Caesars’ $6m question

Caesars’ promotional spend analyzed, Ohio debut apps tested, gaming REITS review, startup focus – Splash Tech +More

Good morning. Welcome to Monday. On the agenda today:

Caesars’ revenues masked huge promotional incentives, says analyst.

Vacant lot: Betr offering gets minus scores from EKG testers.

The gaming REITs look on the bright side.

Startup focus is free-to-play and pay-to-play games developer Splash Tech.

Caesars’ ‘actual’ online revenues

Caesars’ 2022 digital revenues were a mere $6m after incentives, suggests the team at Regulus.

Small print: Looking into Caesars’ 10-K released last Wednesday, the team at Regulus estimated that Caesars’ digital revenues in 2022 fell from $548m to $6m after taking into account $542m of “promotional and complimentary incentives related to sports betting, iGaming and poker”.

Much of the damage came in Q1 last year in New York when incentives hit $373m.

But even when those excesses are stripped out, Regulus estimated that underlying digital revenues stood at ~$300m.

The business “does not seem to be making any material amount of revenue outside its legacy heartland of Nevada,” the analysts added.

New York remains Caesars’ largest state outside Nevada, generating $46m of GGR in Q4, according to NYSGC figures.

Meanwhile, total sports-betting GGR in Nevada in 2022 hit $447m, of which E+M estimates Caesars was worth ~40%-50% or ~$180m-$224m.

Regulus noted that Caesars’ Nevada market share is “protected” by its Strip presence and a retail presence via the old William Hill assets and it “does not need to conquer market share with free money”.

Caesars reported last week, with CEO Tom Reeg saying the digital business would register a “modest loss” in Q1 this year. This was after Q4 registered a $35m net loss against revenues of $237m.

No detail was given on the quarterly promotional incentive spend but, on the call, digital chief Eric Hession said the promotional spend in Q4 declined 43%.

Asked about the target contribution margin, Reeg said Caesars has a “long history of performing well on a margin basis”.

** SPONSOR’S MESSAGE ** Founded in 2013, Metric Gaming is based in Las Vegas and London and developed the industry’s first truly multi-tenant sportsbook platform, purpose-built to support operators across multiple territories, regions or States. Metric is proud to be partnered with both Racebook HQ and Lacerta Sports (powered by Starlizard) and will roll out innovative MTS solutions for both racing and sports in 2023, including soccer and four main US sports.

To find out more, please visit www.metricgaming.com

Ohio app debuts

We’re so pretty: Having conducted some in-state testing of new US market entrant Betr in Ohio, the team at EKG suggested that, while the app has a solid UX, the actual betting offer is “vacant”.

EKG noted that Betr’s stated goal is to disrupt legacy betting operators with a micro-betting-only offer.

But the testers found, without game outcomes to bet on, a “barren feature set” and a smaller list of sports to bet on than other apps.

“Without more to do on Betr, the app will likely struggle against a field that has deeper markets and more betting variety,” the team added.

Two more new entrants – MVGbet and betJACK – also disappointed the testers.

The latter, which runs on a fully outsourced tech stack from Shape Games, Omega Systems and Kambi, “occasionally crashes and freezes”, has a shallow SGP tool and requires an “excessive number of clicks to complete bets as compared to the field”.

Earnings in brief

Smarkets: The London-based betting exchange and sportsbook challenger has released its earnings for 2021 via the UK’s Companies House, showing revenues that rose 20% to £20.3m but that pre-tax losses climbed to £17m. During 2021, Smarkets also raised a Series B funding round led by Susquehanna Growth Equity.

The most recent news from the company involved 17 lay-offs as the company looked to trim costs. As of the end of 2021, the report said it had 130 staff.

Betmakers Technology: Shares recovered some ground today, up over 10%, after the company said H1 revenues rose 7.5% to A$47m, while net losses rose 28% to A$20m after a “significant investment” in its NextGen platform.

Recall, Betmakers is part of the consortium, along with the Australian Betr, to buy PointsBet’s Australia operations.

Analyst takes

Las Vegas: Having met with management teams, analysts at Wells Fargo said operators were “highly upbeat” on the F1 Grand Prix in November, suggesting Wynn Resorts is “extremely well-positioned”. Meanwhile, they noted that MGM Resorts has snaffled most of the teams, who will be staying across its properties.

REIT review

The gaming REIT market couldn’t be more buoyant, say VICI and GLP.

Standout: VICI CEO Ed Pitoniak noted that, on the company’s five-year anniversary since IPOing, ~40% of the gaming space was now “REITed” compared to around 70% of mall space. “We’re very eager to do more business in all the ways we can possibly think of,” he said.

