Hard Rock could have the market leaders in the palm of their hands.

In +More: DraftKings’ mustard buyout, Diller’s Vegas faith.

UK shakedown: shares react badly to tax threat report.

This week’s startup focus is Goat Draft Fantasy Sports.

What makes you think I would try (to run a game on you).

Hard Rock Bet is all about fun and innovation. With a top ranked sportsbook & casino product, unique access to US states, and a globally recognized brand, join our team to help shape the online experiences that millions love. We’re currently seeking:

And other amazing positions here.

The keys to Florida

Open relationship: Comments from Hard Rock International chair and Seminole Gaming CEO Jim Allen, that the tribe might be open to “some type of strategic relationship” with either FanDuel or DraftKings, once again sparked interest in at least one of the top two gaining access to the Florida market.

Such an opportunity could give either of the current market leaders a huge leg-up in terms of potential TAM and, notably, a huge advantage over their rivals.

Give it away now: On the face of it, it is difficult to see why Hard Rock would give up on its monopoly position. But the team at Regulus Partners argued it might well have realized the truth of the axiom that a monopoly, in reducing choice, also reduces the potential TAM.

Hence, Regulus said, “if Hard Rock can clip the revenue of a competitor at the right amount to grow the regulated market to its own benefit, then this is a shrewd move.”

Swing, baby, swing: But the terms of any potential deal would be crucial. Given the current state of affairs in terms of state-by-state legalization, adding 20m people to the TAM for any entity is hugely tempting, particularly given their respective recent public statements.

“It could have a big swing factor in terms of achieving targets,” said the Regulus team.

“Of course there’s a limit but it’s probably right on the edge of economic viability, which makes Hard Rock’s position so strong,”

Who wants it more? Both FanDuel and DraftKings would have good reason to want to add Florida to their list of available states but, in this instance of game theory, Regulus argued the risk and reward are more heavily stacked towards DraftKings.

“If the market is discounting Florida in the TAM, then the winner gets a considerable boost,” said Regulus.

“And if the market is implicitly assuming a Florida liberalization, then the loser suffers.”

FanDuel’s SGP advantage is worth more than Florida currently, but that also means parent Flutter can pay more, or force DraftKings to overpay for access again.”

Defense: The risk for both, then, is overpaying. As New York showed, the potential for each to bid for the TAM boost and ask questions on the economics later is high. Yet, what both managements will be weighing up on entering into any negotiations with Hard Rock is the opportunity to “build a very defensible competitive advantage if the economics are right.”

“The problem is that all that hope means economics often takes a back seat to winning,” Regulus added.

Wide-eyed: A last question relates to the wider issues of tribal relations and in particular the situation in California where both FanDuel and DraftKings have been attempting to rebuild relationships after the disastrous ballot initiative in late 2022.

But Regulus pointed out the differences between the two states when it comes to tribal gaming mean the read across is limited.

The tribal position in California is very different to Florida because it is more fractured and more combative with state authority,” they said.

“They are a much more effective blocker than a proactive lobbyist. We don’t think a Florida deal changes California.”

👀 Of course, another route into Florida, and California and Texas, comes via the sports-betting sweepstakes market.

If one or other of the big two misses out on a deal with Hard Rock in Florida, sources suggested they might look at taking on the sweeps market either organically or more likely via M&A.

As highlighted previously in E+M, Fliff might look very attractive in this regard.

EveryMatrix delivers iGaming software, solutions, content and services for casino, sports betting, payments, and affiliate/agent management to 300+ global Tier-1 operators and newer brands. The platform is modular, scalable, and compliant, allowing operators to choose the optimal solution depending on their needs.

EveryMatrix empowers clients to unleash bold ideas and deliver outstanding player experiences in regulated markets.

+More

Just mustard: DraftKings has snapped up Dijon Systems, a subsidiary of Mustard Systems, which owns and operates the B2B golf pricing business Mustard Golf. Sources suggested the deal is worth ~$20m in cash upfront.

Fore: Greg Karamitis, CRO at DraftKings, claimed golf betting “continues to gain traction” among the DraftKings’ player base.

The company added that Mustard Golf’s advanced data models would enable DraftKings to expand its golf offering and introduce new bet types.

