Has BetMGM stalled?

888’s appointment, Kindred’s return, BetMGM market share examined, Women’s World Cup offerings weighed up +More

Good morning. On the agenda for this month’s data special:

First up, ahead of BetMGM’s half-year update tomorrow we take a look at where it stands in OSB and iCasino market share, and ask, as per recent analyst comment, whether its progress has stalled?

Next, we turn to the Women’s World Cup and the latest analysis from our friends at Propus Partners. Looking at the offerings from 50 major operators globally, the team finds the product offers largely in the same ballpark as the men’s version of the tournament. But in terms of promotion, they believe it is a missed opportunity.

Then we turn to the latest data from Ontario and analysis from Regulus, which shows how the market has outperformed their own expectations in comparison with the performance of the previously gray market.

But first, there is CEO news from 888 and an earnings release from Kindred…

Breaking: 888 appointment

888 has finally secured a new CEO after it announced the appointment of former Expekt and Fortuna Entertainment boss Per Widerström. He will start with the company in October. Upon Widerström joining, Lord Mendelsohn will return to the role of non-executive chair.

The appointment brings to an end a prolonged period of uncertainty for 888, which lost its previous CEO Itai Pazner due to a VIP-related compliance scandal.

888 recently called a halt to talks with investor group FS Gaming, which had hoped to install former Entain CEO Kenny Alexander in the top job.

That attempt came to a shuddering halt when 888 said the UK Gambling Commission had put the company under a licensing review due to worries over Alexander’s links to an HMRC bribery investigation into his former company’s activities in Turkey.

Kindred’s Dutch claim

Kindred proclaims itself number one once more in the Netherlands.

Back where we belong: Citing current trading data and Google search trends, interim CEO NIls Andén said Kindred’s Unibet brand had returned to the top of the tree in the Netherlands following its admittance to the regulated market in June last year.

“The Netherlands is a really pleasant topic,” he told analysts during the company’s Q2 earnings call, adding that “the Netherlands is the most important market”.

He noted that trading was now at 83% of where Kindred was in the Netherlands before it had to exit the gray market when the regulated version launched in Oct21.

But CFO Patrick Kortman said it would be “challenging” to get back to previous profitability levels given the extra tax and compliance burdens.

Puts and takes: The Netherlands helped boost Kindred’s Q2 revenues by 29% to £307m, while underlying EBITDA more than doubled to £56m. It reiterated its guidance for underlying EBITDA of £200m in 2023.

The company said the challenges in Norway and Belgium from Q1 continued into Q2. Excluding both countries, GGR would have been up 41%.

However, current trading was down 1% despite gross win margins coming in at 11.6%, way ahead of the 9.9% from Q322.

Propped up: In the US, the business continued to bump along the bottom with gross win of £8.4m (up 17% YoY) as Kindred continued to trim its losses, with EBITDA coming in at a negative £5.1m vs. £7.4m last year and £5.5m in Q1.

The company hopes the launch of its news proprietary platform in New Jersey and Pennsylvania will help turnaround the business.

Andén said the company had seen “significant improvements” in retention and conversion numbers since relaunch.

Exploring every avenue: Asked about the ongoing strategic review, Andén noted it was proceeding according to plan. We have said we are not making any near-term changes to the business as we are in the middle of the strategic review. But we are turning over every stone in the business.

“There are no near-term changes to the strategy,” he added.

“We have a good focus for the business, keeping costs under control and concentrating on taking market share in key markets.”

Momentum swing?

Ahead of BetMGM’s half-year update, we take a look at where the company is headed.

Stalling mid-flight: Recent commentary has suggested that, particularly in OSB, BetMGM has either lost momentum or headed into reverse in recent months. The team at JMP said it is running a weakened third in the race with FanDuel and DraftKings due to a poorer product offering.

Jefferies, meanwhile, said one of the most active areas of discussion with investors at present is the recent “deceleration” in performance.

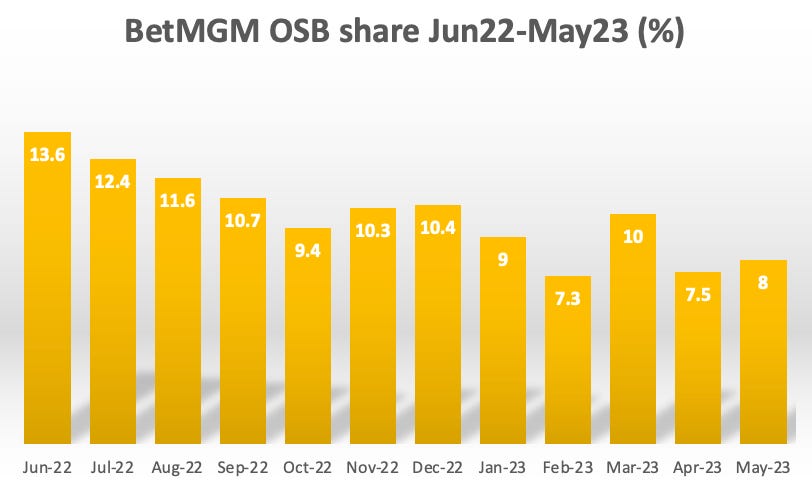

Free fallin’: In OSB, it is clear that BetMGM has lost ground in the past year. According to data provided by Truist in its May interactive monitor, in the last 12 months its market share dropped from above 13% to 8%.

👀 BetMGM hits the slopes

Shipping share: The iCasino evidence is only slightly better for BetMGM given it has more readily established sizable shares across the main states. Yet, these positions remain under threat.

The June data from Pennsylvania, for instance, shows that, according to Wells Fargo, BetMGM controlled an estimated 19% share of the market.

But this is down from an estimated 23% in January and 22.5% in Jun22.

