasy product are in the same app”.

“Companies like FanDuel and DraftKings were rushed to get their sportsbooks and online casino products out post-PASPA, meaning their fantasy sports products have lived in separate apps since,” he added.

Earnings in brief

Golden Entertainment: Continued construction disruption in Downtown Las Vegas is the villain once more for the operator of The Strat, which saw its adj. EBITDA drop by 18.5% YoY to $72m. Revenue was off by 1% to $287m.

The company recently completed the sale of Rocky Gap for $260m to Century Casinos and will use the majority of the cash to pay down debt.

The company also resumed its dividend and on the analyst call management didn’t rule out share buybacks.

With leverage of less than 2x, CFO Charles Protell said Golden had “dry powder” to “invest in what we think is the most compelling M&A opportunity out there, which is our own company”.

Melco Resorts: While the return in Macau has “exceeded everybody's expectation”, according to CEO Lawrence Ho, it has been driven by mass premium play rather than a grind-level of mass play. When that returns he believes it will lead to “incremental growth”.

Total operating revenues for Q223 were $978m, a YoY increase of 220%. Adj. property EBITDA hit $267m, up from a mere $13.8m in Q222.

Bet-at-home: GGR for H1 was down 9% to €24m, which the company blamed on adverse regulatory developments in Germany as well as weaker-than-expected online gaming results. It reiterated full-year guidance for an EBITDA loss in the range of €1m-€3m on GGR of €50m-€60m.

** SPONSOR’S MESSAGE **

Underdog: the most innovative company in sports gaming.

At Underdog we use our own tech stack to create the industry’s most popular games, designing products specifically for the American sports fan. Join us as we build the future of sports gaming.

Visit https://underdogfantasy.com/careers

Analyst takes

Boyd Gaming: The benefits of having multiple strings to its bow – specifically, its online operations and the Sky River contract in California – means Boyd gets the benefit of the doubt, even with signs of weakness in its regional gaming portfolio.

These other growth drivers “will help offset potential consumer pressure”, suggested Macquarie.

Still, as Deutsche Bank noted, the “lighter than expected” Vegas earnings “are likely to curb excitement”.

Datalines

Macau saw GGR grow by nearly 10% MoM in July to $2.1bn, the highest monthly performance since Jan20. The YTD figure of $12bn was 263% up on the same period last year.

Newslines

I’m a believer: 888’s new CEO Per Widerström has snapped up nearly 1m shares in the company.

Clarion has announced that ICE 2025 will be moving to Barcelona. The last London ICE will take place next February.

Horseracing will resume at Churchill Downs Racetrack on September 14 after experts found no issues with the racing surfaces.

NeoGames is to significantly expand its European reach after coming to an agreement with the Lotteries Entertainment Innovation Alliance, which represents lotteries in Scandinavia and France.

Bragg Gaming launched its proprietary online gaming content and remote games server with Flutter’s FanDuel in Michigan and Connecticut.

** SPONSOR’S MESSAGE **

What would you do with $100k in cash? Are you game…?

Calendar

Aug 2: MGM Resorts, Rush Street

Aug 3: Bally’s, Red Rock, DraftKings (e), Accel, AGS

Aug 4: DraftKings (c)

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.