Diller pickle: Barry Diller, chair of the IAC conglomerate that holds a 22% stake in MGM Resorts, has told the FT it is the experiential aspects of Las Vegas that attracted him to the investment and the impossibility of that being disintermediated by Big Tech.

“The amount of entertainment, sports, live performance, in every possible variety and combination in Las Vegas, is unequaled anywhere in the world,” Diller told the paper.

“It can’t be duplicated.”

EveryMatrix has completed its SEK210m ($20.1m) acquisition of Fantasma Games as first announced in September after 95% of the target’s shareholders agreed to the transaction.

Twinkle, twinkle: UK-based gaming affiliate Little Star Media has been acquired by marketing platform Good Engine for an undisclosed sum.

UK tax threat

Rub a dub dub: The UK-listed gambling sector took a bath on Monday after The Guardian reported late on Friday night that the Labour government was contemplating a swingeing tax hike to help fill a hole in its upcoming November budget announcement.

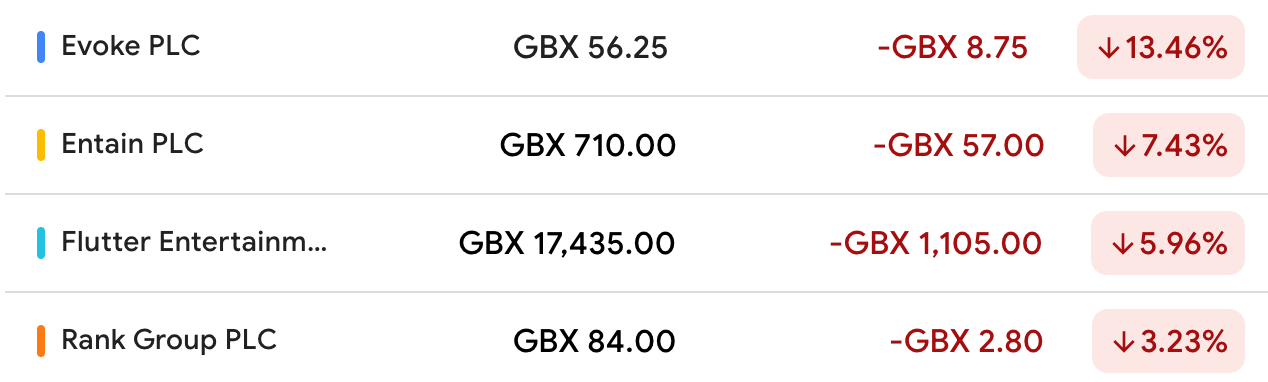

Evoke, home of UK-facing William Hill, suffered worst with a near 13.5% decline on the day while rival Entain, which boasts leading UK brands Ladbrokes and Coral, was down nearly 7.5% on the day.

Flutter, which saw its US-listed shares drop by nearly 9% in New York on Friday, saw its UK shares fall by nearly 6% even as its New York shares recovered nearly 5% on Monday.

💥 R U UK, babe? Tax rumor hits UK-listed gaming stocks

Buy the dip: The analysts were less than convinced that the UK Treasury would go through with what the team at Investec said were proposals “at the more punitive end of the spectrum.”

The plan would be “industry-destructive” and “unrealistic,” the analysts added, suggesting any such move would “backfire.”

Wrecks and effects: As detailed in Compliance+More yesterday, Regulus Partners has also weighed into the debate, suggesting that while the sector could “almost certainly pay more in tax,” the doubling of online rates was based on a “polluter pays” argument that was “deeply questionable, biased and flawed.”

“There are reasons why the Treasury has not been so reckless before and we doubt they will be so reckless this time,” the team added.

Short-term pain: Meanwhile, over at Wells Fargo the analysts argued that the swooning Flutter share price in New York offered a buying opportunity. The team claimed the move last Friday reflected an instant reaction to a “worst-case scenario.”

Game for a Laffer: Meanwhile, Flutter CEO Peter Jackson has spoken to the FT about the threat of increased taxes in the US.

“If you push taxes too high, then people… will use illegal operators and tax revenues [will] go down,” he told the paper.

Citing the Laffer curve, he added that “if the states are genuinely trying to maximize their tax revenues, they should be very thoughtful about pushing the tax rates up.”

