OSB dominance comes in threes

Big states May data examined, Bally’s Rhode island opportunity, Better Collective’s impressive 2023 shares performance +More

Good morning. On the Weekender agenda:

Big three’s market share dominance continues in NJ, PA and MI.

The DraftKings/FanDuel flip flop in New York persists.

Bally’s opportunity in Rhode Island analyzed.

Better Collective’s shares enjoy a stellar 2023.

Sector watch focuses on Plus500’s Odey stake buyback.

Jobsboard by BettingJobs includes senior compliance manager and creative director roles.

In threes

Heading into the quieter summer months, the big three in the three biggest OSB and iCasino states continue to dominate.

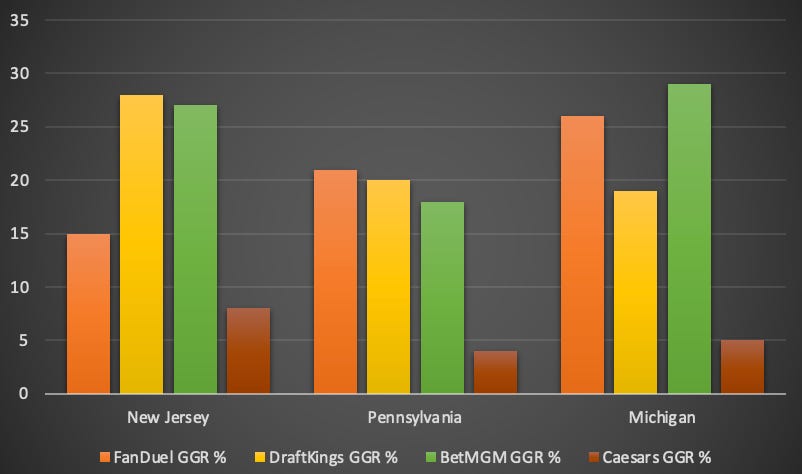

The rest are nowhere: FanDuel, DraftKings and BetMGM continued to dominate in OSB in New Jersey, Pennsylvania and Michigan in May, with joint market shares of between 81% and 90%.

Such is the big three’s dominance in these states that challengers are avoiding them in favor of attempting to stake out ground elsewhere.

Analysts at EKG have noted how bet365 is focusing on Colorado, Virginia and, in particular, Ohio for its belated US push. In the latter state it has garnered ~7% GGR market share since launch.

🥧 The big three’s 84% average OSB GGR share in NJ, PA and MI

Hope springs eternal: More optimistically for the competition, the iCasino markets in these states continued to show a more wide open field of play in May. The average iCasino market share for FanDuel, DraftKings and BetMGM combined was 67%; in Pennsylvania the market share left on the table was 41%.

Add in Caesars, however, and the average market share moves up to 73%; with New Jersey at 78% and Michigan at 79%.

🔪 What a carve up: iCasino shares for the top four in NJ, PA and MI

Big Apple flip flop

New York minute: The latest weekly data from New York shows the flip flop at the top of the market was no fluke as DraftKings maintained its lead by GGR for the second week in a row.

In the week to Jun 18, DraftKings generated GGR of $12.4m off handle of $117m vs. FanDuel’s $11.8m and $102m respectively.

In the previous week, DraftKings knocked FanDuel off top spot for the first time with GGR of $12.3m vs. FanDuel’s $9.1m.

Great leap forward: A further fillip for DraftKings comes from Wells Fargo, which said DraftKings is “on the precipice of a major EBITDA inflection”.

The analysts’ confidence stemmed from “analyzing cohort economics and higher hold/lower promo flow-through”.

The team estimated DraftKings’ net revenue can grow double digits “just from higher hold/lower promos”.

On the Rhode

Bally good news: A fillip for US iCasino hopes comes via the passing of legislation in Rhode Island. However, the good news is confined to two companies, Bally’s and IGT, which would be the sole operator and supplier respectively.

The market is set to open in March next year with the bill’s proponents suggesting the market will be worth $130m in GGR at maturity.

JMP estimates it could be marginally higher at $135m, while the team at Wells Fargo estimated Bally’s could generate ~$35m-$40m in revenues from the state.

JMP noted there are limitations to what can be offered by live dealer with only table games allowed and no roulette.

Bally’s could do with the boost following the (temporary) shuttering of its OSB offering Bally Bet this week as it prepares to relaunch on the Kambi platform.

“For a levered, regional-centric operator… and incremental $15m-$20m of free cash flow is meaningful and a much-welcomed positive,” the analysts added.

** SPONSOR’S MESSAGE ** Existing sports-betting technology and services can be built better for operators. At Metric we’re changing the game by doing things differently, so our customers can too. Inspired to solve the problems and surpass the limitations of existing systems, we’ve employed modern technology and processes to build a ground-breaking sportsbook solution that can handle the needs of any modern operator – whatever they are.

Contact us to find out more.

Email: info@metricgaming.com

Web: www.metricgaming.com

ICYMI

Compliance+More on Thursday led with the shock news that the co-founder of 1xBet, Sergey Karshkov, is reported to have died this week in a hospital in Switzerland.