John Payne, COO, noted VICI’s “bullish bet” on the deal to buy the Venetian, negotiated in late 2021 when the Las Vegas recovery “was uncertain”.

“Consumers did not find a replacement for the experience offered by the Las Vegas market, nor do we believe they ever will,” he added.

“Is there a city performing better?” he added.

The Venetian deal was followed by the acquisition of MGM Growth Properties and, in January, the company closed on the buyout of Blackstone’s interest in the MGM Grand and Mandalay Bay and also bought four properties in Canada.

But Pitoniak did caution over the lack of visibility in the year ahead. “Credit conditions have tightened,” he added.

Yet, as analysts at CBRE suggested, a downturn could lead to further deals with tenants looking for “alternative sources of capital”. At Gaming & Leisure Properties, Steven Ladany, chief development officer, said he believed there was less of a disconnect between buyers and sellers this year compared to early last year and that everyone was looking through the “same lens”.

“I feel like things are probably a little more achievable at this point than they were at the beginning of last year,” he added.

Fit for purpose: CIO Matthew Demchyk said GLP’s business model was “built with (economic) environments like this in mind”. Asked about recent financings, including both debt and equity raises, CEO Peter Carlino said “we walk a tightrope”. “You raise money when you can and as favorably as you can.”

“We’ve got a seat at the table for opportunities,” Demchyk added. “We’re poised to pounce.”

Ladany noted, however, that gaming REITS as an asset class was “starting to get noticed”.

“We’re seeing increased competition,” he added, citing Realty Income Corporation’s deal with Wynn for the Encore Boston Harbor.

Carlino also repeated that GLP would look outside gaming.

“I would take a shack on the beach with no windows and doors if it had demonstrably stable cash flow,” he said.

Analyst take: Deutsche Bank suggested the stability of the cash flows, predominantly fixed-rate debt stacks, and opportunistic acquisition opportunities made both GLP and VICI “relative safe havens in a cloudy macro-economic environment”.

It’s a big week for…

Gaming machine suppliers: IGT and Endeavor report on Tuesday with Everi and Light & Wonder following up the day after.

A recent note from Roth MKM analysts pointed out that “constructive outlooks” from operators should bode well for the suppliers, with the underlying trends seeing them press ahead with development plans and property reinvestments.