Join 100s of operators automating their trading with OpticOdds.

Real-time data. Proven trading tools. Built by experts. Increase your GGR in just one month. Join top operators at www.opticodds.com.

Analyst takes – Light & Wonder

A blip: Following conversations with management at G2E, the Jefferies team have concluded that the disruption caused by the Dragon Train litigation – and L&W having to pull the game from circulation for the time being – is “not disruptive” to the company’s direction of travel.

To support their claim, they pointed out that while Dragon Train was set to be worth ~5% of the $1.4bn 2025 EBITDA target, they believed the pipeline of games was still “robust.”

“While Dragon Train was intended as a key element, the talent acquisition has been broad enough to continue driving the business,” the team added.

Well, that wasn't meant to happen: To the question of why L&W seemed surprised at the legal outcome, having previously dismissed the initial suit, the company told the analysts the discovery process “provided details that would not have been normally evident.”

The analysts argued management “could have initially investigated more thoroughly” when the suit first emerged.

“But its initial protocols and the actions taken since the event occurred seem appropriate to us.”

More takes

Everyone wants a medal: The team at JMP noted the competitive pressures within the online sector are “here to stay,” with both ESPN Bet and Fanatics stating recently of their “desire for a podium position.”

You can’t all be winners: However, as the team pointed out, the current #3 BetMGM has “invested hundreds of millions” in a bid to maintain its position.

Meanwhile, bet365 remains “lingering in the background.”

Higher for longer: The JMP team concluded that promotional spending, sales and marketing are going to be “elevated for the foreseeable future,” with success skewing toward better product and scale (i.e. FanDuel and DraftKings) “until the wave of spending subsides.”

Thrice told tale: Coming away from G2E, the team at Macquarie said there was a “consistently told story” from their conversations across the sector.

The regional and Vegas consumer is “stable but bifurcated,” and online continues to exceed expectations particularly for profitability in the second and third tiers.

Finally, M&A could pick up as “seller and buyer expectations have started to narrow after an extended period of divergence.”

Venture playground

Startup focus – Goat Draft Fantasy Sports

Who are you? Founded in 2021 by David Taylor, Goat Draft Fantasy Sports is based just outside of Oklahoma City. His team includes Robert Holmes, who has a strong tech background, and Christian Taylor, an engineer specializing in mobile development, alongside a strategic partner with over 30 years’ industry experience.

What's the big idea? The aim is “to shake up daily fantasy sports by bringing the focus back to traditional fantasy where players compete against each other, not the house,” says Taylor. Goat Draft has “done away with salary caps, made lineup creation easier and limited contest entries to keep things fair and avoid ‘sharks’ dominating.”

It also “builds on the fun” with community-driven features, such as Herds, where friends can team up and challenge other ‘herds’ in tournaments.

It has also added gamification enabling players to earn rewards such as digital collectibles and real sports memorabilia.

Funding backgrounder: So far, Goat Draft is self-funded with some early-stage investment, but is looking to raise up to $500K in the next round.

Growth company news

Pro League Network’s professional putting league Putt Tour is now available for wagering on BetMGM in approved states and jurisdictions.

Metric’s new multi-tenant sportsbook technology provides a shortcut to crafting a bespoke, premium sportsbook from the ground up, complete with operator-owned IP and built on highly performant technology, free of technical debt.

Our philosophy is to deeply understand our partner’s business and treat it with similar care to our own. We aim to collaborate with ambitious brands to help them realise their long-term growth potential in regulated markets, globally.

For sports betting businesses looking to finally take control of their sportsbook, there is no faster route to competing on product and price.

To find out more, visit www.metricgaming.com

Events calendar

The Thai Entertainment Complex Summit will be held at Bangkok Marriott Hotel The Surawongse from December 2-4, 2024 and will bring together government officials and top executives from the property, hospitality and entertainment sectors to discuss the future of Thailand as a global entertainment hub.

Oct 21-24: World Lottery Summit, Paris

Oct 29-31: SBC Summit Latin America, Miami

Nov 5: Gaming in Germany, Berlin

Nov 11-14: Sigma Europe, Malta

Dec 2-4: Thai Entertainment Complex Summit, Bangkok

An +More Media publication.

For sponsorship inquiries email scott@andmore.media.