Also this week, C+M had a review of the recent legislative season in the US, which turned out to be better than expected.

Plus, on Tuesday C+M reported on the news of the planned ending of the gaming monopoly in Finland.

Speaking of which, on The Gambling Files this week, Jon and Fintan spoke to Finnish legal expert Antti Koivula.

Los Ingresos y Mas this week focused on the gaming market in Chile and took a look at how the lottery and casino sectors are recovering post-pandemic and how new regulations for online could be in the works this year.

+More Media added the Esprouts newsletter to its roster this week. The latest edition focused on Félix “xQc” Lengyel and his deal with new streaming service Kick.

Macau upgrade

Visa restrictions for visitors to Macau are seen as the key to summer growth.

Precautionary principle: A government tightening of restrictions for visitors from the mainland during the latest wave of Covid infections accounts for the recent disappointment in trading in May, according to the analysts at Roth MKM.

The team noted that Wynn, MGM, Galaxy and Melco all cited mass GGR last month as either reaching or exceeding the same period in 2019.

Contrastingly, during a recent analyst meeting, LVS CEO Rob Goldstein said it had seen headwinds.

In terms of visa data, the biggest hit was in non-Guangdong visitation, which was down 10% MoM in May, whereas visitors from Guangdong were up 4%.

LVS is more reliant on non-Guangdong visitors. “With LVS leading Macau's market share, these temporary disruptions were enough to drag down the entire market,” the team added.

Roth went on to say that industry checks suggested a reacceleration in June, with daily GGR trending +5% MoM and 15% above May's exit rate.

The shares week

Better Collective: The betting and gaming affiliate giant has upgraded its financial targets for the year as revenues from the Americas came in at about expectations in Q2.

FY23 revenues are now expected at €315m-€325m, a 3% increase at midpoint and representing 17-21% YoY growth.

Adj. EBITDA is now expected at €105m-€115m, up 10% at midpoint.

The shares rose ~5% on Wednesday only to fall back again later in the week.

Yet, the movement hasn’t dented BC’s impressive performance this year, with the shares just shy of a 70% YTD uplift.

Crossing paths: Better Collective’s performance contrasts with that of rival Catena Media where, of course, it owns an ~5% stake and which has seen its shares give up all its early year gains.

🍆vs 🤮 Better Collective shareholders enjoying 2023; Catena’s not so much

Sector watch – financial trading

Odious: The London-listed CFD and spread-betting provider Plus500 found itself having to buy its own shares in the wake of the scandal affecting the now-disgraced Crispin Odey and his eponymous asset management firm.

Plus500 bought back $101m worth of its own shares, representing Odey Asset Management's entire holding in the business.

"Given the significant strength of the company’s balance sheet and the prevailing circumstances, the board believes the purchase is in the best interest of all shareholders,” the company said.

It added that it had “acted quickly to execute this opportunity to acquire shares at an attractive price, in line with the company’s capital allocation and shareholder return policy”.

Crud: The most recent trading news in the sector came with the early June earnings from CMC Markets, which showed revenues up 2% to £282m but pre-tax profits nearly halving to $52m.

Founder and still CEO Peter Cruddas put a brave face on the profit drop saying the company had “made progress” with its diversification strategy.

This includes the recent launch of the CMC Invest UK offering and receiving regulatory approval for the imminent launch of CMC Invest Singapore.

** SPONSOR’S MESSAGE ** Inside the Pocket is the acquisition, retention, and conversion platform for ANY brand looking to use gaming as its hook.

With 20+ partners, we aggregate content across the P2P and F2P universe, serving up dynamic, tailored gaming experiences in any language for any sport or event. With an easy integration (under three weeks, typically), best-in-class data provision, and AML/KYC capabilities coming soon, we are the fail-safe partner for free-to-play and pay-to-play acquisition.

Visit insidethepocket.biz or connect with CEO Hussain Naqi to learn more.

Career Paths

Kindred has promoted Patrick Kortman to be interim CFO. Kortman has been with Kindred since 2018. The company also named Usha Ganesan as interim chief finance operations officer and Neil Banbury as interim chief commercial and marketing officer.

Ex-Sightline and AGA executive Jonathan Michaels has launched a strategic consultancy focusing on the gaming sector. His first clients include Sightline and cloud-based information systems provider Axes.ai.

Newslines

Playtech has priced €300m of senior secured notes due in 2028. The proceeds will be used to redeem all of the outstanding €200m senior secured notes due this year, pay accrued interest and to repay outstanding debt under the revolving credit facility.

Casual gaming provider Skillz has approved a one-for-20 reverse stock split to return the company to compliance with the New York Stock Exchange.

Getting Messi: Everi’s Venuetize platform will serve as the foundation for MLS soccer club Inter Miami’s mobile app.

What we’re reading

Mythbusting: Dustin Gouker points out that it would be hard to say that there is any state where online gambling is effectively banned.

** SPONSOR’S MESSAGE ** Venture capital firm Yolo Investments manages in excess of €600m in capital across 80 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive.

Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

Calendar

Jun 30: PointsBet EGM

Senior Compliance Manager – North America

Social Media and Creative Director – Remote

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.