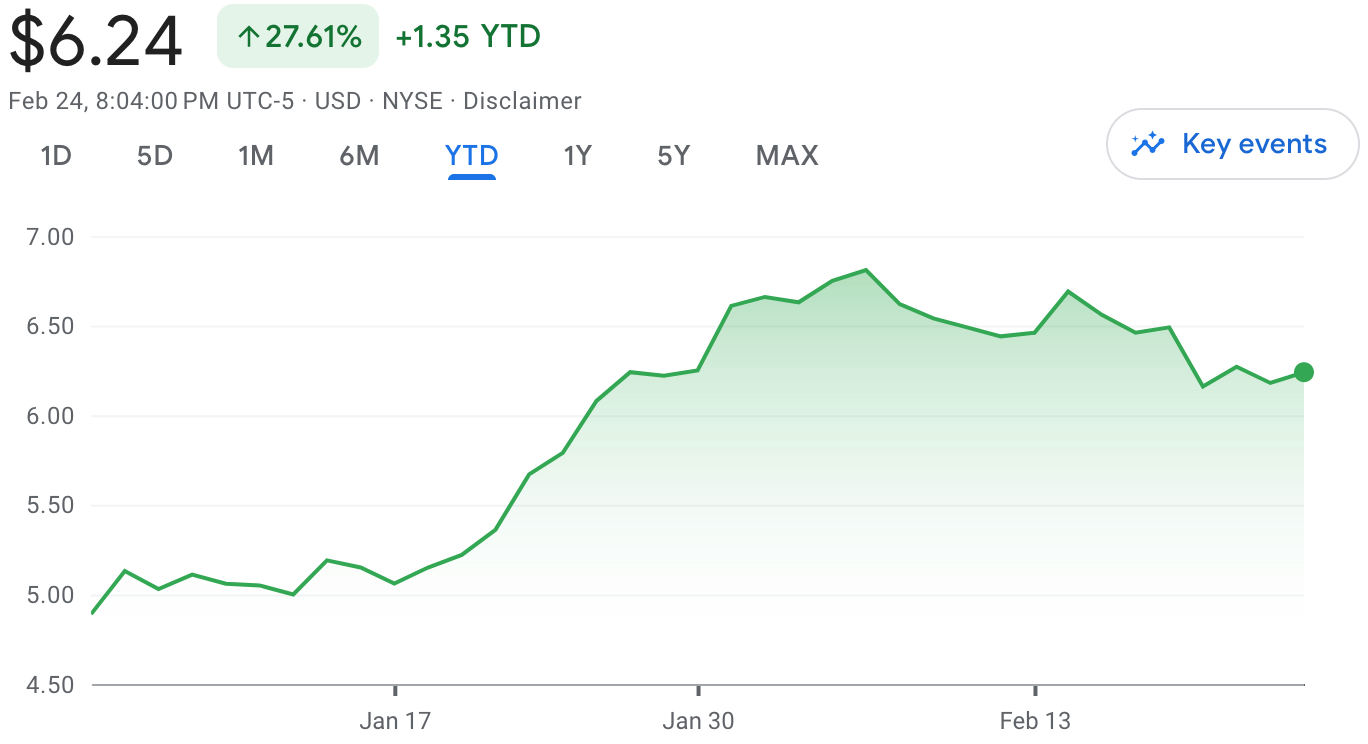

The team specifically singled out AGS where the turnaround story hasn’t been credited. Indeed, the stock is up nearly 28% YTD.

🍉 🍒🍒 Even better than the reel thing: AGS up 28% YTD

Flutter: The full-year earnings call comes on Thursday when it can expect questions around its consultation exercise regarding a potential joint listing in the US.

At the time of the announcement, Jefferies said a US listing “makes sense” with the company commanding a premium valuation.

Also reporting on Wednesday is Rush Street Interactive and Golden Entertainment, while tomorrow Codere Online publishes its Q4s.

Data: E+M’s latest monthly edition, the Data Month, will be sent on Tuesday. In this debut issue, we delve into the importance of Nevada to Caesars sports-betting ambitions and look at Roth MKM’s pessimistic forecasts for DraftKings.

Tomorrow on Compliance+More

Texas swing: Analysts suggest the mood music in Texas is looking good for progress on both the land-based and OSB front.

Paper wraps Rock: Gibraltar receives partial good news from the Financial Action Task Force on its greylisting, but still has work to do.

The UK government is stretching time with its White Paper release date, but has ‘within weeks’ become ‘within months’?

Startup focus – Splash Tech

Who, what, where and when: Splash Tech is a developer of customized free-to-play and pay-to-play games founded in 2020 by Bookee co-founder Adam Wilson. The games are designed to support all marketing and retention dynamics for clients in the gambling sector.

Funding backgrounder: A Seed investment round was led by Jamco Capital, with notable industry figures such as Daniel Burns, Sandford Loudon, Ben Starr and Steve Schrier also making investments.

The pitch: Wilson said he sees the opportunity to create engaging experiences that support fundamental business objectives for its partners. “This can mean a requirement to focus on retention, acquisition, brand building or a mix of all three,” he says. “The skill is in knowing what to use and when.”

“In Q4 2022 we achieved a number of milestones, including 1.5m contests being played by over 365k unique users.

These are headline KPIs. “Conversion and retention rates are just as, if not more, important to us and our partners,” he added

What does success look like? In terms of markets, Wilson believes F2P “can and will” play a unique role in highly regulated markets, which means Europe as of now, but Wilson is sure this will be the case with more markets globally in the near future.

Splash Tech has launched with six partners who work in 40+ markets, including ComeOn, JOI Gaming, GOAT Interactive & 10bet.

Wilson adds that it launched with two further new partners in January and has also rolled out a new product for an existing US-based client.

** SPONSOR’S MESSAGE ** Venture capital firm Yolo Investments manages in excess of €600m in capital across 80 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem.

Newslines

Superbet has appointed Hans-Holger Albrecht as chairman, as it puts plans in place to seek a public listing. Founder and former chairman Sacha Dragic remains on the board.

Churchill Downs has increased an existing $800m credit facility due in 2027 by $500m.

Mohegan has committed $142m of additional funding to ensure completion of its Korean integrated resort project Inspire.

Aristocrat has extended its share buyback program by A$500m.

What we’re reading

Fewer Americans are getting married – but when they do, they do it in Las Vegas.

Sitting pretty: The second-hand office chair market is booming.

Calendar

Feb 28: The Data Month, IGT, Codere Online, Endeavor

Mar 1: Everi, Light & Wonder, Golden Entertainment, Rush Street Interactive

Mar 2: Flutter FY

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.