FanDuel’s iCasino headway

FanDuel’s iCasino market shares examined, Sweden and Spain’s per capita difference explained, Portugal FY data +More

Good morning and welcome to edition #2 of the Data Month.

For this edition, we take a look at FanDuel’s position with regard to iCasino and how it appears to be gaining ground percentage point by percentage point in the three main states that matter.

Next up, we examine what Regulus said in the past month about the comparisons between Sweden and Spain – markets that appear to be similar in terms of GGR outcome but which display very different metrics when it comes to per capita spending.

Finally, we review the latest data from Portugal, one of Europe’s smaller online markets to date but no less interesting for that.

FanDuel’s iCasino advance

The operator is making good on its promise to bolster its iCasino market share.

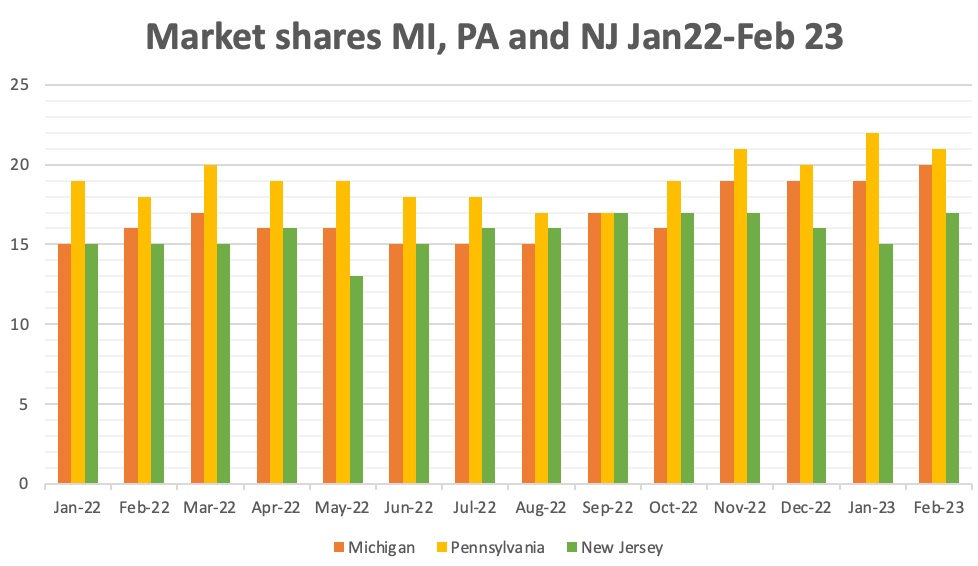

Building blocks: In two of the big three iCasino states, FanDuel’s market share has been creeping up in 2023 as the company attempts to ensure its sports-betting dominance translates to a greater degree in the more immediately profitable iCasino segment.

In Michigan, FanDuel’s iCasino GGR market share rose to 20% in Feb and 19% in January compared to a 2022 average of 16%.

In Pennsylvania, FanDuel’s iCasino GGR market share stood at 21% in February after hitting 22% in January. This compares with an average of 19% in 2022.

In New Jersey, meanwhile, Wells Fargo estimated FanDuel’s market share for January and February was static at 15% and 17% respectively.

🍒 FanDuel’s iCasino market share month-by-month Jan22-Feb23

Pooling the market shares together, it can be seen that FanDuel’s average monthly market share across those three states stood at 16% in January 2022 and 19% by February 2023.

♠️ FanDuel’s average iCasino market share across MI, PA & NJ

When the smaller markets of Connecticut and West Virginia are taken into account, FanDuel’s percentage as of January this year stood at 18.5% vs. 15.6% in Jan22.

** SPONSOR’S MESSAGE ** Founded in 2013, Metric Gaming is based in Las Vegas and London and developed the industry’s first truly multi-tenant sportsbook platform, purpose-built to support operators across multiple territories, regions or States. Metric is proud to be partnered with both Racebook HQ and Lacerta Sports (powered by Starlizard) and will roll out innovative MTS solutions for both racing and sports in 2023, including soccer and four main US sports.

To find out more, please visit www.metricgaming.com

Goal setting

This is Howe we do it: During the FanDuel investor event last November, CEO Amy Howe was keen to stress the company was not where it wanted to be with iCasino but that it was “on a very solid path to change that”.

She added that the company’s iCasino positioning up to that point was down to cross-sell from its successes in sports betting.

But the strategy going forward was to focus more on direct iCasino customers, which the accompanying presentation suggested had a higher average age (40 years-old vs 16 for sports betting) and a greater degree of gender balance.

These customers also prefer slots vs. the more table-game-biased sports-betting-first customers.

Howe said this was where FanDuel had “focused a lot of its energy”, bringing in more product, with the app featuring 49% more games in Nov22 vs. Jan22, including an estimated 90% of the EKG top-25 games in 2023 vs. <50% in Q122.

The results, she said, were already evident, with iCasino direct activations up 55% YoY in Q322. That included the opening of Connecticut, but it still meant that like-for-like direct activations were up 33%.

Meanwhile, new branding will build on what FanDuel sees as an existing propensity to use the iCasino offering.