In New Jersey, the latest data for June shows BetMGM on 26% share vs. 27% in January. But in June last year it was at 31%.

In Michigan in May (the latest data available), BetMGM’s market share was 32% vs. 34% in January and nearly 39% in June last year.

As was noted by the analysts at Wells Fargo, BetMGM has recently bucked the trend on promotional spend in markets such as Michigan, Pennsylvania and Maryland. Against its competitors, BetMGM has been slashing promo spend by up to 40% in these key states.

In comparison, both FanDuel and DraftKings upped their respective promo spends in the same three states.

Diary date: BetMGM will update tomorrow morning (ET) and E+M will report on the call in an afternoon edition.

** SPONSOR’S MESSAGE ** BettingJobs is the global leading recruitment solutions provider to the iGaming, Sports Betting and Lotteries sectors. Boasting a 20-year track record supporting the iGaming industry, and with a team of experts and world class knowledge, it’s no surprise BettingJobs is experiencing rapid growth with outstanding results. Does your company have plans to expand teams to cope with strong growth and demand?

Contact BettingJobs.com today where their dedicated team members will help you find exactly what you are looking for.

Women’s World Cup

With data and analysis provided by Propus Partners, Earnings+More takes a look at how betting operators are covering the tournament.

I’m every woman: The ninth edition of the FIFA Women’s World Cup is likely to be the largest in terms of betting interest, despite inconvenient kick-off times for most regulated betting audiences (the tournament is being jointly hosted by Australia and New Zealand).

Propus used a sample of 50 major operators from Europe, North America, South America, Africa, and Oceania, collecting data a day before the start of the tournament on July 20.

Product comparison

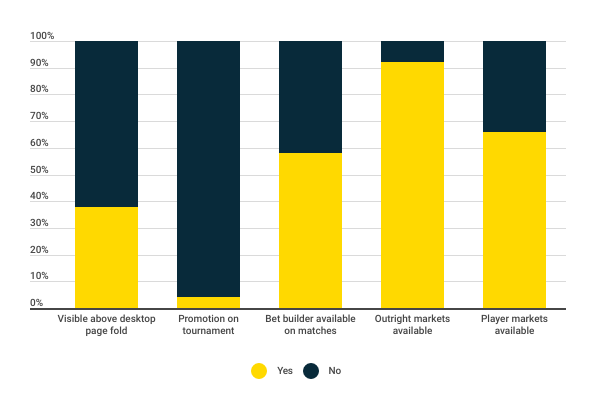

Five factors: Propus looked at whether the tournament was visible through links or banners in a prominent position on site; whether there were any promotional offers for the tournament; whether bet builders (SGPs) were available; whether tournament outright markets were offered; and whether player markets were offered.

All 50 offered betting on the matches, while 46 of the 50 had tournament outright markets.

Two-thirds of the sample offered individual player markets.

The most outright markets offered (group winners, stages of elimination, top team goalscorers etc.) was 70, with an average across the sample of 21.

The most match markets offered was 288, with an average of 122 and a minimum of three.

… vs. the Men’s World Cup

The Propus team pointed out they do not have the precise comparison data, but they believed that market coverage, both tournament outright and match markets, is slightly behind the men's competition. But it is, crucially, in the same ballpark.

This is largely driven by pricing models producing common market sets.

The availability of player markets is not quite as widespread as the men's competition, but Propus suspected that it is considerably higher than the 2019 women's tournament, which mirrors wider market trends.

Overrounds applied are slightly higher than the men's tournament; however, the levels are generally competitive and in line with tier 1 domestic leagues.

Propus did not see any super-aggressive operators competing with next to no margin.

Promotion: While the product coverage is similar to that of the men's, the prominence and promotion of the tournament is nowhere near close to parity.

Well under half of the sample made the competition easily visible on their site, with the majority not having any links or banners above the desktop page fold of the sports homepage.

And only two of the 50 had specific promotions advertised for the tournament. Many opted to promote The Open golf instead.

Missed opportunity: With the ever-growing popularity of the women's game across the world, increased media interest and a relative lull in the wider sporting calendar, Propus considered the lack of promotion of the Women's World Cup to be a missed opportunity, especially given the product that has been created is generally relatively strong.

** SPONSOR’S MESSAGE **

What would you do with $100k in cash? Are you game…?

Ontario analysis

Adding some color to the recent figures from iGaming Ontario, the team at Regulus suggest a run-rate that far exceeds the GGR figure for the previously gray market.

Act your age: The figures from iGO showed GGR in the three months Apr-Jun coming in at C$545m on handle that hit C$14bn. As Regulus noted, it was the QoQ comparison that is most relevant, showing 3.5% growth and hinting the market was already “approaching maturity”.

“Channel checks” suggested that some level of incentives are present, the team added, but the numbers still point to an annualized run-rate of ~C$2bn.

Adding in Ontario Lottery’s ~C$450m and a further ~C$50m of horseracing GGR, and the annualized run-rate comes in at ~C$2.5bn.

This compares with Regulus’ own estimates for the pre-regulated gray market of ~C$1.1bn in the 12 months ahead of the regulated launch.

Getting what you paid for: This near doubling of the ‘commercial’ market comes, the Regulus team contended, because of the clear benefits of operating within a regulated market: the ability to market, the consumer choice on offer and the product quality.

The commercial market is spending three to four times what was spent during the gray years and this has “engaged a mass market”.

Add in more brands – such as FanDuel and theScore – and the extended choice has “helped drive faster adoption” as well as drive “visible quality” in the localized betting options.

It means Ontario’s per capita online gambling spend figure of $130 is only slightly shy of Pennsylvania’s “bellwether” number of $150. Hitting such numbers so early, though, means, as Regulus suggested, they would be “surprised” if strong double-digit growth continues from here on in.

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.