🍒 YouGov brand tracker survey (from FanDuel presentation)

After the FOX

Fragmented: Howe agreed with one analyst questionnaire about the potential for iCasino to deliver greater market fragmentation vs. more settled sports betting. But she noted that within the Flutter operation there were other brands with which to attempt to grab further market share, with PokerStars being the most obvious.

That currently sits under the banner of the FOX Bet brand, which, It should also be noted, controls small but meaningful market share, with around 4% in Pennsylvania in Feb23, 4% in New Jersey and 2% in Michigan.

The bottom line: The core message from FanDuel and parent Flutter is that the US/North American business will deliver EBITDA profitability this year. To be clear, that doesn’t appear to depend on delivering further iCasino market share gains; but every basis point will certainly help increase the quantum of profits.

What we’re writing

Compliance+More: The UKGC hits William Hill with a record £19.2m fine, plus UK White Paper rumors, North Carolina’s big OSB push +More.

Sweden and Spain comparison

The two countries achieved similar online GGRs in 2022, but there is a wide disparity between the per capita spend.

Same but different: With similar licensing systems, similar levels of competitors, few product restrictions and attractive GGR-based tax rates, Spain and Sweden have similar inputs, but the outcome from each in terms of average spend per head of population is initially perplexing.

In 2022 the Swedish online market was worth SEK17.1bn (~€1.5bn), while Spain recorded online GGR revenue of €953m.

Yet, as the analysts at Regulus pointed out, the per capita calculation shows a wide disparity: €119 in Sweden vs. a “measly” €21 in Spain.

There is a clear difference between the two countries in terms of economic prosperity, but the team at Regulus don’t believe that explains more than 5ppts of the disparity. Then there is connectivity; Spain has a lower quality cell network, but this also doesn’t account for much more than 20ppts difference.

Give me two good reasons: Two more reasons have been identified. One is the use of cash – Spain clings to its notes and coins, with POS cash transactions at 70%, while Sweden is much further down the road to cashless at 10%.

The other is the existence of horseracing as a popular betting product. “Sweden has a secret weapon when it comes to betting: high quality – from a betting perspective – domestic horseracing,” Regulus pointed out.

The analysts showed that Sweden’s digital betting revenue per capita of €58 is 51% horseracing, leaving only €29 on other sports betting.

In comparison, Spain’s domestic horseracing product is “negligible”, generating only €4m of online betting revenue, meaning 99% of Spain’s betting revenue is sports betting.

How the land lies: Turning to gaming, Regulus noted that the same per capita gap cannot be explained away with horseracing, but a look at the whole market figures provides an answer. Again, Regulus identified a sizable disparity with Swedish per capita iCasino spend at €62 versus Spain’s much more modest €13, or an 80% gap.

But the answer to the conundrum lies in land-based, and in particular the Spanish propensity to play gaming machines.

The Spanish gaming machine market was worth €2.5bn in 2022 whereas the Swedish VLT market is miniscule in comparison at ~€50m.

Party this is down to availability: Spain has a slot machine for every 260 people vs. for every 2,260 in Sweden.

But also it is down to the declining use of cash in Sweden, which, Regulus proposed, mirrors the decline in land-based gaming from ~€850m in 2010 to <€200m in 2022.

Portugal FY data

Online revenue continues to grow, albeit it at a slower rate.

Port of call: The Portuguese online market saw the pace of growth slow in 2022 to 29% compared with the 50%-plus increases in the previous two years, as total GGR came in at €655m. Since inception in 2017, the market has grown more than fourfold from €122m.

🚀 Portugal’s online market 2017-2022

iCasino was worth €360m in 2022 or 55% of the total, with sports betting worth the remaining 45% or €295.

Within the iCasino segment, slots accounted for 80% of GGR, with roulette worth 9%, blackjack 6% and poker and craps 3% each.

Names in the frame: This GGR was shared between 26 operators and, while we do not know the market shares, familiar names include Bwin, 888 and Betway, alongside domestic hero brands Casino Solverde, Casino Portugal, Placard.pt and the Luckia brand from neighboring Spain.

** SPONSOR’S MESSAGE** BettingJobs is the global leading recruitment solutions provider to the iGaming, Sports Betting and Lotteries sectors. Boasting a 20-year track record supporting the iGaming industry, and with a team of experts and world class knowledge, it’s no surprise BettingJobs is experiencing rapid growth with outstanding results. Does your company have plans to expand teams to cope with strong growth and demand?

Contact BettingJobs.com today where their dedicated team members will help you find exactly what you are looking for.

Data points

Pennsylvania: Promo spend data shows the cost of keeping up with the market leader.

Horses for courses

Who rocks the Festival? OpenBet, the backend provider for many of the UK’s leading sports-betting offerings, said it saw a 22% rise in activity compared to last year’s Cheltenham Festival, with more than 65m bets processed.

Flutter alone said it took £250m in stakes during the week of the Festival across 37m bets.

Checkd Media, meanwhile, said it generated over 1m impressions and 57,390 branded views for its ITV7 video campaign during Cheltenham.

Calendar

Mar 30: XLMedia, FansUnite, GAN

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.